In the latest episode of Expert Opinions – Russia, Eurasia, a podcast from the Harriman Institute at Columbia University, Masha Udensiva-Brenner interviews anti-corruption investigator Thomas Mayne about kleptocracy and what it means for democracies all over the world.

Transcript:

Intro: Today you’ll hear from Thomas Mayne, a research fellow at the University of Exeter who’s been involved in global anticorruption work for nearly two decades. At Exeter, he’s investigating money laundering through real estate, but for a long time he was responsible for Eurasian investigations at the NGO Global Witness.

In this episode, Tom and I are going to talk about kleptocracy, a topic that affects all of us more than some might think, and one that we’ve explored quite a bit at the Harriman Institute. Tom has partnered with us on some of our kleptocracy-related events and has a coauthored article forthcoming in Harriman Magazine on the topic.

Masha Udensiva-Brenner: Hi, Tom, how are you?

Thomas Mayne: Yeah, good. Thanks.

Udensiva-Brenner: I’m glad to have you on the show. Thank you for joining us.

Mayne: No problem.

Udensiva-Brenner: So, I wanted to start with the basics. Just in case some of our listeners are not familiar with the term, what is a kleptocracy?

Mayne: Well, I think probably we used to call it grand corruption, corruption that is perpetrated at the highest levels of government and that requires some kind of subversion of the political and legal systems. I’d probably say that a kleptocracy is systemic grand corruption which affects all layers of political society in a particular country. If you want a very short explanation, it’s rule by theft. That’s what it literally means.

Udensiva-Brenner: Can you give some examples of countries that are kleptocracies, and some of the countries you’ve worked on the most?

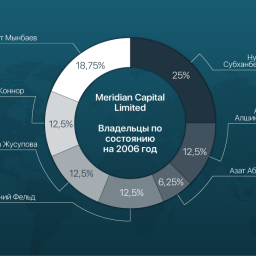

Mayne: Well, I think one of my favorite – if you can call it a favorite – examples of a kleptocracy is Kazakhstan. I think when you talk about kleptocracy, it’s important to say what it isn’t: It doesn’t necessarily mean chaos. It doesn’t mean that all the people are poor. It doesn’t necessarily mean that the country isn’t in some respects well-run. And I think Kazakhstan is a good example of this. On the face of it, it looks like it’s doing quite well, especially in comparison to its neighbors. We have Kazakh companies a decade or so ago listing on the London stock exchange, for example. But when you actually look at the details and who’s controlling the wealth and the power, it’s really a very small group of people. Literally 162 individuals owning half the wealth in Kazakhstan and all those people are kind of related to each other. So, it’s a very close-knit community of political figures who don’t let any competitors control any of the major revenue streams in the country.

Udensiva-Brenner: And you mentioned that kleptocracy doesn’t necessarily mean chaos. It doesn’t necessarily mean poverty. So how does this affect regular people and how are they able then to stay out of poverty if so few people control all the wealth?

Mayne: I think Kazakhstan, because it has so much oil, it’s actually been quite clever in allowing a certain amount of money to flow down to a nascent middle-class. And this is really to prevent the people from rebelling like we have seen in the Kyrgyz Republic, for example, which has had three revolutions in the space of about 15, 16 years

But, the situation, for example, in Turkmenistan, is very different. Here, we’re talking about North Korean levels of oppression and a very poor populace. And it shouldn’t be that way. The country only has 5 million people. It has the fourth largest gas reserves in the world. So, some countries do suffer from poverty and serious amounts of repression.

I often concentrated on Kazakhstan because it has been a little bit more clever in easing the repression to a certain extent and allowing, as I say, that money to trickle down. But it’s still a kleptocracy because the people can’t change their leaders. The system is built on controlling resources and not allowing any kind of political pluralism.

Udensiva-Brenner: And what’s interesting about kleptocracy and what you talk about at great length in the article that you wrote for Harriman Magazine is that while on the surface kleptocracy seems to be the problem of whatever country is being run by kleptocrats, when you look deeper, you realize that all these other global institutions are involved.

I think a really good illustration of this is Kyrgyzstan. And you did a report on it and back in 2013 called Grave Secrecy that illustrates just how many international actors can enable kleptocratic governments. So, can you talk about that report and the case?

Mayne: Absolutely. Yes, kleptocracy can’t exist without the West, because part of a kleptocracy is getting the wealth out of the country, legitimizing it through buying real estate, through having bank accounts in America and in Europe and creating safety for that wealth that you have stolen.

And the case you mentioned was one of my most difficult but, perhaps, most successful reports. The Kyrgyz Republic’s largest bank at the time was a bank called Asia Universal Bank. It had won awards. It was the biggest bank. It was the best bank. But when there was a change of power in 2010 and the regime at that time, the Bakiyev regime, was removed from power, it was then discovered that Asia Universal Bank was basically a money laundering scheme, but it had managed to survive because it had presented itself through very canny operations as being a legitimate institution.

How did it do this? Well, it employed former U.S. senators, including Bob Dole, as board members. And there’s a great interview online with one of the people from AUB who hired the senators. An interesting character called Eugene Gourevitch who studied in America. He said he was amazed, that he didn’t think that the senators would ever be part of something like Asia Universal Bank, but because the wages were high, they agreed to come on board.

Udensiva-Brenner: Did they know how corrupt it was when they agreed?

Mayne: I reckon they knew absolutely nothing about the corruption there, because it looks like, from our investigation, there was a system of double bookkeeping that was kept from the senators and the Western board members, what was really happening. And Gourevitch actually in the interview speaks about this kind of round robin system of everybody’s saying that everything’s okay – so, the senators say it’s okay because the due-diligence company says it’s okay – without really getting to the fact that this was a bank that was registering thousands of shell companies and using those shell companies to siphon money abroad. And it perhaps comes as no surprise that the chairman of the bank was very close friends with the son of the president at that time.

And I think that’s a great example because, on the surface of it, you know, people could actually see, Oh, wow, Bob Dole’s on the board. It must be okay, right? Bob Dole wouldn’t get involved in anything suspicious or shady. But I think he simply had no idea of what was happening in the bank. And to be honest, I don’t think Bob Dole really knew anything about the Kyrgyz Republic or anything about Central Asia before he joined this bank.

So, it was a great illustration of how the West enables that kind of Kleptocracy. And when it comes to enabling those various levels of complicity, there are certainly those people who are actively, helping people steal money. But I think the system also relies on those people who just simply don’t understand, are either turning a blind eye, or simply don’t ask the right questions and are complicit in that way.

Udensiva-Brenner: And do you think those senators could have done something different and exposed or understood better what was happening?

Mayne: I think in this example it was a perfect system because they had hired Kroll and APCO, companies involved in due diligence, to check out the bank and say, actually, it’s got really good money laundering procedures in place.

Now, I myself had actually seen the report that Kroll did on Asia Universal Bank, and the problem with it was it didn’t really address the main question, which was Maxim Bakiyev, the son of the president, [and his] possible influence over the bank. It dealt with this particular topic in a very offhanded manner and said, well, there’s a lot of rumors, but there’s no proof.

And that’s is a problem sometimes we find with due diligence, that if you have a financial interest in continuing your relationship with a bank, you can be swayed in that direction, produce a report that basically gives a green light when, if you’re doing proper due diligence, independent due diligence, you should really be trying to answer these questions and to get to the bottom of it.

So, I would say it’s 50/50. It was a very well-hidden scheme. But I think more could have been done to look at the people involved here and really question why this bank was so successful on the surface.

Udensiva-Brenner: A quick editorial note here. A couple of days after our interview I got an email from Tom telling me that he was probably a little lenient on the senators in his response to my question. The first thing the senators should have asked, he wrote, is why is this bank offering me so much money?

[MUSIC]

Udensiva-Brenner: And what was the reaction to your 2013 report about Kyrgyzstan? Was there any policy response?

Mayne: I like to think that it led in part to a change in the United Kingdom, a large part of the report demonstrated how Asia Universal Bank was using shell companies to transfer money and it was shown that a lot of them were registered in the UK, not the Cayman Islands, not the British Virgin Islands, but actually on the UK mainland. And this was because there just aren’t checks, or at least weren’t checks in the UK about who registers companies. It’s obviously a big problem in the United States as well, that only now is being addressed through policy, and the way the UK dealt with it was, before, you didn’t have to put the actual owner there, the beneficial owner, the real owner on public record in the United Kingdom, you could use a proxy, a nominee. After the report, there was a movement by NGOs and from other organizations to change this. And now we have a beneficial ownership register in the UK.

So, when you register a company in the UK, even if you’re a lawyer or a proxy, you have to put down on record the actual person controlling the company. Now, certainly, there are still questions over whether this information is being checked. And I think there are movements ahead to improve the system so people who are abusing it are held accountable.

But that I think is one change that the report led to. And I think that’s fed into movements in the U.S. as well. The U.S. isn’t going to have a public register at the moment, but at least it is now making moves to put the real owners, the actual owners of U.S.-registered companies, to collect that information for law enforcement.

Udensiva-Brenner: And how has awareness of kleptocracies and their global reach evolved since you published that report, or maybe even since you started working on global corruption? Can you talk about the evolution of what’s been happening?

Mayne: I think just the term kleptocracy has become very common in the last perhaps only five years. Ten years ago, it would perhaps have been a confusing term. I think people are familiar with it now, with all the different kinds of media outlets, even Buzzfeed and Vice are reporting on kleptocracy.

The Arab spring was quite a big moment because after that it was revealed that Gaddafi and Mubarak had assets in the UK and in the U.S. And perhaps also with the Trump Organization’s, dealings abroad, or, whatever you think of it, the investigation into Trump and Russia, did bring these elements more to the forefront. That, yes, of course, corrupt foreign governments are going to try and influence foreign politicians. And there are lots of examples of that. And this has fed into our thinking of what kleptocracy is and the dangers of it.

Udensiva-Brenner: Given that our last president allegedly made deals with kleptocrats, what do you think the fallout might be for the U.S. in terms of its credibility in the fight against kleptocracy in the future?

Mayne: Well, obviously the U.S. reputation was definitely harmed. I like to look to the future and, Biden is obviously going to have a very full agenda in the next four years, but it seems like he gets kleptocracy. He has written about it. He’s talked about foreign corruption and the effect it can have on democracy in the United States, and he’s saying all the right things. And that is good to hear.

So, even though we’ve had that set back of those four years, it seems like, both in terms of recognition of kleptocracy, and moves to improve U.S. legislation, that is a good sign and hopefully will continue for the next few years.

Udensiva-Brenner: And changing legislation and then enforcing it can be quite tricky as we can see from the UK, which implemented some of these things earlier. Can you talk about how some of these laws have worked in the UK and what the U.S. can learn from them?

Mayne: Well, I think, U.S. versus UK, they have their strengths and weaknesses. And actually the U.S. has implemented certain things which are very interesting that the UK hasn’t had. For example, geographic targeting orders, which relate to the fact that in real estate purchases in, I think 12 high-value areas, in the United States – so Miami, New York – you have to collect the information on the beneficial owner. And this has really seen a dramatic reduction in cash purchases in the United States in those areas, because it seems like, the conclusion we have to draw from that is that people who have money of dubious origin, they don’t want to have their name on record. This is something that the UK doesn’t have.

Where does the UK have some advantage? Well, for example in its anti-money-laundering legislation, it recognizes this concept of the politically exposed person (PEP), basically a foreign politician or a family member. And it means that in certain regulated industries – real estate banking, accountancy – you have to make sure you’re identifying a person as a PEP and do enhanced due diligence on their source of funds. And this isn’t in operation in for example, a real estate industry and in the United States.

In terms of really new legislation to do with kleptocracy, we could perhaps talk about the Unexplained Wealth Order in the United Kingdom –

Udensiva-Brenner: That was going to be my next question.

Mayne: And this is on the surface very interesting because it allows the UK enforcement bodies to, if they have a suspicion that a foreign politician owns a house, for example, in the UK, which is worth far more than their salary, they can issue one of these orders and the owner of the house then has to explain their sources of wealth.

And if they fail to do so then that house can then be recovered under civil recovery proceedings because it is deemed to be purchased on the proceeds of crime. There have only been a few cases so far and only two involving politically exposed people in the UK. And one of them was pretty much a disaster for our enforcement body, the National Crime Agency, because the owner of the house, Dariga Nazarbayeva, the daughter of the first president of Kazakhstan, managed to come up with a lot of information saying that the house purchases were legitimate. Now she appealed to the Kazakh Prosecutor’s office for rulings on the legitimacy of her wealth. And for some reason, the judge in the case decided that that was acceptable.

And obviously the whole point of Unexplained Wealth Orders is that they’re supposed to get around the issue of not being able to trust enforcement agencies in kleptocracies. And yet, here in one of the first cases we had a judge saying, well, if Kazakhstan says it’s okay, then it must be okay.

So, I think in essence it’s a great piece of legislation because it allows UK enforcement bodies to ask questions and get information where they haven’t been able to before. But it certainly needs to be tweaked in order to counteract the fact that politically exposed people are going to hire these very expensive lawyers and are going to find ways to get around it.

And we have a report coming out later in the year that identifies four or five issues with this legislation and how it can be changed. I think probably, there’s something perhaps a little bit un-American about it, in that it reverses the burden of proof and that perhaps it would be hard for it to get passed in the United States. But then, as I say, geographic targeting orders seem to be doing a pretty good job at reducing suspicious transactions, suspicious real estate transactions in the United States. So, there’s pluses and minuses to the different regimes for sure.

Udensiva-Brenner: And can you talk about the Financial Crimes Enforcement Network (FinCen) leak and what it exposed and shed light on?

Mayne: Absolutely. I think the FinCen files were fascinating because they confirmed what anti-corruption campaigners have thought for quite a while, namely that the system of reporting suspicious transactions is fundamentally broken. In banks, you can basically escape legal liability by filing what’s called a suspicious activity report (SAR), which means that you send to FinCen in the United States and the equivalent in the UK, the National Crime Agency, a little notice about why you think that this particular transaction has suspicions of money-laundering or elements of money laundering.

That would seem on the surface of it good. You want banks to report such suspicions. The problem is, in the U.S. millions of reports are filed every year – I think the number in the UK was 500,000. And it seems that banks, rather than having a genuine interest in stopping money laundering – they could close the client’s accounts, they could prevent the transaction from being completed – they’re just sending these SARs to a very underfunded and overloaded enforcement agency, which just hasn’t the ability to look at these hundreds of thousands, millions of SARs and to stop the money from flowing.

Meanwhile, banks still continue to accrue banking fees and the people who were sending the SARs escape legal liability. So, in that sense, the system, I think, is broken. It is being overhauled in the United Kingdom. And I think it’s certainly needs to be looked at in the United States in light of the FinCen leak and what it showed us.

Udensiva-Brenner: Isn’t there also some competitive advantage to turning a blind eye because if some countries are still enabling kleptocracy, they’re profiting from it. So then other countries that are maybe trying to fight it and aren’t profiting from it as much, might they not then be more tempted to turn a blind eye?

Mayne: I mean, definitely. There’s definitely a race to the bottom going on here. Certainly, we’ve seen this with the various U.S. states and, you know, trying to reduce any regulation on company registration, for example. Because you know, Wyoming, Delaware, they want the companies to come to their state and to accrue those fees.

There’s not a joined-up approach between a lot of nations. And as you say, there’s definitely a feeling in the financial services, well, you know, if I don’t take this money, somebody else will. And the fact that virtually nobody is prosecuted for facilitating money-laundering, if there’s no repercussions then the money continues to flow and the kleptocracies get richer and those countries start to get more oppressive and that starts to feed into our democracies. So, it’s a real nasty, vicious cycle.

Udensiva-Brenner: And particularly in the U.S., it’s so difficult to prosecute white collar crime, that even if there is legislation that might criminalize the enabling – I mean there is, the Foreign Corrupt Practices Act – it never gets enforced because prosecutors are afraid to lose, and so they don’t prosecute.

Mayne: And when you have these hundreds of thousands of SARs, you know, you’re going to concentrate on the most egregious. When you have situations involving that grayness of capital, you’re just not going to investigate it.

Udensiva-Brenner: And can you talk about the Global Magnitsky Act and its effects?

Mayne: The global Magnitsky Act is an addition to the original Magnitsky act, which was legislation introduced to sanction Russian officials involved specifically in the killing of a lawyer, Sergei Magnitsky, who was involved in investigating Russian financial fraud and hundreds of millions of dollars of money being laundered through the global financial system. This led to the Global Magnitsky Act, which was taking the idea of the Magnitsky Act, that we should sanction people involved in human rights abuses and corruption and not allow them to benefit from the use of the U.S. financial system.

So, periodically, human rights abusers and officials involved in corruption are added to the Global Magnitsky List and yes, you are not allowed to transact with them if you are a U.S. citizen or a U.S. financial institution, for example. And there are some quite high-profile names on it. [Ramzan] Kaydrov, the leader of Chechnya, he’s on the Global Magnitsky List.

And I think it is a very useful tool because one thing that is a problem with kleptocracy is when you have a risk-based approach, people will just say, well, there isn’t a risk here and do what I said earlier, just saying, well, this person’s a, you know, a big fish in Kazakhstan. That’s good, right? I should be accepting his money. And, once somebody becomes sanctioned and is on the Global Magnitsky List, it becomes very hard to deal with them. And, and I don’t think any reputable or even semi-reputable banking institution would transact with them. So, it is a useful tool.

There are equivalents being created in the EU and in the UK, but we are yet to see on it many names from Central Asia, certainly on the U.S. side of things. The UK and the EU are just getting started. A Kyrgyz official, [Rayimbek] Matraimov, was put on the global Magnitsky list. Recently he was involved in hundreds of millions of dollars of what appears to be money laundering.

But for these to have teeth we need to see some more high-profile figures in there. I think it’s unlikely that you’d ever see obviously, a head of state or a minister being sanctioned, I think that would be too politically risky. But there are a whole cadre of these mid-ranking officials who were involved in kleptocratic practices in Kazakhstan, Turkmenistan, those Uzbekistan, the Kyrgyz Republic that we need to see on the Global Magnitsky List for it to start to have some kind of effect.

Udensiva-Brenner: And the world is just slowly emerging from this global pandemic, some parts faster than others, others, not at all. All these economies are now in shambles. How do you think that will affect the fight against kleptocracy?

Mayne: Well, I wrote an opinion piece for the Independent website, which basically flagged that as a risk, that with all our economies basically in ruins, there is a danger that we’re going to be less inclined to turn away that kind of dodgy money from kleptocracies. And especially with the UK leaving the EU, there’s perhaps even more of a push to turn the UK into some kind of offshore haven, make it kind of like Switzerland where all the Kazakhs and Russians have private bank accounts.

Udensiva-Brenner: And just to wrap up, why should the average person living in one of these democracies affected by kleptocracies, why should that person care?

Mayne: There’s so many reasons. House prices get distorted. So, the average citizen can’t afford to live in certain areas because foreign money of dubious origin is flooding into these areas and pushing up the house prices in the UK. Obviously, we have Russian security forces poisoning people in our country. That is part of the whole, the whole game.

We have financial institutions going under because the money that they’ve taken is not as strong as they thought it was. It undermines democracy when you have lawmakers flying off to Azerbaijan and having nice holidays there, and in the case of one European politician was actually bribed by the Azerbaijani regime to speak good of Azerbaijan in the European parliament. He’s now being jailed, but if that had not been investigated you can start to see how we become part of the kleptocracy.

I think people understand certainly in, in the U.S. the dangers of big business, the dangers of big businesses having too much power, capital being condensed into just a few people’s hands, you add in the kleptocratic element to that and foreign powers trying to influence politics and to try and use that capital to do nefarious things. I think that only exacerbates those problems that many Americans are all too well aware about.

Udensiva-Brenner: Thank you so much. This was really fascinating. And the work you do is so interesting that I’m sure our listeners will really enjoy the interview.

Mayne: My pleasure Masha, it’s always good to speak about kleptocracy because not many people listen to me. Thank you.

Udensiva-Brenner: Thanks for listening to expert opinions, Russia Eurasia, a podcast from the Harriman Institute at Columbia University and Eurasianet. I’m your host, Masha Udensiva-Brenner. I love to hear from listeners and hope to hear from you or email or whatever other social channel you prefer. I would also appreciate a review on Apple, Spotify, or wherever you get your podcasts. And please subscribe to the show if you haven’t done so already. Thank you, until next time!

www.irishsun.com by Eurasianet