Professor Kristian Lasslett of the Corruption and Human Rights Initiative (CHRI) conducted a damming investigation into one of the largest infrastructure projects in Uzbekistan’s capital, Tashkent dubbed ‘Tashkent City’.

The investigation into the $1.3 billion project unravelled the beneficial owners, complex company structures and severe conflicts of interest associated with a number of lots led by companies associated with Akfa Group owned by Tashkent mayor Jahongir Artikhodjaev, one of Uzbekistan’s wealthiest businessman. The project has also been marred by allegations of suspicious award tendering and fraud charges against a Kazakh businessman associated with the project for 1 billion Kazakh tenge (€2.4 million).

Since the publication, the mayor of Tashkent has been forced to convene a press conference and respond to concerns of conflict of interest and personal patronage relating to his company and his office as mayor of Tashkent. He confirmed he had disassociated himself from the overseeing the management of the company, though as the investigation pointed out, he still owned the company, was deriving monetary gain and had a financial interest in its success.

Professor Lasslett adds, “that Artikhodjaev has no involvement in the day-to-day management of these companies is irrelevant. If it was discovered he employed his position in government to curry favour for a firm in which he has a beneficial stake, this would be corruption by any definition”.

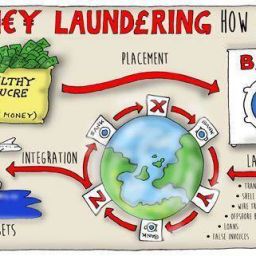

Only four days after the publication of this investigation, the Uzbek Finance Ministry publicly announced that the OECD had upgraded Uzbekistan’s credit rating from 6 to 5. This indicated improvement in the Uzbekistan’s credit risks, despite such stark evidence to challenge this. Laziz Kudratov, the Uzbek deputy chair of the State Committee for Investments who attended the press-conference rejected the need for public disclosure of beneficial owners of companies investing in Uzbekistan, thus embracing risk of money laundering and de facto inviting organized crime to wash their assets in Uzbekistan. He added,

“investments come from abroad, in this case it is a German company [Hyper Partners GmbH, a company registered in Germany with no information of its beneficial owners], and they pass through the banking system as a source of funds from Germany. By law, we have no right to request additional information about the founders. We set conditions for investors to invest, take legal obligations to implement the project, sign documents, and they can work… We had negotiations with more than 700 companies, it was very difficult to find investors who would believe in this project. Therefore, when we received such an offer from a German company, we said: ‘Welcome’”.

However, one of the leading experts on anti-corruption, Richard Messick highlightedin his recent blog, that Uzbekistan does have a law that requires a rigorous check of beneficial owners of companies entering its markets. Article 7 of the law “On Anti-Money Laundering and Terrorist Financing”, adopted in 2004, but updated in January 2019, requires relevant state and private entities to take due diligence measures, including:

- verification of the identity and credentials of the customer and persons on whose behalf it is acting on the basis of the relevant documents;

- identification of the owner of, or the person exercising control over, the corporate customer by studying the ownership and management structure in the constituent documents;

- an ongoing study of the business relationships and transactions with funds or other assets carried out by the customer in order to ensure their consistency with the customer’s profile and its activities.

The statements made by all three officials: Mr. Kudratov, Mr. Gulyamov and Mr. Artikhodjaev at the press-conference were entirely misleading and contradictory to Uzbekistan’s national laws and its international commitments, including its commitment on the UN Convention Against Corruption, of which Uzbekistan is a signatory.

Given this position was publicly articulated by a top Uzbek official, CHRI expresses its concerns that the Gulnara Karimova assets frozen in a number of jurisdictions, if returned directly to the government of Uzbekistan, cannot be guaranteed a safe disbursement. Similar to the ‘Tashkent City’ investigation, there remains a high risk the assets would be orientated towards ingratiating existing patronage systems in Uzbekistan; and that funds would disappear offshore through opaque contracts – a practice well-established in Uzbekistan. In our view, a safer passage for the repatriation of assets can only take place if the government of Uzbekistan condemns the practice of contracting companies with obscure beneficial ownership, and implements sound anti-money laundering and anti-corruption policies in line with the Uzbek CSO framework for return.

By Fatima Kanji

Is the Uzbek government embracing the risks of money laundering?