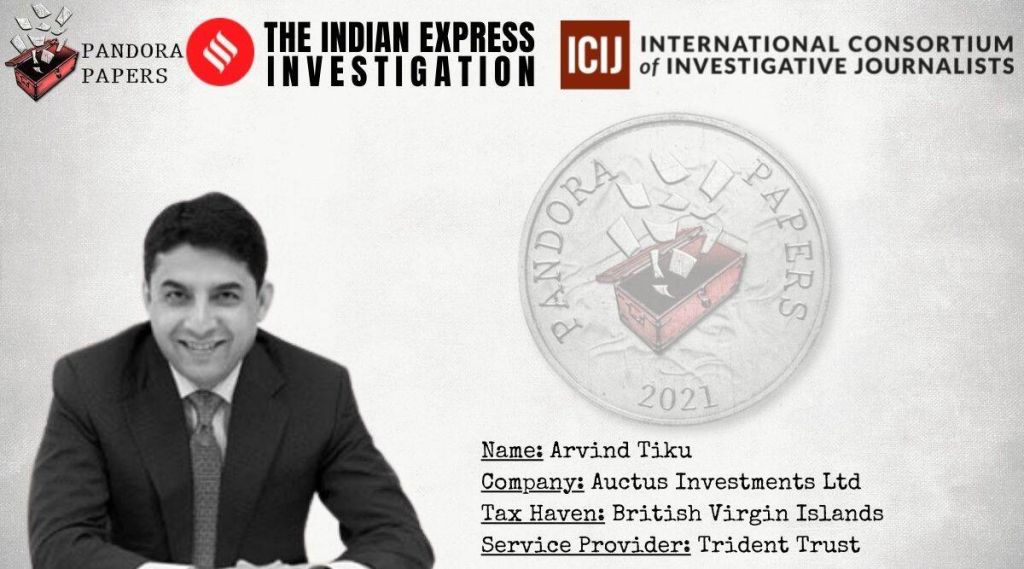

India-born Arvind Tiku, 51, ranked by Forbes in 2021 because the 18th richest in Singapore with a internet price of $2.2 billion, has established The Sai Charan Funding Holding Belief in Singapore, of which Auctus Investments Ltd, a British Virgin Islands firm, is the prime funding holding automobile with property of $199.4 million, present information of Trident Belief, a worldwide company companies firm headquartered in BVI.

Tiku isn’t just one other businessman. His enterprise associates embody LN Mittal, chairman of the world’s largest metal and steel firm, ArcelorMittal, and Timur Kulibaev, son-in-law of former President of Kazakhstan Nursultan Nazarbayev.

Whereas verifying credentials utilizing the World-Verify service supplied by Thomson Reuters, Trident Belief had red-flagged Tiku, given his affiliation with Kulibaev and Mittal (each Politically Uncovered Individuals), and sought an enhanced due diligence examine on him. He was proven as a useful proprietor of KazStroyService International BV, an organization managed by Tiku, LN Mittal, Timur Kulibaev and Goldman Sachs.

The Indian Express independently corroborated it. The 2013 Annual Report of UK vitality firm Nostrum Oil and Fuel highlights KSS International as an entity not directly managed by the 4, and because the useful holder of 26.6 per cent of the UK firm.

Profiling him among the many 50 richest in Singapore, Forbes stated Tiku left India when he was 18 to check mechanical engineering in Russia and labored as a commodities dealer earlier than venturing into oil and fuel in Kazakhstan.

As we speak, he’s the Founder and Group Chairman of AT Capital Pte Ltd, a Singapore personal fairness firm, with $2.5 billion in property unfold throughout sectors comparable to actual property, hospitality, pure assets, engineering, and building.

Responding to questions from The Indian Categorical, Hywel Phillip, Normal Counsel, AT Capital Pte Ltd, stated: “Mr. Tiku has been a Non-Resident Indian since 1998. The AT Capital group shouldn’t be an proprietor of KSS International. The AT Capital group bought its curiosity in KSS in 2018 similtaneously different shareholders together with Goldman Sachs.”

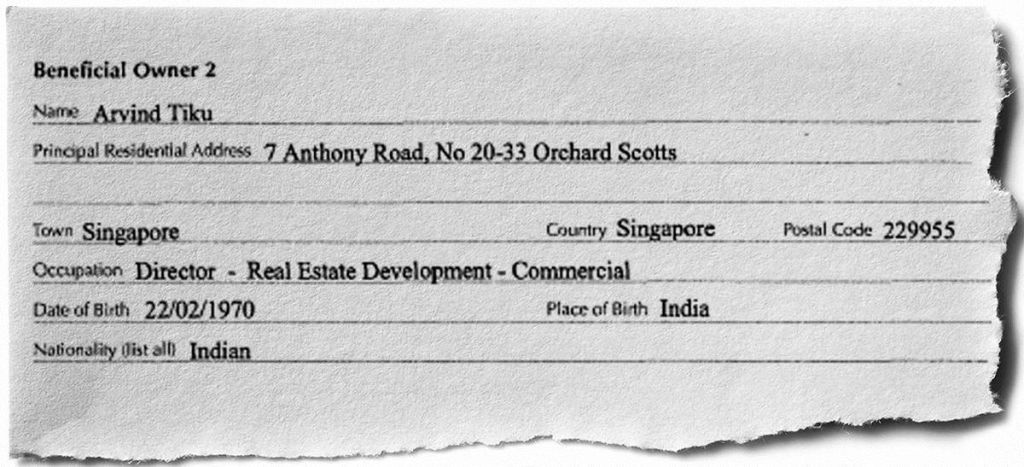

Tiku arrange The Sai Charan Belief in Channel Islands, Guernsey, in August 2011. The trustee of Sai Charan Belief is Commonplace Chartered Belief (Guernsey) Restricted. It’s a discretionary belief arrange for property planning of Tiku, who can also be the ‘Settlor’ and ‘Final Useful Proprietor’. In easy phrases, he owns all property assigned to the Belief. His spouse Niharika Tiku is the ‘Protector’ of the belief, in accordance with the paperwork. Auctus Investments is the account holder for the belief.

Whereas a ‘Settlor’ is an individual who units up the belief, a ‘Protector’ typically supervises the trustee. The trustee, on this case, Commonplace Chartered Belief (Guernsey) Ltd, administers all of the affairs of the belief based mostly on the directions of the ‘Settlor’ – Arvind Tiku.

Phillip stated the AT Capital group is held by two irrevocable discretionary trusts, of which The Sai Charan Funding Holding Belief is one. “The beneficiaries of the trusts settled by Mr Tiku embody solely himself and his speedy members of the family and no different individuals,” he stated.

To a query if all property have been declared, Phillip stated, “All related property/ earnings required to be disclosed to the Revenue-Tax division in India, Singapore and/or another tax jurisdictions have been declared and paid.”

Auctus Investments, the BVI firm, included in February 2013, owns the funding portfolio stored with Commonplace Chartered Financial institution’s branches in Hong Kong and Singapore. This consists of money accounts, bonds, equities, and mutual funds, valued at $199.7 million. The trustee to Sai Charan Belief – Commonplace Chartered Belief (Guernsey) Ltd – offered nominee shareholders, administrators, and secretaries for Auctus Investments, all for a price. Arvind Tiku and the trustee are named the ‘useful homeowners’ of this funding firm.

Auctus Investments is the only real shareholder in a number of corporations, together with two BVI corporations, Starlet Group Holdings Inc and Swift Ventures Belongings Ltd.

These two BVI corporations have been arrange primarily to personal actual property property and financial institution accounts in the UK, and the ‘useful proprietor’ for each is The Sai Charan Belief. Starlet, the paperwork present, owns a $34.7 million property in London, and Swift a $1.9 million property, once more in London.

Apart from these two, Auctus Investments and Arvind Tiku, are additionally named the ‘useful homeowners’ of AT Investments Ltd, which holds property with an estimated worth of $26 million. Tiku can also be the useful proprietor of Darley Central Asia Ltd, whose title was modified to Painite Holdings Ltd, efficient April 2017, since its funding was not in Asia.