Experts have criticised inadequate legislation, failures by the National Crime Agency, and “flawed” legal judgements which led to the dismissal of a high-profile case against the relatives of Kazakhstan’s autocratic first president.

The National Crime Agency “failed to adequately investigate and rebut” material supplied by the law firm Mishcon de Reya, a new report which examines the complex web of Kazakhstan property ownership in London says.

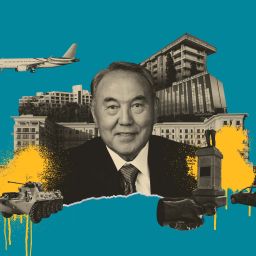

The NCA should take “a large part of the blame” for the collapse of the Unexplained Wealth Orders against Dariga Nazarbayeva and Nurali Aliyev, the daughter and grandson of Nursultan Nazarbayev, whose rule ran from 1991 to 2019.

The report, launched in Parliament today by academics and Dame Margaret Hodge MP, says the judgement made by the judge who heard the case, Ms Justice Lang, was flawed, as she accepted evidence from the Kazakh authorities that was “likely tainted by political bias, given the Nazarbayev family’s control over Kazakhstan at the time the UWOs were issued”.

Professor Heathershaw and Mr Mayne call on the NCA to review the case, known as NCA v Baker, and examine the ownership of £137 million properties in Baker Street.

“Criminality Notwithstanding: The use of Unexplained Wealth Orders in Anti-Corruption Cases”, was written by Tom Mayne and John Heathershaw from the University of Exeter. Research for the report was conducted under the Global Integrity Anti-Corruption Evidence Programme, funded by UK Aid.

The report calls for increased funding and mandate for the UK enforcement agencies so that they can properly investigate and freeze corruptly obtained assets. It argues for the use of specialist investigators, greater use of experts who can provide evidence on the politics and laws of countries in question and an economic crime court with specialised judges.

Unexplained Wealth Orders were introduced in the United Kingdom in 2017 to tackle organised crime and grand corruption emanating from kleptocracies. Only four UWO investigations have been reported since 2018, no UWO has been issued since July 2019, none have been issued against Russian nationals, and only one UWO investigation has been successful against property held by a foreign political figure — a former Azerbaijani banker, Jahangir Hajiyev, and his wife. Even though the UWO was upheld, the properties are yet to be recovered and legal proceedings are still ongoing.

The UWO investigation into Dariga Nazarbayeva and Nurali Aliyev was launched in 2019, and three orders were issued on properties owned by them. Other properties, including a block of flats and offices on Baker Street worth £137 million, were not issued with UWOs, although it is unclear why. The orders were dismissed by the High Court in 2020, which saw the National Crime Agency landed with a £1.5 million bill in costs.

The report says the NCA “did not focus to any great extent on the kleptocracy centred on the Nazarbayev family that forms the basis of Kazakhstan’s political economy and missed key evidence already in the public domain which would have helped the judge dismiss certain aspects of Nazarbayeva’s claims as unreliable”.

It highlights how Ms Justice Lang “expressed the need for caution in treating the complexity of corporate structures as grounds for suspicion, yet did not question the possible reasons why Nazarbayeva and her son were using such complex structures”.

The report identifies five flaws in the original Unexplained Wealth Order legislation:

- its acceptance that wealth is “lawfully obtained” if it is generated legally under the laws of the country from where the income arises;

- that respondents can point to public statements of wealth as legitimate and sufficient evidence in and of themselves without corroborating evidence;

- the fact that respondents can avoid the presumption that their property was criminally obtained by “purporting to comply” rather than complying fully with the order;

- the fact that enforcement bodies can issue UWOs against trustees and other nominees, yet the other requirements refer more clearly to the property’s beneficial owner. This creates an awkward mismatch, where the enforcement body must demonstrate that, for example, a trustee is a politically exposed person.

- the fact that costs in unsuccessful cases are not capped, meaning that the UK body that has brought the investigation is liable to pay the legal costs of the other side, leading to bills in the millions of pounds.

The recently-passed Economic Crime (Transparency and Enforcement) Act 2022 seeks to address the final two of these but leaves the first three untouched. However, the report argues that “the first three issues remain, and pose a threat to the future use of UWOs against corrupt incumbent officials.”

Tom Mayne said: “We believe key to the successful outcome of NCA v Hajiyeva and the lack of success in NCA v Baker is the fact that at the time the orders were issued Jahangir Hajiyev was in jail in Azerbaijan and had no support from the country’s ruling powers, while Dariga Nazarbayeva, the daughter of the then president of Kazakhstan, retained favour in her home country. Thus, there is the possibility that instead of counteracting kleptocracy, UWOs may reinforce it. Extra efforts must be made to better tackle those who remain in power and not just the “fled and politically dead.”

Professor Heathershaw said: “There is the danger that UWOs will only have an impact in the most clear-cut anti-corruption cases. Unless there is further reform or new legal precedent to establish that wealth accrued by such political means is not in fact “lawfully obtained”, then UWOs will remain a weak tool against kleptocracy.”

The report says in NCA v Baker the NCA “paid little attention to the corrupt underpinnings” of Kazakhstan, where Nazarbayev “allowed members of this family to accrue billions of dollars in opaque and questionable circumstances”. The NCA’s case failed as it attempted to tie the properties to Dariga Nazarbayeva’s criminal ex-husband, Rakhat Aliyev, even after it was revealed that the beneficial owners of the properties were Dariga Nazarbayeva and Nurali Aliyev. However, despite parts of the NCA’s case being faulty, its central tenet – that there is little separation between Dariga and Rakhat’s wealth – is predominantly true, based on other publicly available information and further research.

One of the properties originally subject to UWOs was 32 Denewood Road, Highgate. Purchased on 2 April 2008 for £9.3 million. According to Mishcon, the property was held by Nurali on trust for his mother, through a company called Twingold Holding Ltd that was owned in turn by Dariga, Nurali and a company called Sagitta Business Corp. The property was later transferred to a Panamanian private interest foundation, Villa Magna, which held the property for Dariga Nazarbayeva. A French lawyer was the original president of the foundation, but was replaced in 2015 by Andrew Baker, a British solicitor based in Liechtenstein. The house was put on sale in March 2021 for £9.5 million, later reduced to just under £9 million.

Another property, 33 Bishops Avenue was purchased on 20 May 2008 for £39.5 million. A previous owner, Hossein Ghandehari, bought it in July 200 2 for just £4.21 million, almost ten times less. Ghandehari, an Iranian investor, is the son of Hourieh Peramam, a businesswoman originally from Kazakhstan, who also owns a house on the same road, which she bought for £50 million in 2008. dNurali bought the house through an offshore company, Riviera Alliance Inc, which was wholly owned by Nurali’s company Greatex Trade and Invest Corp. In March 2013, Nurali’s Greatex transferred its shares in Riviera to Manrick Private Foundation, incorporated in Curaçao, and the legal title for the property was transferred from Riviera to Manrick.

Original source of article: eurekalert.org