The NGO Public Eye has accused Vitol, the second largest company in Switzerland, of using a discreet joint venture to conceal links to powerful elites in Kazakhstan, helping the company win lucrative contracts in the country. Public Eye has called on the Swiss Federal Council to strengthen standards for transparency and due diligence in commodity trading.

In a report released on Wednesday, Public Eye claims that Vitol, the world’s largest private oil trader and a major player in the Kazakh oil export industry, relied on an opaque and intricate web of business relationships with several key figures in the Kazakh petroleum sector to help expand its operations in the country. In a statement to swissinfo.ch, Vitol said it has a rigorous compliance framework to ensure that it complies with anti-corruption laws.

The report is based largely on emails and documents hacked from the inboxes of top-level Kazakh managers, which were divulged by the anonymous platform Kazaword. In 2015, the platform also revealed that Thomas Borer, a former Swiss ambassador, sought to lobby the Federal Council and the Swiss judicial authorities on behalf of the Kazakh government.

Friends with indirect benefits

At the centre of the affair is a joint venture called Ingma Holding NV, which was set up by Vitol’s Dutch subsidiary, of which it retains 49% ownership. Vitol Central Asia is also a subsidiary of Ingma according to Public Eye.

Registered in Rotterdam in 2003, Ingma Holding has no website and is not mentioned in any Vitol corporate materials, making it difficult to confirm the reports from Public Eye. According to the report, Ingma, with only 11 employees, posted revenue of US$93.9 billion and net profits of US$1.1 billion between 2009 and 2016. It also has ten subsidiaries, four of which are registered in Switzerland – in Geneva, Baar and Lausanne.

Public Eye’s investigation claims that Kazakh president Nursultan Nazarbayev’s son-in-law, Timour Koulibayev, indirectly benefited from the joint venture. Koulibayev and his wife also own a house in Anières in Canton Geneva that they bought for CHF74.7 million in 2009.

Ingma distributed more than $1billion in dividends to its shareholders, including Vitol and its partners, which included three politically exposed persons (PEPs) with ties to Koulibayev. One of the men is Arvind Tiku, an Indian businessman and shareholder of Ingma through his company Oilex NV, which owns 51% of Ingma.

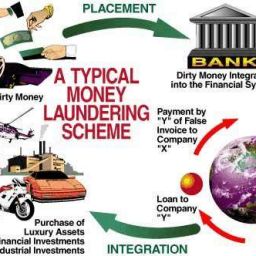

In 2010, a court case in Switzerland against Koulibayev and Tiku for money laundering, filed in 2013 and eventually closed, revealed that the two men were co-beneficiaries of a trust at Credit Suisse. Between May and August 2006, this trust received nearly $600 million from companies according to Public Eye’s investigation. In 2007, $283 million emerged from the trust in the form of interest-free loans to Merix International Ventures, which belongs to Kulibayev.

Vitol told swissinfo.ch that it is unaware of any benefit that Kulibayev received from Ingma.

Vitol’s ascent in Kazakhstan

Corruption is a major hurdle to doing business in Kazakhstan according to the 2017 OECD anti-corruption network report. It found that global companies believe corruption is widespread among the country’s political circles where networks of patronage and cronyism undermine business environment. Kazakhstan ranks 122 out of 180 on Transparency International’s Corruption Perceptions Index.

The oil industry is the backbone of the economy, contributing 50% of GDP and $23 billion to export revenue. Kazakhstan is Switzerland’s second largest supplier of crude oil exports behind Nigeria. The Extractives Industry Transparency Initiativeindicates that the country has made progress in disclosing oil and gas revenue but gaps remain regarding state-owned oil companies, licensing processes, and beneficial ownership.

The world’s largest private oil trader has been a major player in Kazakhstan’s oil export sector for the past decade. By 2014, Public Eye reports, Vitol was responsible for the sale of nearly a quarter of the country’s crude oil for export. The Financial Times reported that in 2017 Vitol was awarded a six-year loan-for-oil deal with state-oil company KazMunaiGas called a pre-financing agreement.

In a response to swissinfo.ch, Vitol said that “Ingma had nothing to do with the pre-financing arrangements with KMG.” It added that its two pre-financing transactions in Kazakhstan – in Tengiz and Kashagan – were awarded to Vitol SA after open and competitive tender processes.

Familiar story

This is the second revelation in one week of major Swiss commodity traders’ involvement in activities that present high risks of corruption. Last Friday, Public Eye and Global Witness alleged that three major commodity traders with headquarters in Switzerland, Glencore, Trafigura, and Vitol, worked with intermediaries accused or convicted of bribery in Brazil’s “Car Wash” scandal, one of the largest corruption scandals in the country.

Under current Swiss law, commodity traders are not required to conduct in-depth screening of PEPs as banks are under the Money Laundering Act. In the case of Kazakhstan, Public Eye argues that Vitol partnered with PEPs in a joint venture, which carries high risks of corruption.

However, in a statement, Vitol noted that commodity traders are subject to stringent laws in their dealings with PEPs including those relating to anti-bribery and anti-money laundering. This includes obligations under the EU’s 5th Anti-Money Laundering Regulations and the UK Bribery Act 2010. The company said that “it already implements all the measures suggested by Public Eye and is already obliged to implement robust due diligence and anti-bribery procedures under the UK Bribery Act 2010 and other similar legislation.”

The NGO calls on the Swiss Federal Council to mandate due diligence of business partners and transparency in payments to governments. It also recommends that Switzerland establish a Commodity Market Supervisory Authority to regulate the sector.

By Jessica Davis PlüssNov

Swiss oil trader accused of profiting from ties to elites in Kazakhstan