As it became known from open sources on the Internet, in November 2009, the state oil company Kazmunaigaz acquired 100% of the shares of Mangistaumunaigaz, as a result of which the budget of Kazakhstan lost 1.8 billion US dollars.

According to tax legislation, an increase in the value of a Kazakh asset is subject to taxation in the territory of the Republic of Kazakhstan. In this case, such an asset is the shares of JSC Mangistaumunaigaz.

As you know, this oil-producing enterprise was once sold to a foreign investor, some Indonesian company Central Asia Petroleum Ltd., for a relatively small amount, although even then it was one of the largest in the country with an annual production of about 5-6 million tons of oil.

By the way, the question of who was the shareholder of Central Asia Petroleum Ltd. and, accordingly, JSC Mangistaumunaigaz, still remains unanswered.

From the documents posted on the Internet, it follows that 28% of the shares of the Indonesian company through offshore structures belonged to Timur Kulibayev and his partner, an English billionaire of Indian origin Lakshmi Mittal. But the owner of the remaining 72% of the shares is still unknown.

100% of the shares of JSC Mangistaumunaigas were bought for $2.6 billion by the offshore company Mangistau Investments B.V., owned by the Chinese CNPC Exploration and Development Company Ltd. and Kazakh national company KazMunayGas.

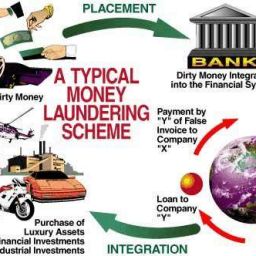

The deal was not formalized as a direct purchase, but as a sale and purchase of shares on the Kazakhstan Stock Exchange. This was done in order to take advantage of the norm contained in the Tax Code and providing: if the shares were sold and, accordingly, bought on the stock exchange during open trading, then the increase in value on them is not subject to income tax.

However, from the documents posted on the Internet, it irrefutably follows that the purchase and sale of 100% shares of JSC Mangistaumunaigaz on November 25, 2009 at KASE was a direct deal disguised as an open trade.

The following stubborn facts evidence this. Firstly, the buyer and seller were known in advance – almost a year before the transaction. Secondly, there was only one buyer. Thirdly, since the subsoil user’s shares were sold, and in such cases the legislation requires prior permission from the competent state body, there could not be targeted, open trades in shares of JSC Mangistaumunaigaz at KASE in principle.

Since, according to Kazakhstani legislation, the purchase and sale of Mangistaumunaigaz shares was actually carried out by the “direct transaction method”, the seller company Central Asia Petroleum Ltd. had to pay tax on profits arising from the increase in the value of Mangistaumunaigaz shares to the budget of the Republic of Kazakhstan.

According to the tax legislation of the Republic of Kazakhstan, income from the increase in the value of shares is taxed at a rate of 20%. The seller (Central Asia Petroleum Ltd.) carried out its activities in the Republic of Kazakhstan through its branch and representative office. Consequently, Central Asia Petroleum Ltd. must have paid an additional tax of 15% on the net income of the permanent establishment.

The initial value of Mangistaumunaigaz shares was 719.7 million US dollars (10,795,530,2000 tenges). Thus, even with the declared fictitious sale price of Mangistaumunaigaz shares in the amount of $2.6 billion, the amount of tax should be at least $652.4 million, taking into account the fact that capital gains amounted to $1.9 billion.

The question arises about the real market value of JSC Mangistaumunaigaz. In fact, this oil-producing enterprise should cost at least 6 billion US dollars. Moreover, the underestimation of the purchase price to 2.6 billion and registration of the acquisition not directly at CNPC Exploration and Development Company Ltd. and KazMunayGaz, were made on purpose for the offshore company Mangistau Investments B.V.

Accordingly, the increase in the value of the Kazakh asset was initially calculated at $1.9 billion, in reality, reached $5.3 billion. And the unpaid income tax to the state budget of Kazakhstan equalled $1.8 billion.

Since it follows from the documents available on the network that 28% of the shares of JSC Mangistaumunaigaz through the Indonesian company Central Asia Petroleum Ltd. belong in equal shares to Timur Kulibayev and Lakshmi Mittal, then you can calculate yourself how many of the above-mentioned billionaires from the list of the American Forbes magazine saved on taxes.

We ask you to check these facts and, if these circumstances are confirmed, take measures to bring the perpetrators to justice and compensate for the damage caused to the state.

Your response will be brought to the attention of the public and mass media.

Best reagrds,

Bulat Abilov

Urazaly Yerzhanov

From:

Mr. Abilov B.M.

Mr. Yerzhanov U.S.

Yelge Qaitaru Foundation, 42V Ivanilov street, Almaty, Kazakhstan

To:

Mr. Asylov B.N, Prosecutor General of the Republic of Kazakhstan

Mr. Akhmetzhanov M.M., Minister of Internal Affairs of the Republic of Kazakhstan

Mr. Bektenov O.A., Chairman of the Agency of the Republic of Kazakhstan on combating corruption

Mr. Elimanov Zh.K, Chairman of the Agency of the Republic of Kazakhstan on financial monitoring

July 27,2022

Original link to claims on the website: Government of the Republic of Kazakhstan