Google translated

Corporation “Kazakhmys” is both unique and at the same time typical for Kazakhstan history. More precisely, this is the history of the Republic of Kazakhstan, concentrated in one corporation. Its essence is that the legacy of the Soviet industry was privatized in the interests of the country’s political elite, and management was entrusted to a group of nominal owners.

The main goal of privatization was to create a mechanism capable of generating resource rent for a narrow circle of trusted persons. This explains the transformation of the network of legally independent industrial plants into a single corporate structure, which is a real monopoly of the type of the early twentieth century. The placement of shares of this monopoly on the London Stock Exchange has become a mechanism for the Kazakh elite to legalize the structure created in Kazakhstan and the resource rent extracted with its help.

The corporation’s investment plans were implemented solely by attracting funds from Western investors buying the company’s shares. As a result, this led to the division of the corporation into two parts — rent, which exists due to the exploitation of old assets and available raw materials, and investment, the future of which is connected with the implementation of plans to launch a giant copper deposit in the Russian Far East to supply raw materials to the market of the People’s Republic of China.

Private monopoly with many unknowns

Until recently, the Kazakhmys corporation was in fact a real monopoly, crushing all copper mining and production in the country. In a 2011 report , it was even named the world’s only copper vertical integrated corporation. At that time, the copper empire included 18 mines, a network of GOKs, copper smelters and four coal-fired power plants. The latter accounted for 20% of all national electricity generation. Three stations served the interests of the corporation itself, and the fourth (Ekibastuz GRES‑1), where the corporation owned half of the stake, worked both for domestic industrial consumers and for export (10% of the generation went to Russia).

This entire system was created on the basis of a complex of enterprises for the extraction of copper ore and the production of copper, located in the Karaganda region. In Soviet times, this complex served the needs of the military-industrial complex, and now its main client, as we have found out, is the Chinese economy.

The first mining operations in Kazakhstan began in 1913. They were carried out at the Zhezkazgan copper deposit by the Spassky Joint-Stock Company, which was headed by the Englishman Leslie Urquhart. But the real industrial development of the region began in the years of the first five-year plans and reached its peak by the end of the 30s, when the “Big Dzhezkazgan” was launched — quarries, mines and the Dzhezkazgan copper combine.

In the 1950s, this complex of enterprises was merged into the Dzhezkazgan Mining and Metallurgical Combine, which at that time produced more than 90% of all copper in the USSR. In 1987 the plant was transformed into NPO Dzhezkazgantsvetmet, and in 1992 — into Zhezkazgantsvetmet JSC, which later became the Kazakhmys corporation.

The transformation into a joint-stock company launched the process of privatization of the Soviet monopoly, which became the property of independent Kazakhstan. But the privatization was hidden and was carried out through the transfer of the complex to the management of Samsung C&T Deutschland GmbH — a division of the Korean concern. It was in 1995. A year later, Samsung bought out 40% of the company’s shares from the state, but then sold them. A whole series of strange stock transactions followed, in which the then head of the corporation Lee Gong Hee took an active part. In 2008, South Korean law enforcement accused him of tax evasion. According to them, the head of the concern was buying back shares from his concern at a reduced price. This led to the enrichment of the manager at the expense of Samsung. Following the investigation, Lee Gong Hee was convicted and received a suspended sentence for tax evasion.

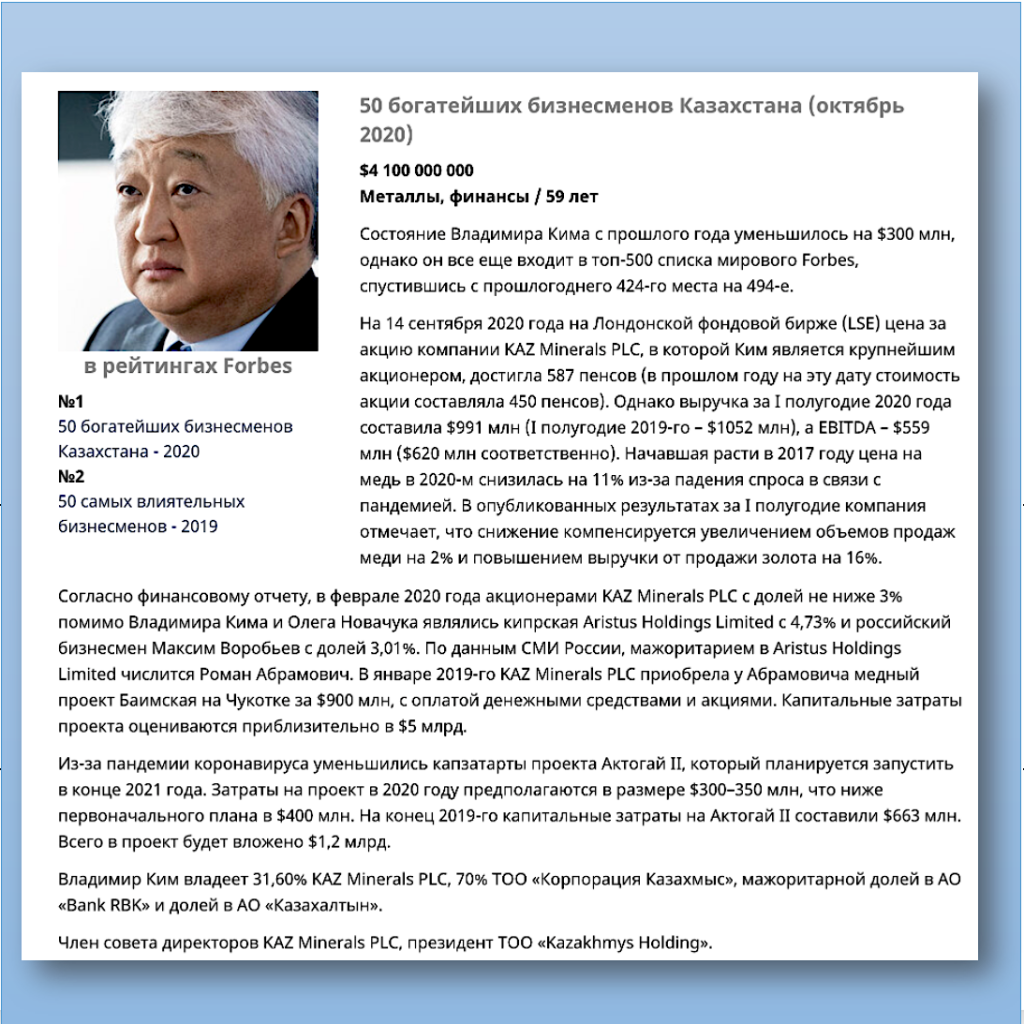

In October 2005, part of the company’s shares was sold on the London Stock Exchange to a wide range of investors. Vladimir Kim and Oleg Novachuk played a special role among them.

Vladimir Sergeevich Kim began his career in the copper business in 1995 as Managing Director and Chief Executive Officer of Zhezkazgantsvetmet JSC. This appointment happened at the moment when the company was transferred to the management of a division of the Korean concern Samsung. In December 2000, Kim was already elected Chairman of the Board of Directors of the company, becoming the owner of the largest block (25.7%) of the corporation’s shares (he controlled this stake through the Cuprum Holding Limited corporation).

Oleg Novachuk until 2005 owned 12% of the Kazakhmys corporation (through Harper Finance LTD), but after the placement on the London Stock Exchange, the size of his block decreased to 5.6% of shares (for 2011).

It should be noted that in 2005, during the placement of shares on the London Stock Exchange, there were no questions to the company. However, in 2010 they appeared. In London, they started thinking about who controls the Eurasian copper monopoly. An investigation conducted by the British NGO Global Witness highlighted the close ties between Kazakhmys shareholders and the first president of Kazakhstan, Nursultan Nazarbayev.

Interestingly, the publication of the Global Witness investigation coincided with the adoption by Kazakhmys of a new investment program, which was going to be financed by the China Development Bank.

Chinese plan

It is difficult to say whether it was accidental or not, but the investment program mentioned above radically changed the state of affairs in the corporation itself. Instead of extracting ore from well-explored deposits, and then producing quality copper, which was supplied to the world market, the company began quarrying and selling concentrate to China. It was a completely different business in terms of marginality, which was going to be financed by the China Development Bank.

The China Development Bank has allocated more than $ 4 billion for the development of two large copper deposits — Aktogay and Bozshakol. The money passed through the cash desk of the Kazakhstan state holding NWF Samruk-Kazyna, which gave this loan an interstate character. Enriched ore extracted from new deposits was to be sent to Chinese copper smelters. Thus, this program led to the accelerated development of the raw material base for the Chinese industry.

On average, over a five-year period — from 2008 to 2012 — sales to China already provided about 45% of all revenues of Kazakhmys Mining — the metallurgical division of Kazakhmys at that time (it did not include the energy division of the concern). And in 2012, about 80% of all copper of Kazakhmys was exported to China.

That is, it is completely unimportant in this situation who was the owner of the corporation, since its market model was determined primarily by financial and commodity logistics.

Geopolitics of Kazakhmys

In total, more than 90 copper deposits have been explored on the territory of Kazakhstan. The current reserves of copper are about 41 million tons. This is approximately 5% of the world’s reserves. The republic ranks 4th in the world in terms of copper reserves after Chile, Indonesia and the United States. And yet this is too little to meet the needs of China. At least the leadership of Kazakhstan thinks so.

In 2012, Minister of Industry and New Technologies Asset Issekeshev made a loud statement that “the explored reserves of copper and polymetals in Kazakhstan remain for 10–15 years.” He explained this by the fact that geological exploration is carried out in insufficient volume, while the deposits discovered by geologists back in the USSR are being developed very intensively. As a result, according to the data provided by Issekeshev, since 2000, copper reserves in the country have decreased by 2.4 million tons (5.8%).

This was a serious statement, given the fact that Issekeshev was close to the first president of the country. And it turned out to be especially significant for Kazakhmys, the main copper producer in the country. The fact is that a year earlier, in the summer of 2011, the general managing director of the corporation, Oleg Novachuk, promised Kazakh journalists that the reserves of copper at the company’s deposits would be enough “for more than 30 years.” True, he had to admit that copper-bearing ores are getting poorer, and if “10 years ago, the 0.5% ore grade was not considered a project at all, it was just waste”, today “the 0.51% ore grade is considered a successful project.”

The new projects of Kazakhmys, which were ready to be financed by the China Development Bank, were oriented towards this kind of mining of poor ores. Chinese contractors began to move there, which forced out the former firms from among the Turkish concerns.

But most importantly, there were no copper smelters in the new mining areas, and their construction was not planned. GOKs were supposed to ship products directly to China, which is geographically closer to new deposits than the old centers of copper metallurgy.

Restructuring. Kazakhmys Corporation LLP

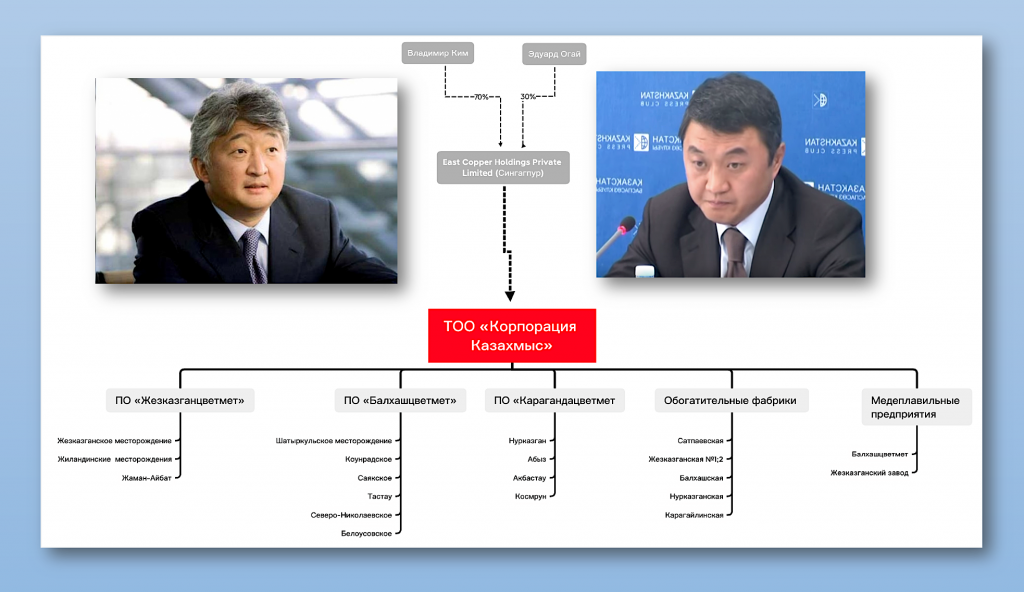

In 2014, a new geographic reality was consolidated with a new legal status. The business of Kazakhmys was radically restructured. The so-called “mature” projects, located in the traditional centers of the copper industry in central Kazakhstan, were transferred to the Kazakhmys Corporation LLP, owned by Vladimir Kim and Eduard Ogay.

The decision on this transfer was approved on August 15, 2014. Since then, information about the development of the company has left the public sphere. But this spring it became known about radical changes in the system of its management. On April 14, 2020, the Chairman of the Board of Kazakhmys Corporation LLP, Eduard Ogay, appointed Andrey Gaidin as his first deputy, who is believed to have Russian interests behind him.

Finding itself without the support of third-party shareholders, the company is likely to become an easy prey for Russian corporations that are actively developing the copper business in the regions neighboring Kazakhstan.

To enlarge the diagram, click on it with the mouse. Two clicks give the largest scale.

All promising projects focused on the extraction of raw materials remained within the “old Kazakhmys”, registered in London and renamed KAZ Minerals PLC. The shares of this particular corporation are now traded on the London Stock Exchange.

However, it is obvious that the company will lose its status as a public corporation already in 2021. The private investment company Nova Resources BV, registered in the Netherlands, has offered shareholders to buy back shares from them with a 12% premium to the closing price on October 27, 2020. The entire company is valued at £ 3 billion. The buyback will be financed by the Russian bank VTB, but the company Nova Resources BV itself is declared to be controlled by Vladimir Kim and Oleg Novachuk, who now own almost 40% of the shares of KAZ Minerals (Kim — about 31.6%, Novachuk — about 7.8%).

To acquire a company, the approval of a majority of voting shareholders holding 75% of the shares must be obtained, with the exception of those shares owned or controlled by Vladimir Kim and Oleg Novachuk.

According to Novachuk, KAZ Minerals’ long-term interests will be best served as a private company. Most likely, this is due to more favorable conditions for attracting debt financing compared to the issue of shares in the interests of external investors.

To enlarge the diagram, click on it with the mouse. Two clicks give the largest scale.

China Growth Projects

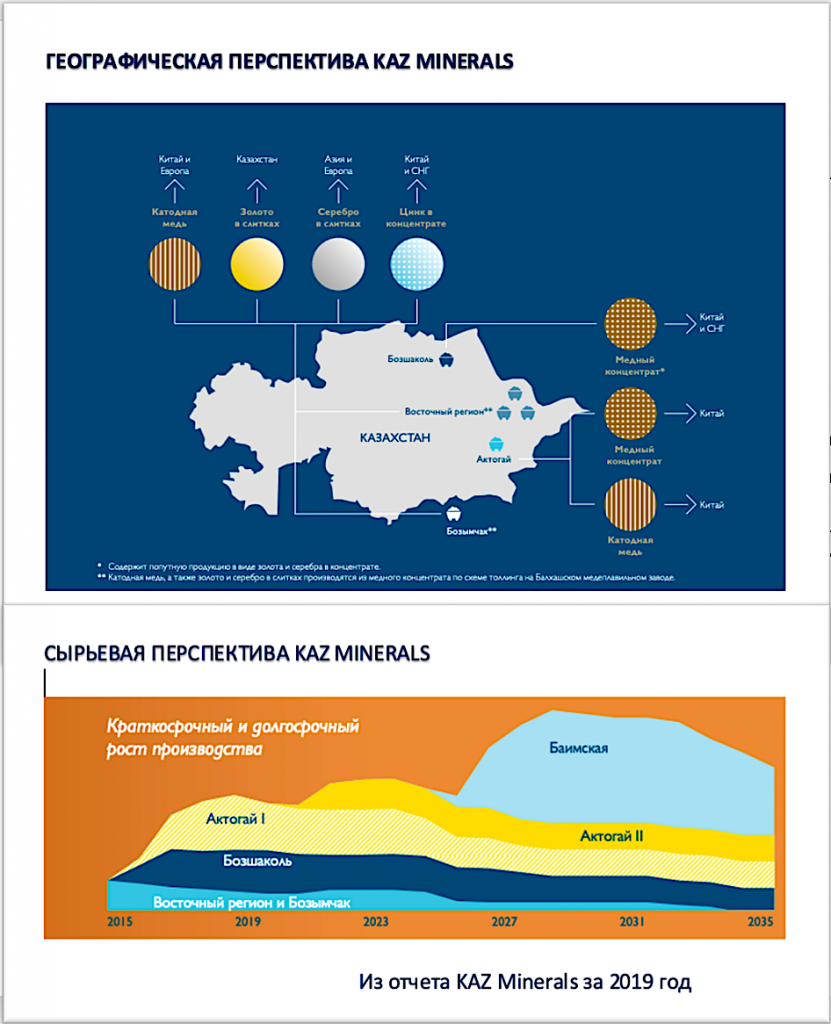

At the core of KAZ Minerals’ business are two major projects called Growth Projects. These are the Bozshakol and Aktogay fields, the development of which is considered by the government of Kazakhstan to be the largest industrial construction project in the country over the past 50 years.

Deposits are open pits from which ore is extracted. The huge amount of ore itself and low mining costs offset the low copper content in the rock.

Bozshakol reserves are estimated at 992 million tons. The copper content in the ore is here on average about 0.36%. According to calculations, the deposit will make it possible to extract about 100 thousand tons of copper annually for ten years.

Aktogay’s reserves amount to 1,604 million tons of mineral resources with an even lower copper content of 0.33%. The production volumes are now about 146 thousand tons of copper per year. But already in 2021 this figure is expected to double. The estimated life of the field is about 25 years (including the expansion project).

Most of the ore mined from these two deposits, as expected, is sent to China in the form of concentrate produced at the GOK. And only a small part will go to the Balkhash copper smelter, where it is melted into cathode copper under tolling conditions. According to the financial report, in 2019, 13.6 thousand tons of copper concentrate from Bozshakol and 43.7 thousand tons from Aktogay were sent for smelting. In the same report, such supplies are explained by the availability of available copper smelting capacity and attractive conditions.

KAZ Minerals also includes the Bozymchak project, an open-pit mine located in southwestern Kyrgyzstan. In terms of its scale, it is seriously inferior to Bozshagol and Aktogay (in 2019, 1,081 thousand tons of ore were mined at the deposit, from which 7.3 thousand tons of copper were produced). But on the other hand, the copper content in the ore here is 0.82%, which is significantly higher than in large projects.

In addition to open pit mines, KAZ Minerals produces ore from three underground mines located in eastern Kazakhstan. At these deposits, the copper content in the ore exceeds 2%. In 2019, about 3.0 million tons of ore were raised from the mines and 51 thousand tons of copper were produced.

But the real prospects for the business of KAZ Minerals are associated with the Baimskaya project, which has not yet begun, which will be implemented in Russia on the Chukotka Peninsula. The Peschanka deposit is located here — one of the world’s largest undeveloped copper deposits. Here, 9.5 million tons of copper can be mined with an average grade of 0.43% of this metal in the ore. In January 2019, KAZ Minerals paid 900 million US dollars for the right to develop Baimskaya.

Three open pits and a mining and processing complex will be built at the field. This will be the project of the century for Chukotka. The entire infrastructure will also be equipped here — a rotational camp for miners, an airfield and other auxiliary facilities. The total investment is estimated at US $ 7 billion.

Baimsky GOK will produce 1.5 million tonnes of copper concentrate. There are no plants for the production of rolled products from copper and its alloys in the Russian Far East. China will become the main consumer of copper raw materials. Thus, a very interesting picture is emerging: a Kazakh corporation will critically depend on access to Russian assets in Chukotka and access to the Chinese market. Without any alternatives.

A team of journalists worked on the project:

Alexey Tikhonov, Nazira Darimbet, Evgeniya Mazhitova, Zhanna Baitelova, Alexander Baranov, Yulia Kozlova, Irina Petrushova

This investigation was originally published in the Russian language and appeared on the original KLEPTO ASIA website.