Google translated

Kazakhstani billionaires are buying up the most expensive real estate on the French Riviera — about a year ago, we already published a longread about this. This time we will tell you about the possessions of another member of the Kazakhstani Forbes list, though the former, Nurzhan Subkhanberdin. The ex-co-owner of Kazkommertsbank got rich on offshore schemes, which cost the Kazakh budget almost $ 9 billion. Subkhanberdin turned out to be the owner of an estate on the Mediterranean coast with an area of several hectares and worth tens of millions of euros.

Who is Nurzhan Subkhanberdin

In 2017, a scandal erupted in Kazakhstan. The German newspaper Süddeutsche Zeitung obtained 6.8 million confidential documents from the Bermuda law firm Appleby. They shared this data with the International Consortium of Investigative Journalists (ICIJ) and the Organized Crime and Corruption Research Center (OCCRP). The documents contained massive amounts of data associated with many offshore firms and revealed the structures, transactions and other operations of many holding companies around the world that tried to hide their activities in specific jurisdictions.

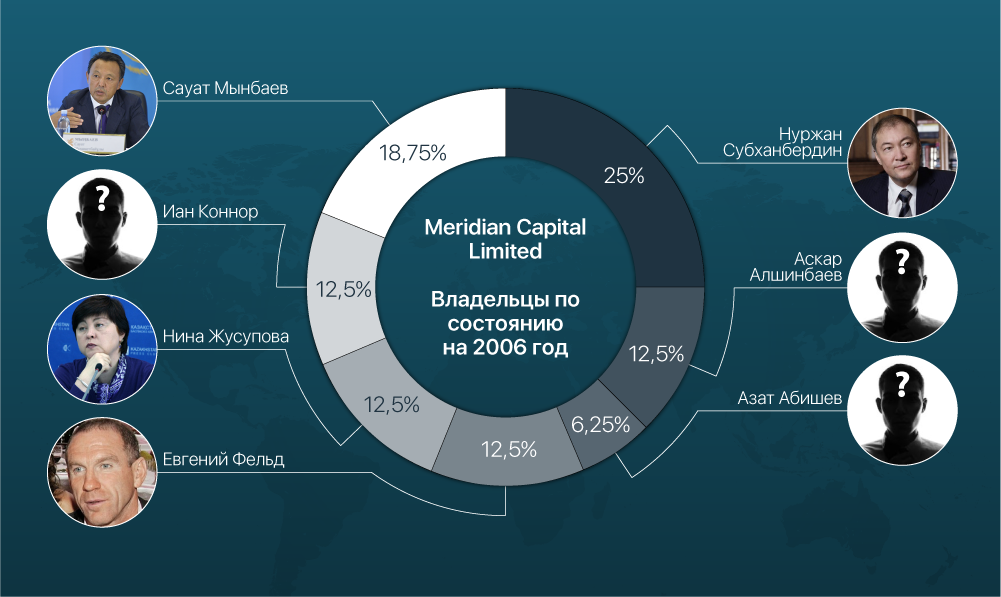

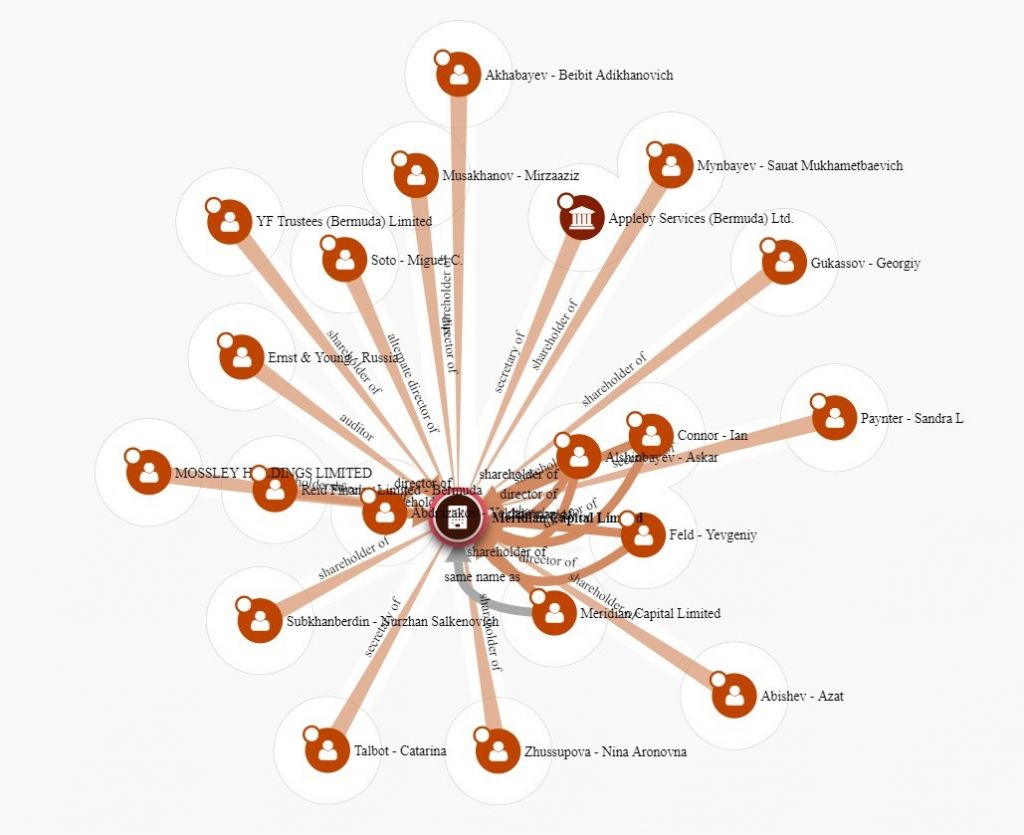

Thus, Kazakhstanis learned that the number of real beneficiaries of Meridian Capital is not limited to only two participants in the Kazakh Forbes list, Askar Alshinbaev and Yevgeny Feld (both appeared only twice in the magazine’s rating and data on them has not been published for the last 6 years). In fact, the list of the company’s shareholders was much broader.

Among them was Sauat Mynbayev, a major Kazakhstani official who held ministerial posts and was at that time in charge of the national company KazMunayGas . In January of this year, he, already the head of another national company, Kazakhstan Temir Zholy (KTZh), was hospitalized with a severe spinal injury. The press service of the railway monopoly reported that he was injured while playing sports. Later , information appeared on social networks that Mynbayev’s injuries could be the result of a corporate conflict. In April, he finally left the chair of the head of KTZ.

The beneficiaries of Meridian Capital were also the chairman of the board of Kazkommertsbank Nina Zhusupova and the head of the board of directors of the same bank Nurzhan Subkhanberdin . In addition, Subkhanberdin owned (directly and through the Central Asian Investment Company JSC, in which Zhusupova owned 13%) a large block of shares in this bank. In 2015, his share was 37% in the share capital of Kazkom, but by 2017 he almost completely got rid of it, selling the stake to Kenes Rakishev . Less than a year after the published journalistic investigation, the country’s second largest bank by assets came under the control of the largest “People’s Bank” Timur and Dinara Kulibayev .

Among the shareholders of Meridian Capital, one can also notice a certain Azat Abishev , probably a relative of Subkhanberdin’s wife Zhanar Abisheva .

Kazkomovtsy owned the largest stake in Meridian Capital. According to documents received by journalists, it is clear that it was through this bank, using a chain of offshore companies, that the Meridian group financed many of its projects.

The interests of the group, which positioned itself as a venture fund, extended to many of the holding’s projects in the field of mining, development and logistics business ( here you can read how they managed to build an entire transport empire in Kazakhstan), etc.

The group operated not only in Kazakhstan, but also in neighboring Russia, as well as in North America, Asia, Europe and Australia. Almost uncontrolled access to “cheap” money and Mynbayev’s lobbying capabilities ensured rapid growth for the holding. At the same time, the authors of the investigation note that unsuccessful projects were simply written off to the balance sheet of Kazkomertsbank — only after the leak from Bermuda it became clear that many firms to which the bank “forgave” loans turned out to be associated with Meridian Capital.

The result was predictable: the bank needed several rounds of financial assistance from the state. In 2010, the volume of injections of state funds reached $ 1.4 billion, and a year later Kazkom received another $ 7.5 billion. This is slightly less than half of the combined fortune of the 50 richest businessmen of Kazakhstan according to Forbes in 2012 ($ 23.9 billion).

The important role of Kazkommertsbank in the activities of Meridian Capital is also confirmed by the fact that after the bank came under the control of the Kulibayevs, the interest of the group members in Kazakhstan noticeably decreased.

The Askar Alshinbaevs and Evgeny Feld still run Meridian Capital. The group’s offices are located in Hong Kong, Moscow and Amsterdam. It is difficult to judge how successful their projects are.

Central Asian Investment Company JSC of Nurzhan Subkhanberdin and Nina Zhusupova has not provided audit reports since 2018. Judging by the last published list of affiliated persons in 2019, they also included a small trading company LLP InKo Company (Subkhanberdin 32.92% / Zhusupova 67.08%), its subsidiary LLP Oil Service and shares in the media ‑business — newspapers Publishing House Vremya LLP (Subkhanberdin 41.8%) and Republican Gazeta Panorama LLP (Subkhanberdin 40%)

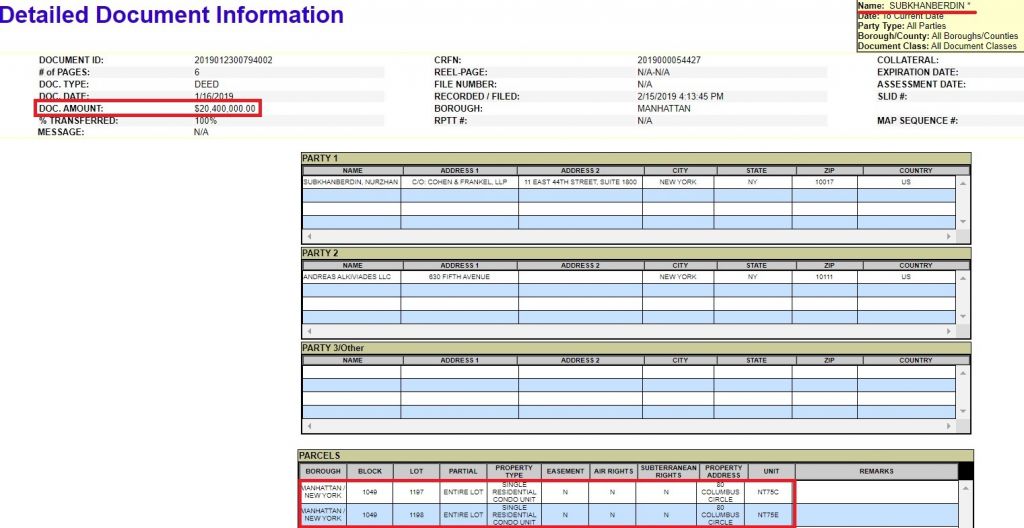

Probably, problems with a reliable source of financing in the form of Kazkommertsbank forced Subkhanberdin to finally get rid of luxury apartments in the center of New York in 2019.

He collected this asset for several years: first he bought the first apartment in the Time Warner Center in 2004 for $ 8.65 million, ten years later — the neighboring one for $ 7.25 million. The total area of two penthouses on the 75th floor of the elite complex was 440 m² … The original sale price was announced at $ 33 million, after a few years it fell by $ 10 million.As a result, judging by the city register of the New York Department of Finance, Subkhanberdin’s lot went for $ 20.4 million.

Of course, this is not the only foreign asset of Nurzhan Subkhanberdin.

Manor with an island on the French Riviera

We decided to start our search for Nurzhan Subkhanberdin’s overseas property in France. A simple fact brought us to this country — his three daughters (the former banker has ten children in total) are named Jeannette, Chantelle and Jacqueline. This is no accident, we thought — and it was right.

A simple search through the usual telephone directory yields two addresses on Avenue Raymond Poincaré ( 316 and 653 ) in Eze, in the heart of the French Riviera, about halfway between Nice and Monaco. Checking on a map compiled on the basis of land surveying of the state cadastre tells us that these sites with land buildings and infrastructure form a huge estate with a long coastal strip of almost 1 km, its own artificial island and a total area of almost 30 thousand square meters. It is very close to the Vatican Square, the smallest state in the world.

About a third of the estate is occupied by gardens. There are also two mansions there. One of them, apparently, is for guests, the second — Villa Isoletta with an interesting history — for the owners.

In 1923, the villa was bought by Alva Belmont, the first wife of William Vanderbilt, grandson of Cornelius Vanderbilt, the founder of the famous family of American businessmen. Belmont has been a fairly prominent figure in the international feminist movement. A few years earlier, her daughter Consuelo, after her marriage to Charles Richard Churchill, 9th Duke of Marlborough, acquired another mansion in the same place. Since then, the cousin of Alva Belmont’s son-in-law Winston Churchill has become a frequent guest at Villa Isoletta. After World War II, the family sold the villa, which then changed several owners.

In addition to two villas, the estate has several beaches and an artificial island. In the 19th century, an artillery battery was located there to protect the bay — now on the island of Subkhanberdin, connected to the mainland by a small bridge, there is a recreation area and a pool with sea water.

The cost of all this real estate, judging by the market prices in the vicinity of Nice, can be approximately estimated at € 40 — € 50 million. How much the former co-owner of the burned-out Kazkom actually paid for it, we will tell in the following publications.

Here you can watch the drone footage (from 1.5 minutes), which gives a clear idea of the site and the objects standing on it. The author mistakes her for “Villa Bono”, a famous Irish musician and leader of the group U2. In fact, his mansion is located about 400 meters west of the Subkhanberdin estate.