Can Kazakhstan create an international financial centre in the middle of the steppes or is it just the latest central Asian pipe dream?

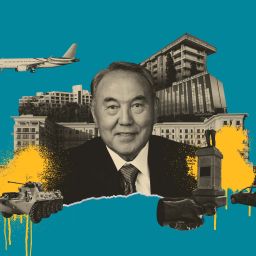

No one can accuse Kazakh policymakers of lacking ambition. In July, with great fanfare, the country’s strongman leader Nursultan Nazarbayev opened the Astana International Financial Centre in the capital, Astana.

AIFC, which will be housed in the former Expo Centre known irreverently as ‘the Death Star’, will be – according to the glitzy presentations that accompanied the launch – a regional hub for asset management, Islamic finance and fintech. And infrastructure finance, private banking and green finance.

Or, as the AIFC’s website puts it: “Astana has built a financial field of dreams.” The question is: if you build it in the middle of the central Asian steppes, will anyone come?

Certainly, a lot of distinguished guests turned up for the Astana Finance Days event that preceded the AIFC launch, including the British judges and senior barristers who – under the aegis of former UK lord chief justice Lord Woolf – will preside over the AIFC Court.

The court, which opened in January, is the first in the former Soviet Union to use English common law and will have jurisdiction over all AIFC activities. It will be complemented by an International Arbitration Centre, also headed by British lawyers and featuring a multinational panel of arbitrators.

Among the speakers at the Finance Days event were Lady Barbara Judge, the former head of the UK’s Institute of Directors, who will chair the AIFC’s new independent regulator, the Astana Financial Services Authority, and its chief executive Stephen Glynn.

Originally from Australia, Glynn has spent the last 13 years as part of the team responsible for the development of Dubai’s FSA and international financial centre, which have provided the inspiration for much of Astana’s financial make-over.

He was joined in the Kazakh capital in May by Tim Bennett, a veteran consultant and former head of the New Zealand Stock Exchange, who has been tapped to run the new Astana International Exchange (AIX).

AIX, which was also launched in July, counts Nasdaq and the Shanghai Stock Exchange as shareholders and strategic partners. A third investor, China’s Silk Road Fund, was signed up during the Finance Days conference.

Add to all this recent agreements with Euroclear and Clearstream to settle Kazakh domestic government debt, and it is clear that Astana is developing the infrastructure required for a fully functioning financial centre.

Whether or not it will be put to use, however, remains to be seen. At present, AIX has no traded securities – bonds and FX, as well as a handful of highly illiquid equities, are listed on the Kazakhstan Stock Exchange in the country’s old capital, Almaty.

The plan is – or was, as of July – to kick start the new bourse this autumn with the first IPOs in a promised $70 billion privatization programme.

At the start of the summer, Kazakh sovereign wealth fund Samruk-Kazyna, which is overseeing the process, indicated that Kazakhtelecom would come to market in October and that listings of uranium producer Kazatomprom and national carrier Air Astana would follow this year.

That in turn would pave the way for the sale of stakes in some of Kazakhstan’s biggest companies, including energy giant KazMunaiGas and rail operator Kazakhstan Temir Zholy, over the next two and a half years.

The fact that things are starting to happen in other countries in central Asia supports the story of the Astana IFC

– André Küüsvek, EBRD

By late August, however, there seemed to be some doubt over whether or not the autumn listings would go ahead as planned. A spokesperson for Samruk-Kazyna said IPOs of the first three companies were still “possible” before the end of the year.

Investors were also surprised to hear that Baljeet Grewal, a former investment banker and Asian Development Bank alumnus, who had been the international face of Samruk-Kazyna and a driving force behind the privatization programme for more than two years, had left the fund in mid August.

Samruk-Kazyna said Grewal’s departure was because her contract had expired but declined to comment further or give details on who would replace her as the fund’s head of strategy and portfolio investments.

The episode is unlikely to reassure western fund managers, many of whom are already sceptical about Kazakhstan’s commitment to transparency and reform. This wariness is warranted, given Kazakh policymakers’ track record of failing to deliver on their promises. The current privatization programme, in the works since 2015, is the second in less than a decade.

A similarly grandiose plan for selling stakes in state assets, the so-called ‘People’s IPO’, was launched in 2011 but fizzled out after two small listings.

Second attempt

The AIFC represents Nazarbayev’s second attempt at creating an international financial centre. As late as 2014, the Regional Financial Centre of Almaty was still being boosted as an Asian hub by AIFC governor Kairat Kelimbetov in his previous role as head of the Kazakh central bank.

Central Asia veterans question if the Astana version will be any more successful than its predecessor, particularly given the city’s notorious discomforts. For all its famous futuristic buildings by big-name architects, Kazakhstan’s new capital – which celebrated its 20th anniversary this summer – is notoriously badly designed.

Public transport is non-existent and traffic is appalling at any time of year, while in winter howling gales from the steppes sweep through the city’s broad boulevards, taking temperatures to below -40°C. “You’d think they could have put in some underground parking,” laments a US lawyer based in Kazakhstan.

Like most of the country’s business community, he has so far resisted government prodding to relocate to Astana.

“When I was in Astana earlier this year, I could hardly find anyone to set up meetings with,” says one western asset manager. “It has been able to attract diplomats, and the Kazakh state-owned companies are there, but everyone else is still in Almaty.”

This seems to be tacitly recognized by the decision of the Kazakh authorities to allow firms to register virtually for AIFC and its new stock exchange, rather than requiring a physical presence in Astana.

Indeed, those wanting to establish an office in the centre will have to wait at least until early next year, as the Expo building is still being repurposed. For the moment, AIX and the rest of the new AIFC bodies are camping out in rented offices behind Astana’s Congress Centre.

Bigger question

Apart from the specific physical disadvantages of Astana, however, there is the bigger question of whether or not central Asia needs an international financial hub. Supporters of the project argue that AIFC can serve both as a regional centre and as a link between Europe and Asia.

Kazakh officials make much of their country’s position in the Belt and Road Initiative, which was unveiled by China’s president Xi Jinping in Astana in 2013, as well as its implications for the prosperity of the surrounding region.

The AIFC’s western backers agree.

“The flow-on effects for Kazakhstan from both the growth of local GDP and the need to support economic growth in neighbouring countries will be tremendous,” says one.

If the privatizations don’t happen this time then the whole AIFC concept goes down in flames

– Regional banker

Proponents also point to the recent opening up of Uzbekistan as a potential opportunity for its Kazakh neighbours.

“The fact that things are starting to happen in other countries in central Asia supports the story of the Astana IFC,” says André Küüsvek, head of local currency and capital markets development at the European Bank for Reconstruction and Development.

A government official from neighbouring Kyrgyzstan is equally enthusiastic, particularly about the AIFC’s common law courts.

“It’s exactly what our region needs,” he tells Euromoney.

Other bankers note that regional hubs have rarely had much success in the developing world.

Some analysts are less convinced that there is a gap in the market for the AIFC to fill when technology is transforming international capital markets, a point that Küüsvek makes.

“The argument that it makes sense to have something in Astana to fill the gap between Europe and Asia seems slightly out of date given that we seem to be moving into a non-time zone dependent world where everything works 24/7 and T+2 settlement has a lot less relevance because blockchain provides you with almost immediate matching,” he says.

What everyone seems to agree on is that, for the AIFC to be a success, Kazakh policymakers need to show they are serious about reform by moving ahead promptly with the promised privatizations.

“The privatization programme will be a test,” says a person involved. “If we get that right, it will kick start market development in Kazakhstan, so we need to prove that we can do it properly.”

On the sidelines of the Finance Days event, a regional banker puts it more bluntly: “If the privatizations don’t happen this time then the whole AIFC concept goes down in flames.”

If state asset sales go ahead as planned, the next question mark is over who will participate in the process. Despite intensive investor work by Samruk-Kazyna over the last year, reports suggest that western fund managers will stay away.

Regional specialists seem particularly unenthusiastic – unsurprisingly, given that many have been badly burnt in Kazakh assets repeatedly over the last two decades. Eurobond buyers were battered by two defaults by BTA Bank, while equity investors arguably have even more to complain about.

Boasts by Kazakh officials that the country is now ranked number one by the World Bank for the protection of minority shareholders ring hollow with asset managers who spent years battling for their rights as holders of shares in KMG EP, which listed on the London Stock Exchange in 2006, before it was finally taken private by parent KazMunaiGas in May.

Compared with other frontier markets, it is very developed in terms of the ecosystem and infrastructure, which makes it much more accessible for investors

– Karine Hirn, East Capital

Similarly, pledges of transparency are met with cynicism by those who got caught up in the scandals surrounding Eurasian Natural Resources Corporation, the Kazakh mining company that was delisted with the help of the Kazakh state in 2013, and whose travails also impacted copper miner and fellow FTSE100 member Kazakhmys.

“As investors, we have very long memories when it comes to Kazakhstan,” says one western fund manager. “We have had some good investments and some bad ones, but it’s the bad ones we remember.”

Even if privatization officials can convince investors of their bona fides this time, concerns about liquidity may still act as a deterrent. Samruk-Kazyna has indicated that all assets will be listed on AIX as part of the Kazakh government’s drive to develop local capital markets but has also mooted the possibility of dual listings in London or elsewhere.

Investors say splitting liquidity would be a mistake in what will likely be relatively small deals. At current valuations, the 25% stake of Kazakhtelecom up for grabs would be worth around $200 million.

“It’s all very well to say they’re going to list on LSE or Nasdaq or Hong Kong, but when your free float is only $50 million to $100 million, you’re going to get lost in the crossfire there,” says a capital markets specialist.

If officials do opt to list in Astana only, however, potential buyers may fret about the lack of local liquidity. Since policymakers opted to nationalize and merge Kazakhstan’s 11 second-pillar private pension funds in 2013, the country has had little in the way of an institutional investor base.

Succession

The other pressing question that will face those marketing the privatizations concerns the future of Kazakh politics. Nazarbayev, who has ruled the country with an iron fist since independence in 1990, turned 78 in early July. Whether or not his successor – as yet unknown – will continue his flagship policies and honour his promises remains to be seen.

“The big question mark in Kazakhstan is about the succession,” says a veteran western investor in central Asia. “The leadership matters – if you want to invest long-term, you have to have some kind of certainty about the direction in which the country is heading.”

At the same time, bankers say a shortage of investible assets in frontier markets will likely prompt fund managers to give Kazakh assets a fair hearing. Karine Hirn, chief executive of East Capital, agrees.

“The reality of frontier investing is changing very fast,” she says. “Since we started our first frontier fund four years ago, 34% of the index has either been upgraded to emerging market or will be shortly.

“This presents an opportunity for Kazakhstan. Compared with other frontier markets, it is very developed in terms of the ecosystem and infrastructure, which makes it much more accessible for investors.”

There is also the possibility that Kazakh officials may decide they can manage without picky western investors. As well as London and New York, Samruk-Kazyna has conducted roadshows in St Petersburg, Moscow, Shanghai and Hong Kong. It was also notable that, of the first 12 brokers to sign up as members of AIX, the only two non-Kazakh firms came from Hong Kong.

And if private investor demand fails to materialize, Kazakh officials seem fairly relaxed about the possibility of selling large stakes in state assets to other sovereign wealth funds or Chinese public sector buyers.

Kazakhstan has in recent years proved adept at attracting investment from Gulf countries including Saudi Arabia and Qatar; and Abu Dhabi Crown Prince Sheikh Mohammed bin Zayed was one of the star guests at the AIFC opening ceremony.

Meanwhile, Samruk-Kazyna has reportedly told fund managers that there will be no restrictions on Chinese investment in the privatization programme.

“They say: ‘We understand that China will be very important in this process,’” says one.

How that might play out domestically is another open question. While China may be popular with Kazakh policymakers – Belt and Road was the key theme of the Finance Days event and nearly every panel featured a Chinese speaker – it is less so with the population as a whole, who feel threatened by their powerful neighbour.

An attempt by Nazarbayev to privatize land holdings in 2016 triggered mass protests – rare in a country where dissent is heavily suppressed – over fears that the majority of buyers would come from China.

More recently, there has been growing outrage over reports of the treatment of ethnic Kazakhs in western China, many of whom have apparently been caught up in the government’s notorious “re-education programmes” for the local Muslim population in Xinjiang.

If the situation deteriorates, it could add another layer of complexity to an already volatile and challenging region and give investors yet another reason to think twice before investing in Kazakh assets.

Above all, however, it is the Kazakh government’s dismal record of delivering on its promises that will likely prove the biggest barrier to successful asset sales and the development of Astana as a financial hub.

“They are quite good at window-dressing, but if you scratch the surface, there’s not much behind,” says a western central Asia specialist.

Anuar Ushbayev, a board member at local investment bank Tengri Capital, agrees. During a panel session at the Finance Days event, he expressed the frustrations of many with Kazakh policymaking.

“There have been a lot of declarations by state officials about various things that related to the investment experience in Kazakhstan and they have spectacularly failed in following up on many of these declarations,” he said. “We need to create a transparent and stable environment, and prove that we can maintain that over time. Only then will we see meaningful investment in Kazakhstan.”

By Lucy Fitzgeorge-Parker

Full article: https://www.euromoney.com/article/b19wv4yfqypmzd/central-asia-astana-ifc-a-steppe-too-far?copyrightInfo=true

Visit http://www.euromoney.com/reprints for additional distribution rights. For more articles like this, follow us @euromoney on Twitter.