ATOMREDMETZOLOTO-(ARMZ ) acquired its stake initial stake in Uranium One in June 2009. The Russian state company acquired a 23.1% stake in Uranium One. Reportedly the deal gave ARMZ Uranium Holding Company a 19.95% stake in Uranium One in exchange for ARMZ’s 50% stake in Kazakhstan’s Karatau Uranium Mine. Alternatively, ARMZ had taken a 16.6% stake in Uranium One in exchange for the 50% stake.

On 16th November 2009 Kazakhstan’s Energy and Mineral Resources Ministry confirmed the agreement between ARMZ and Uranium One over the Karatau Uranium Mine.

In 2010 ARMZ, the mining arm of Russian state corporation Rosatom, acquired its controlling stake of 51% in Uranium One in a deal involving $610 million cash and an exchange of Kazakh uranium assets. At the end of 2010 ARMZ had increased its stake to 51.4%.

On 7th December 2009 an article on atomnews.info/based on Newsweek information reported that Zhivov was married to Shkolnik’s dauther and that the newly announced cooperation between Rosatom and Kazatomprom on 20th November 2009 was a result of such links. The article quited Bulat Abilov stating that Shkolnik “was in the Russians’ pocket and does what they tell him”.

In December 2010 it was announced that ARMZ’s acquisition of a controlling stake in Uranium One had been approved by US government agencies including the Nuclear Regulatory Commission. The NRC safety-evaluation report stated that day-to-day project development, operations and any decommissioning activities will be made by Uranium One’s two US-based subsidiaries- Uranium One USA Inc and Uranium One Americas Inc. The agency said that Uranium One and ARMZ did not have a license to export fuel and material from the mines must be used in the US. The deal was also reviewed by federal agency, the Committee of Foreign Investments in the United States which reviews foreign purchases which raise questions over national security.

The Acquisition.

On 14th January 2013 it was announced OOO Atomredmetzoloto (ARMZ), a subsidiary of Russian state atomic company Rosatom (see Spark for exact ownership), had bid for the remainder 48.6% of Canada-based uranium producer Uranium One Inc (“Uranium One”). At the time, ARMZ owned a controlling 51.4% stake in Uranium One. The offer put forward to minority shareholders was worth C$2.86($2.90) per share totaling C$1.3billion,giving Uranium One an approximate total equity value of C$2.8billion. According to the Chicago Tribune, the deal sent the stock up 14% to close at C$2.76.

On 15th January 2013 ARMZ used money from Rosatom to buy-out Uranium One’s minority sharholders.

On 16th January 2013 a Rosatom press release announced that (SPV?) ARMZ Uranium Holding Co was to acquire 100% of Uranium One Inc. shares. The offer of C$2.86 per share cash consideration represented a 32% premium to the 20-day volume weighted average price of the common shares for the period ending 11th January 2013 ( the last trading day prior to the transaction announcement). The PR quotes Zhivov describing the transaction as “friendly” and “unanimously supported by the Uranium One Inc Board of Directors”. ARMZ’s financial and legal consultants for the transaction are Canadian firms BMO Capital Markets and Stikeman Eliott LLP.

On 8th March 2013 Uranium One’s shareholders voted in favour of ARMZ’s offer to take the company private. 96% of Uranium One’s minority shareholders voted in favour of the going private transaction that took place on 7th March 2013. The deal still needed to undergo regulatory approvals. By Canadian two thirds of the votes cast by the holders of common shares had to be for the deal for it to proceed.

In March 2013 ARMZ received approval from the Supreme Court of Ontario, Canada – because the deal involved the same parties as the 2010 transaction and does not change the corporate structure of Uranium One, and does not alter ARMZ’s majority control over Uranium One, ARMZ did not need to apply for US regulatory approval once again. In September 2013 Uranium One Inc said that it had received regulatory approvals for going private.

On 18th October 2013 Uranium One that the C$1.32 billion going-private transaction had closed. Uranium One’s shares were withdrawn the Toronto Stock Exchange on Monday 21th October 2013 and the Johannesburg Stock Exchange on 22th October 2013.Mining Weekly noted of the deal that: “ Within 30 days of the transaction being complete Uranium One was to make an offer to buy the $259.98-million principal amount of its convertible unsecured subordinated debentures due on 13th March 2015, as required under the terms of the debentures”. The 18th October 2013 Uranium One PR announced that Uranium One Holding NV (formely Effective Energy NV), an affiliate of ARMZ, had acquired all of the outstanding common shares of Uranium One.

AFTERMATH.

On 14th July 2014 it was announced that Vadim Zhivov was to be replaced as President of Uranium One’s shareholder Uranium One Holding NV vy Vasily Konstantinov, a Senior Vice-President at ARMZ shareholder OAO TVEL. The new appointment was reported to have been motivated by Zhivov’s family wanting to move for the sake of his children’s education ( although not clear from where to where). RIA NOVOSTI reported on his successes as President at Uranium One Holding, stating that in three years he had managed to make Rosatom one of the largest uranium miners in the world. Zhivov became Head of the Uranium One Holding Supervisory Board and Uranium One member. An ARMZ source quoted in a kursiv.kv report said that Zhivov had been responsible for the Uranium One acquisition:

“ ARMZ looked in detail at all possibilities on the market and following long negotiation decided upon Uranium One. Zhivov of caurse was responsible for all this. Uranium One did not want be sold but we convinced them”.

On 17th July 2014 it was reported that Zhivov may be concentrating on running his own private firms in Canada.

On 6th August 2014 Shkolnik left Kazatomprom to become Minister of the newly-created Ministry of Energy (formerly Oil and Gas Ministry). The new Energy Ministry has also been handed the environment portfolio. In addition financial police have replaced by a new anti-corruption agency.

During Shkolnik’s tenure as Kazatomprom head, a number of contracts between the Kazakh state firm and its Russian equivalent Rosatom. For example in February 2014 a joint venture between Uranium One Holding, another Rosatom subsidiary OOO Intermiks Met and Kazatomprom.

ONGOING LITIGATION

On 27th March 2014 Uranium One announced that the Special Inter-District Economic Court for the City of Astana had issued an order invalidating the original transfers in 2004 and 2005 from Kazatomprom to Uranium One Betpak Dala and Kyzylkum joint ventures for the Akdala, South Inkai and Kharasan fields. The proceedings with brought by the State Prosecutor of the Saryarka District of the City of Astana against Betpak Dala, Kyzylkum and Kazatomprom:

-“ Uranium One considers the lawsuit to be without merit. Neither Uranium One nor its shareholders are parties to the proceedings. Kazatomprom,has, however, assured the Company and its shareholders that their legal rights and economic interests will be fully presented. The Company and its shareholders are now in discussions with Kazatomprom with a view to obtaining new subsoil use rights to the Akdala, South Inkai and Kharasan fields in the event that the order becomes effective. The Company’s shareholder, Uranium One Holding N.V., and Kazatomprom have signed protocols to this effect and are taking the steps necessary to ensure that scheduled production and deliveries to customers are not affected.”

In June 2008 it was reported that Kazakh investigators were examining the sale of a 30% stake in the Khorasan Mine, the country’s largest uranium mine, for a supposedly token price of 15.6 million tenge, or approximately $104.000. Uranium One claims to have paid market value of $75 million for the 30% stake.

LINES OF ENQUIRY.

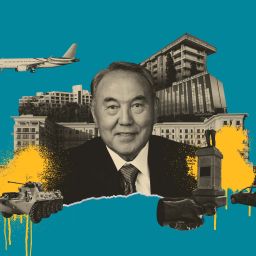

- The relationship between Zhivov and Shkolnik. Alternatively in Kazakh/Russian media, the relationship is either referred to as Zhivov is married to Shkolnik’s dauther or Shkolnik’s son is married th the dauther of Zhivov or simply as a relative. Zhivov was also reportedly responsible for Rosatom’s relationship with Kazatomprom and that the joint venture was supervised by him personally.

- The dates of the ARMZ_Uranium One transaction (June 2009-Jan/October 2013) closely match Shkolnik’s tenure as head of Kazakhstan’s state uranium company Kazatomprom (May2009-August2014). Vadim Zhivov was Chairman of ARMZ Board of Directoers at time of acquisition in January 2013, left the role in July 2014-currently a board member. In addition, on 20th November 2009 agreement signed between Kazatomprom and Rosatom.