Google translated

Pervomaisky district of Izhevsk, almost the center of the capital of Udmurtia. Late Stalinist development of five- and four-story houses, typical for hundreds of Russian cities. Udmurtia is a subsidized and poor region, so even in the center of the house they look quite neglected. Falling plaster, chaotic advertisements on the facades, broken sidewalks, and the first floors have been converted into eclectic commercial spaces designed in the style of “the worst urbanist’s dream”.

In general, nothing unusual, with the exception of one — an unusual girl is registered in one of the apartments in building 201 on Kommunarov Street. By the age of 30, she became the owner of a multimillion-dollar fortune and the controlling shareholder of several Kazakhstani mining companies. The girl’s name is Anna Berezina, and today our story is about her.

Director. Black gold

The earliest traces of Anna Berezina’s presence in Kazakhstan’s business that we were able to find in the public domain are the girl’s signature in the document on the approval of the board of directors of Aman Munai Exploration JSC .

In 2013, she signed it as the director of the parent Aman Munai Exploration BV (the company was founded under the name Kazakhmys Petroleum BV ), she also became the head of this structure in 2013. At that time, she was barely 25 years old, and a business structure with a capital of € 342.9 million was under the management of a young Russian woman (the capital has not changed since the creation of the legal entity in 2007).

Aman Munai Exploration is a Kazakhstani company engaged in the exploration and production of oil in the Aktobe region on the East Akzhar block with an area of 500 km².

Judging by the audit reports, the Dutch company headed by Berezina was not the ultimate beneficiary. The controlling party was the Maltese investment fund Falcon NR&I Fund SICAV PLC , which owned the Dutch company through the Belgian structure Aman Munai Exploration BVBA .

It is difficult to document who was the ultimate beneficiary at that time, even though the Maltese fund, which owned the oil field in the Aktobe region, was spotted in the PanamaLeaks leak.

Most likely, the final owner can be considered the billionaire and officially the richest Kazakhstani Vladimir Kim or people close to him. This may be evidenced by the fact that initially the Dutch company bore the name Kazakhmys Petroleum BV, consonant with Kim’s main asset.

Probably, last year Vladimir Kim decided to take new partners into the oil business. In June 2020, Aman Munai Exploration BV left the company’s shareholders (Anna Berezina was no longer its director at that time), and Aman Munai Exploration changed its name to Altai Resources JSC .

Syntech FZE, registered in the special economic zone of Sharjah, has become a new shareholder . The ultimate beneficiary in Altai Resources’ reports is the Singaporean firm Mahesh S / O Pulandaran , controlled by the Maltese offshore Advaita Trade Private Limited .

Judging by the base of the same “heavenly documents”, the key person in the company from Malta is Boris Nikolayenko from Almaty . This is the full namesake of the former top manager of the Kazakh office of Kazakhmys PLC . At the same time , new faces appeared in the latest report on the affiliates with Altai Resources JSC — the former son-in-law of the first president of Russia, Boris Yeltsin, Leonid (Alexei) Dyachenko and his family. Leonid Dyachenko was the second husband of Yeltsin’s daughter Tatyana; the couple lived in marriage from 1990 to 2002.

Dyachenko is quite familiar with the oil sector. For some time he headed and partially owned the Urals Energy company registered in Cyprus , which was producing oil in Russia — on Sakhalin and in the Timan-Pechora basin in Komi. The company arose in the late eighties with the sanction of the head of the first main directorate of the KGB of the USSR (foreign intelligence) Leonid Shebarshin as a cover for studying shadow export channels, in 1990 set off on an independent commercial voyage and went first to the former intelligence officers and son-in-law of Boris Yeltsin — Leonid Dyachenko, and then Sberbank for debts.

It was bought from the bank by the Khotin family of businessmen, and it became the basis of their oil company Dulisma. In 2019, Alexei Khotin, who was doing business with his father Yuri, was detained by the FSB and the Ministry of Internal Affairs on suspicion of embezzling 7.5 billion rubles from his own bank, Yugra.

Shareholder. Brown gold

Anna Berezina’s departure from the post of director of the Dutch Aman Munai Exploration BV can hardly be called a dismissal; rather, it is a transition to a new quality. In 2016, the girl becomes the sole owner of the Dutch company Karazhyra Holdings BV with a share capital of € 100. Soon this company gets 49.9% in Karazhyra JSC .

The Kazakhstani company was not originally a joint stock company: in December 2002, the structure was registered as Karazhyra LTD LLP and received at its disposal a coal deposit of the same name on the territory of the former Semipalatinsk nuclear test site.

Only in 2016, the company re-registered as a joint-stock company with the following distribution of shares: American Demex LLC received 80% in it, dollar millionaires Vladimir Dzhumanbaev and Eduard Ogay — 10% each .

A year later, the share of the American partner was divided. Anna Berezina’s Karazhyra Holdings BV gained control of almost half of the company, Dzhumabaev and Ogay increased their shares to 20%, and the new shareholder Yerlan Nigmatullin , former senator and brother of Majilis chairman (then and now) Nurlan Nigmatullin , got 10%.

In 2017, the company received a net profit of 2.8 billion tenge, and a year later it almost doubled — to 5.1 billion tenge. Apparently, thanks to these funds, the capital of Karazhyra Holdings BV increased in 2018 from € 100 to € 2.2 million.

In February 2020, Anna Berezina’s company transferred 49.9% of its shares to the children of Eduard Ogay, Elina and Vladimir . At that time, the market capitalization of the company on the Kazakhstan Stock Exchange was estimated at about 13.5 billion tenge or $ 32 million. Formally, by that time, Berezina’s share was slightly more than $ 15 million.

Beneficiary. Gold

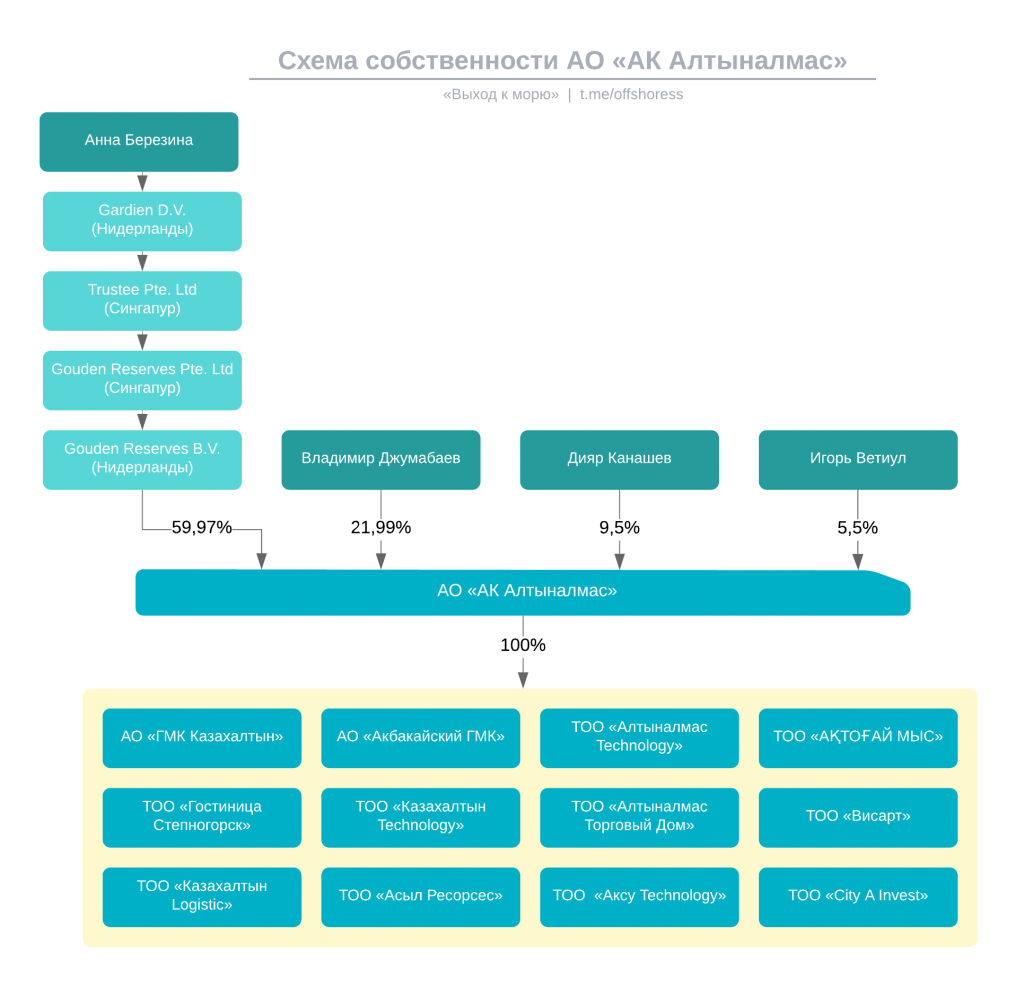

Anna Berezina’s exit from the coal business did not end her career as a Kazakhstani millionaire. Now its most valuable asset is the gold mining JSC AK Altynalmas . And this is already a really serious business with a capitalization of $ 362 million, in which Berezina owns 59.97%.

Kazakhstan, according to the World Gold Council, ranks 15th in the world in terms of precious metal production. Last year, 78.5 tons of gold were extracted in the republic — the third place after Russia and Uzbekistan in the post-Soviet space. The authorities of the republic reported about 111.5 tons of gold, but, apparently, the volumes of the already refined metal were also included here.

Be that as it may, over 10 years the volume of extraction of precious metals in Kazakhstan has grown, again according to the World Gold Council, 2.5 times — from 29.9 tons to 78.5 tons.

As Kazakhstani Forbes wrote in its review, due to the difficulties associated with gold mining in the republic at the first stages after Kazakhstan gained independence and the beginning of the privatization of gold-bearing areas, interest in them was mainly shown by large foreign players.

Control over the largest in the republic Vasilkovskoye field (reserves — more than 360 tons) in 2000 went to the Dutch Floodgate Holding BV , behind which were Israeli businessmen Lev Leviev and a native of Ukraine Arkady Gaidamak. In Kazakhstan, they are known for their chemical projects, and in the rest of the world for their arms trade. In 2009, a French court sentenced Gaidamak to 6 years in prison in absentia for illegal diamond trade. In Kazakhstan, partners tried to modernize Vasilkovsky GOK (VGOK), but could neither find funding nor organize the work. Five years later, they scrapped their projects in Kazakhstan.

Now this field is being developed by Kazzinc LLP , a joint venture between the Swiss Glencore (69.74%) and a subsidiary of the state fund Samruk-Kazyna Tau-Ken Samruk (29.82%).

Two years ago, a scandal erupted in the Swiss press , the central plot of which was the suspicion that Glencore transferred its stake in the elite Haileybury Astana school to Bulat Utemuratov’s charitable foundation worth $ 23 million. This money was then simply written off the company’s balance sheet. Journalists suggested that the funds could be used for the provision of some lobbying services by Utemuratov, who, like Vladimir Kim, is considered to be in the inner circle of the first president of Kazakhstan, Nursultan Nazarbayev.

Last year, Kazzinc produced 18.7 tons of gold, almost a quarter of the total in the country.

Approximately 16 tons of gold fell to the share of a subsidiary of the Russian mining company Polymetal of billionaires Alexander Nesis and Alexander Mamut .

Another major player in the market and one of the first on it is JSC AK Altynalmas. In 2020, the company mined 12.9 tons of gold. And taking into account the acquired last year another oldest gold mining enterprise JSC Kazakhaltyn (3.9 tons), the total volume of gold mined by the group can be estimated at 16.8 tons.

Dutch company Gouden Reserves BV is the key shareholder of JSC AK Altynalmas with a 59.97% stake. The ultimate beneficiary of this company, through an intricate system of gasket firms in the Netherlands and Singapore, is also Anna Berezina .

At the end of last year, the company received 63.2 billion tenge of net profit or $ 148 million — almost five times more than the value of the entire Karazhyr coal company. Other shareholders of Altynalmas are Vladimir Dzhumanbaev(21.99%), President and CEO of this joint-stock company Diyar Kanashev (9.50%) and a citizen of the Republic of South Africa Igor Vetiul (5.5%).

Emigrant share

So who is this really Anna Berezina, who closes assets in Kazakhstan for several hundred million dollars?

The same document that she signed in 2013 as director of Aman Munai Exploration BV gives us some hint. From it, we, in particular, learn that “a citizen of the Netherlands Anna Berezina” was born in Soviet Izhevsk on July 27, 1988.

Since it is not forbidden to have a second citizenship in Russia and the Netherlands, we assumed that she could have kept her Russian passport. And indeed it is. In July last year, Anna Berezina received a new foreign passport at the Russian consulate in The Hague. We got access to this document, which, among other things, contains data on all previously issued passports to her.

It follows from it that Anna Berezina is still assigned in Izhevsk in a house on Kommunarov Street, 201. Although it is obvious that in the middle or since the end of the 90s she does not live there (Anna received her first foreign passport in 1995, when she was 7 years). She last renewed her general civil (internal passport) in 2011, when she turned 23. To do this, she had to return to her homeland and receive a document at the place of her registration in Izhevsk.

But the most interesting thing here is not Anna’s photograph, but information about her parents. And if we could not find information about her father in the public domain (he is the full namesake of the Petersburg businessman Andrei Valerievich Berezin), then her mother turned out to be a well-known person in the Kazakhstani business community.

Elena Yaroslavna Yakubovskaya is listed as the head of dozens of firms associated mainly with the business of Vladimir Kim and Eduard Ogay. It was previously impossible to trace her relationship with Anna Berezina in the reports of Kazakhstani companies, since Kazakhstani legislation does not require the indication of close relatives of non-residents in the lists of affiliated persons.

Elena Yakubovskaya has worked and continues to work as a director in:

- Dutch Financial Services BV (Kim and Oh), Aman Munai Exploration BV (Anna Berezina), Petroleum Partners BV (Kim), Cooper International BV (linked to Altynalmas), Kerem Equipment BV (linked to Karyzhara), Global Service Technology BV (liquidated ), Vostok Cooper BV (Kim and Novachuk),

- British Kazakhmys Corporation Finance Limited (Kim and Ohio), Kazakhmys Smelting Finance Limited (Kim and Ohio), Kazakhmys Limited (Kim and Ohio).

Most likely, it was Elena Yakubovskaya who brought her daughter into this business, registering for her shell companies for businessmen from the Kazakhstan Forbes list.

Why do businessmen need it? For example, in order to protect part of their assets in European jurisdictions and gain access to arbitration outside the control of the Kazakh authorities. “Their” foreign parent companies and large shareholders theoretically have access to cheaper loans. Thus, Altynalmas borrowed money for the purchase of Kazakhaltyn from the European structures of the Russian VTB . The total debt of JSC “Altynalmas” to the “daughters” of the bank, which is controlled by the Russian government, is € 1.1 billion with a rate of 6–7% per annum. Another question is whether they could get that kind of money from HSBC or Deutsche Bank.

Again, through these companies it is easier to withdraw and legalize funds abroad, formalizing it as issuing loans to unrelated parties.

Finally, these denominations may simply be the holders of the part of the business that is actually owed to other people or to some one, but very important person.