An open statement from Yelge Qaitaru Foundation

The Public Fund “Elge Qaitaru” appeals to you in connection with the offenses committed during the rescue of “Tsesnabank” and “ATF Bank” (the current “Jusan Bank”), and the damage caused to the state. “Jusan Bank” positions itself as the successor of “Tsesnabank”, which has existed since 1992. In 2018, “Tsesnabank” started having problems and the state spent 1.5 trillion tenge (!) on improving the bank, as a result of which the most problematic loans and other assets were bought by the state, and the bank itself received very preferential financing from the state.

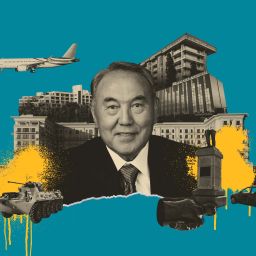

In February 2019, the shareholders of the troubled “Tsesnabank” sold 99.5% of their shares to JSC “First Heartland Securities”. As follows from the statements of “Jusan Bank”, JSC “First Heartland Securities” at that time was an investment division of a financial holding company owned by the private fund named “Nazarbayev Foundation” and a group of autonomous educational organizations “Nazarbayev University” and “Nazarbayev Intellectual Schools”. In April 2019, the new shareholders of the bank decided to rename the bank from “Tsesnabank” to “First Heartland Jusan Bank”.

In September 2019, the merger of JSC “First Heartland Jusan Bank” (former “Tsesnabank”) and a small bank JSC “First Heartland Bank” (former “Bank Expocredit”), which belonged to the same group, was carried out. As stated in the statements of “Jusan Bank”, the merger was formalized in such a way that a small bank became the buyer of the former “Tsesnabank” and the name of the merged bank became JSC “First Heartland Jusan Bank” (“Jusan Bank”).

At the moment when this small bank acquired “Tsesnabank” which was cleared of problems, the state made the first gratuitous “gift” to the shareholders of “Jusan Bank”.

Thus, the audited statements of “Jusan Bank” for 2019 show the income from the acquisition of the former “Tsesnabank” in the amount of 241.4 billion tenge. According to the statements of the English company “JTL” (a holding company that includes “Jusan Bank”), this income is reflected in US dollars and according to the exchange rate of tenge in that period it amounted to $636.5 million (the “gain on business combination” line in the “JTL” income statement).

It means the state spent a huge amount of money on financial recovery of “Tsesnabank” (1.5 trillion tenge), after which the net assets (capital) of the former “Tsesnabank” amounted to the same 241.4 billion tenge ($636.5 million). Then the audited statements of “Jusan Bank” and the holding parent company “JTL” show that “Tsesnabank” was transferred free of charge to the shareholders of “Jusan Bank”.

In December 2020, “Jusan Bank” acquired “ATF Bank”. On this purchase, “Jusan bank” recognized a profit of 170.6 billion tenge (or $412.7 million, according to the statement of the parent holding “JTL” holding). According to the audited statements of “Jusan Bank”, at the time of purchase, the fair value of net assets (cost of capital) of “ATF bank” amounted to 205.1 billion tenge, and in return, the former owners of the “ATF bank” received compensation in the amount of 34.5 billion tenge (the compensation was made in the form of shares of “Jusan Bank”). The difference between the value of the bank and the compensation received was exactly equal to the profit of “Jusan Bank” in 170.6 billion tenge.

If you look at the audited statements of the government’s Problem Loans Fund (FPC) for 2020, you can find that at the end of 2020 (before the acquisition of “ATF Bank” by “Jusan Bank”), the FPC bought the problem assets from ATF Bank, paying with live money in the amount of 174.0 billion tenge. At the same time, according to the FPC reports, the market value of the repurchased distressed assets was only 35.3 billion tenge.

As a result of this very unfair operation for the state, the state-owned Problem Loans Fund (FPC recognized a “loss on the acquisition of distressed assets at non-market value” in the amount of KZT 138.7 billion (taken from the fund’s statements). Similarly, “ATF Bank” should have recognized a similar profit in its financial statements, which represents a gratuitous contribution of the state to the capital of “ATF Bank”. Taking into account the fact that the state had previously provided large concessional financing to “ATF Bank” at a loss to itself, it can be said with great confidence that the profit of “Jusan Bank” in the amount of 170.6 billion tenge (or $412.7 million) earned on the purchase of ATF Bank is entirely a “gift” from the state to the owners of “Jusan Bank”.

The audited financial statements of “Jusan Bank” for 2020 show “Income from modification of financial obligations to state institutions” in the amount of 124.6 billion tenge (or $301.4 million according to “JTL” reports). This means that in 2020, state institutions restructured their financing of “Jusan Bank” (meaning reduced the financial burden on the bank) in such a way that it recognized a profit on this in the amount of $301.4 million!

As part of the acquisition of “Tsesnabank” and “ATF Bank”, “Jusan Bank” received a huge portfolio of concessional financing from the state equal to several hundred billion tenge. Then, in 2020, the government suddenly decided to make such preferential financing for “Jusan Bank” even more preferential by lowering interest rates and greatly lengthening the maturity dates. According to the statements of “Jusan Bank”, such benefactors (who reduced the financial burden on the bank) were the Kazakhstan Sustainability Fund, which belongs to the National Bank, and the “Samruk-Kazyna” National Welfare Fund, which belongs to the government. At the same time, mirror image, these state-owned companies have mirror-reflected a similar loss ($301.4 million).

Thus, if we add up the amount of income that “Jusan Bank” received from the state during the acquisition of “Tsesnabank” and “ATF Bank”, as well as reducing the financial burden, it just turns out that the owners of the bank during 2019-2020 received a gift from the state in the amount of $ 1.3 billion. According to the audited statements of “Jusan Bank”, at the beginning of 2019, the bank’s share capital was only 13.6 billion tenge. Then the owners of the bank additionally invested 70.3 billion tenge in 2019 and 41.7 billion tenge in 2020 (a total of 111.9 billion additional capital from shareholders was invested in 2019-2020). At the same time, in the same year 2020, the owners of the bank took all the additional invested capital (and even a little more) in the form of dividends in the amount of 113.4 billion tenge (all taken from the bank’s statements). That is, the net investments of the owners of “Jusan Bank” in the bank’s capital at the end of 2020 amounted to a meager 12.1 billion tenge.

At the same time, in 2019-2020, the state invested 536.6 billion tenge in the capital of “Jusan Bank” (241.4 billion for operations with “Tsesnabank”, 170.6 billion for operations with “ATF Bank”, and 124.6 billion tenge to reduce the financial burden of state-owned companies on the bank). That is, if you look at the invested funds, “Juasan Bank” should almost 100% belong to the state! With such huge investments of the state in the capital of “Jusan Bank”, last year the private owners of this bank amazed the public by the fact that the bank in 2021 paid them 114 billion tenge in the form of dividends (45 billion in December and 69 billion in May). That is, based on the analysis of financial statements, we can say that until 2021, the owners of “Jusan Bank” withdrew all their investments from the bank’s capital, and in 2021 they began to cash out state investments previously made in the capital of “Jusan Bank”.

The conclusions contained in this statement are based on an analysis of the audited financial statements of “First Heartland Jusan Bank” JSC (hereinafter referred to as “Jusan Bank”) and the English company “Jusan Technology Limited” that owns “Jusan Bank” through a local company “First Heartland Securities” JSC and were obtained from the published article by the famous economist Murat Temirkhanov at www.exclusive.kz on March 21, 2022.

We ask you to verify the facts stated, bring the perpetrators to justice and take measures to compensate for the damage caused to the state.