A recent revelation involving Ilyas Khrapunov, a Kazakhstani individual accused of orchestrating hundreds of millions of dollars laundering from the largest city in Kazakhstan and a central bank, has sparked controversy as he aligns himself with his brother’s litigation finance startup. According to records from the Swiss business registry and a court affidavit, Ilyas Khrapunov has assumed the consultant position at Litigation Partners, SA, founded by his brother Daniel Khrapunov in February.

Shady Past And Current Endeavors

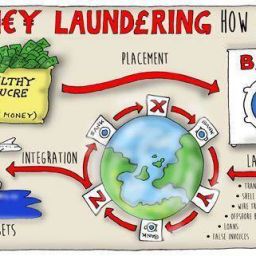

Money Laundering And Exile

Ilyas Khrapunov, previously accused by a federal judge of establishing shell companies exclusively for money laundering purposes, has now positioned himself as an external advisor to Litigation Partners. The litigation finance firm, based in Geneva, specializes in complex litigation, mainly focusing on disputes related to former Soviet Union countries.

Litigation Partners: A Controversial Venture

The Industry Landscape

Litigation finance, a decade-old industry boasting approximately $13.5 billion in assets under management, involves investors funding lawsuits in exchange for a portion of the award if the case succeeds. Although major markets for this industry include the US, UK, and Australia, Switzerland has seen the presence of notable firms like Burford Capital and Omni Bridgeway.

Lack Of Transparency And Regulation

The industry’s growth can partly be attributed to the minimal regulation and transparency surrounding funders. While some US courts have started advocating for more disclosure, Switzerland, where Litigation Partners operates, has yet to see significant regulatory pushes.

Funding Origins And Controversial Figures

Litigation Partners’ capital sources and the extent of its funding remain undisclosed in the public domain. Daniel Khrapunov claims that the startup funds were derived from a 2020 sale of Swiss-based real estate initially purchased by his mother in 2004. His parents, Viktor and Leyla Khrapunov are in exile in Switzerland after being convicted in absentia in 2018 of defrauding Almaty, Kazakhstan’s largest city, of at least $300 million.

Past Financial Misconduct And Current Ventures

The Beverly Hills Connection

Daniel Khrapunov, now 27, and his sister Elvira Kudryashova were implicated in a California LLC named 628 Holdings, allegedly using funds looted from Almaty to purchase properties. Despite claims in a lawsuit filed by Almaty, the lawsuit was dismissed in 2018 due to jurisdictional constraints.

Denial And Educational Pursuits

In response to questions about his role in 628 Holdings, Daniel Khrapunov refuted any involvement in the alleged crimes, stating he was a full-time student in Switzerland. Meanwhile, Ilyas Khrapunov, a key player in managing family fortunes, is currently involved in a master’s law program with aspirations of becoming a litigation consultant.

Recent Legal Troubles And Financial Struggles

Judgment And Financial Strain

In July 2023, a US District Judge upheld a $200 million verdict in favor of BTA Bank against a unit of Swiss Development Group (SDG), a company set up by Ilyas Khrapunov for real estate deals in the US. Despite financial struggles, including a $221,000 judgment, Ilyas Khrapunov revealed his involvement with Litigation Partners in a court update.

Little Oversight In Switzerland

Unlike the US, where battles over disclosure are intensifying, Switzerland lacks significant regulation in the litigation finance sector. While the Swiss Federal Supreme Court deemed litigation funding permissible in 2004, provided funders act independently, there is a notable absence of strict oversight.

Industry Insider’s Perspective

Isabelle Berger, Chief Investment Officer at Nivalion, a Swiss-based entity regulated by the Swiss Financial Market Supervisory Authority, highlighted the industry’s adherence to rules. Despite the lack of strict regulations, Berger believes that the market’s size may deter new entrants.

In summary, the intertwining of Ilyas Khrapunov with his brother’s litigation finance startup raises eyebrows, especially given the family’s controversial past and ongoing legal battles. The evolving landscape of the litigation finance industry and Switzerland’s minimal regulatory environment add further complexity to this unfolding saga.

Original article source: JDJournal