The “Russia’s Sanctions Evasion Report 2024 — 2025” examines how Russia has adapted its strategies to evade international sanctions through various partnerships, particularly with nations in Central Asia, the Caucasus, Turkey, and China. The report outlines key findings, recommendations, and a detailed analysis of sanctions’ impact, responses, and methods employed by Russia to circumvent restrictions. It also discusses the roles of different countries in facilitating or obstructing these evasion tactics.

The key findings regarding Russia’s sanctions evasion strategies include

Russia’s Sanctions Evasion Strategies (2024–2025)

- Russia continues to circumvent international sanctions through partnerships with Central Asia, China, Turkey, the Caucasus, and other third-party nations.

- Despite international efforts to close vulnerabilities, Russian-linked businesses exploit alternative trade routes to access critical resources.

Key Transit Hubs Facilitating Sanctions Evasion

- China acts as a central player, using Central Asia as a conduit for dual-use goods, spare parts, and military resources. China facilitates cross-border payments and trade in sensitive goods, supporting Russia’s sanction evasion.

- Turkey, despite its NATO membership, remains a critical conduit for Russian goods and financial transactions.

- Kazakhstan, Kyrgyzstan, Uzbekistan, Georgia, and Armenia play pivotal roles in rerouting sanctioned goods to Russia. Caucasus Nations used to obscure the origin of imports, ensuring continued access to restricted goods.

- Russia leverages its extensive resource base, including oil, gas, steel, aluminum, and rare-earth minerals, but still relies on external sources such as Kazakhstan for additional materials.

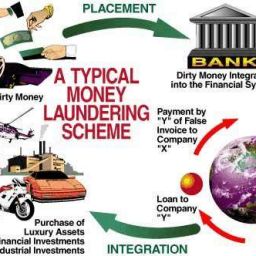

Role of Russian Oligarchs and Financial Networks

- Russian-affiliated oligarchs in Central Asia facilitate Russia’s access to markets and resources.

- Russian entities engage with financial institutions in Central Asia to bypass sanctions.

Russia’s Military Supply Chain and Procurement Tactics

- Russia’s defense industry is sustained by covert procurement networks and repurposed civilian industries.

- Russia seeks high-tech components, including semiconductors and drone technology, from China, Iran, and North Korea despite Western restrictions.

- Western-made microchips and dual-use technologies continue to reach Russia through intermediary nations, fueling military operations.

Expansion of International Mechanisms for Sanctions Evasion

- The Eurasian Economic Union remains a key facilitator of sanctions evasion. o Russia successfully expands BRICS membership in 2024, potentially using it

- as an alternative trade bloc to bypass restrictions.

- Russian energy leverage influenced European decision-making, particularly in Germany, Hungary, and Slovakia.

Cryptocurrency as a Tool for Sanctions Evasion

- Russia increasingly utilizes cryptocurrency to obscure transactions and bypass banking restrictions (Iran, North Korea, China, Kazakhstan, and Kyrgyzstan).

As the geopolitical landscape shifts in the wake of sanctions against Russia, Central Asian countries have emerged as key players in supporting the Kremlin’s efforts to evade these restrictions. A recent report from the Center for Global Civic and Political Strategies underscores the increasing significance of nations like Kazakhstan, Kyrgyzstan, Uzbekistan, Georgia, and Armenia in facilitating trade and financial transactions that enable Russia to circumvent international sanctions.

Russia’s reliance on Central Asia has notably intensified since the onset of sanctions following its invasion of Ukraine. These nations, strategically situated between Russia and more economically powerful regions, have become vital channels for sanctioned goods and services, allowing the flow of critical resources into Russia. This dynamic is particularly salient as other regions enforce stricter measures, compelling Russia to adapt and seek alternative routes for acquiring essential materials.

Kazakhstan, often viewed as a linchpin in this network, has leveraged its geographic proximity and economic ties to Russia to bolster trade relations. While the state has publicly supported global sanctions, numerous businesses have capitalized on Russia’s needs, facilitating the transfer of goods and resources. Companies like KazTransOil and KazMunayGas have been identified as playing vital roles in the energy sector, providing oil and gas supplies that are crucial for Russia’s continued energy operations.

A notable example involves the Kazakh ex-President Nursultan Nazarbayev’s family, particularly his son-in-law, Timur Kulibayev.36 Kulibayev’s oil trading company, Vitol, has been implicated in selling substantial volumes of oil to Western markets, with allegations that Russian oil is transported through the Caspian Pipeline Consortium (CPC) pipeline, mixed with Kazakh oil, and subsequently reaches Western markets. The Netherlands has initiated investigations into Timur Kulibayev’s oil trading operations. The Dutch Public Prosecution Service (OM) is reportedly examining Vitol for potential bribery activities in Kazakhstan.37 Additionally, the UK’s House of Commons has requested information from the Serious Fraud Office regarding these matters. These developments highlight the ongoing scrutiny of international oil trading practices and their potential links to sanctioned entities.

Kazakhstan’s Nurbank has become the first financial institution in the country to join the Russian money transfer system Kwikpay. This partnership enables fee-free bi-currency transfers and comes amid challenges faced by Zolotaya Korona, a Russian payment system widely used in Kazakhstan, which several major Kazakhstani banks stopped supporting after its developer was sanctioned by the U.S. Kwikpay, registered in 2019 but active since August 2023, has been expanding internationally, allowing transfers to multiple countries, including Armenia, Turkey, and Kyrgyzstan. The company is owned by Irina Khellmikh, with CEO Yuri Mindrin also linked to other businesses.

Nurbank, founded in 1992 and headquartered in Almaty, has historical ties to Kazakhstan’s political elite. In the 2000s, Nurali Aliyev, the grandson of former President Nursultan Nazarbayev, served as the bank’s deputy chairman and later as chairman of the board of directors. His mother, former Senate Deputy Dariga Nazarbayeva, was also involved in the bank’s board. Currently, JP Finance Group, controlled by businessman Eldar Sarsenov, holds an 86.4% stake in Nurbank. With Zolotaya Korona previously handling around 80% of international money transfers from Kazakhstan, Nurbank’s move to Kwikpay marks a significant shift in the country’s financial landscape, potentially reflecting broader economic and geopolitical realignments.

Oligarchs use complex offshore financial structures to obscure the origins of their wealth and circumvent sanctions. Financial hubs like Cyprus, the Cayman Islands, and Switzerland are often used for these purposes.

Kazakh and Russian oligarchs have a history of intricate financial collaborations, often involving complex offshore structures to manage and obscure their wealth. A notable example is the Eurasian Resource Group, the former Eurasian Natural Resources Corporation (ENRC), founded by three Kazakh oligarchs—Alexander Mashkevich, Patokh Chodiev, and Alijan Ibragimov.

Polymetal, Russia’s second-largest gold producer, underwent significant changes in its structure due to sanctions and the evolving geopolitical landscape. The company delisted from the London Stock Exchange, re-listed in Kazakhstan, and sold its Russian assets to Mangazeya, a company controlled by unsanctioned Russian oligarch Sergey Yanchukov.

This move reflects the broader exodus of Western investors from the Russian gold sector, although some foreign investors, including Kazakh oligarchs Oleg Novachuk and Vladimir Kim, have retained control of key assets, particularly the Baimskoye gold project. To circumvent sanctions, Novachuk and Kim created a new company, Trianon Ltd., which acquired Baimskoye from their Kazakh firm, KAZ Minerals, with approval from Russian President Vladimir Putin.

Kyrgyzstan also plays a critical role, serving as a key transit point for Russian-linked digital asset transfers and enabling the obscuring of transactions. Notable individuals such as Sadyr Japarov, the President of Kyrgyzstan, have been involved in navigating the complexities of these relationships, while businesses like KyrgyzTransOil assist in the seamless movement of goods.

This partnership not only aids Russia in maintaining access to international markets but also demonstrates how Central Asian states are positioning themselves as essential allies in the face of global economic pressures.

Uzbekistan’s involvement in this intricate web cannot be overlooked, either. Companies such as Uzbekneftegaz actively engage in energy trade with Russia, providing necessary resources that circumvent direct sanctions. This partnership illustrates the willingness of Central Asian economies to engage with Russia, prioritizing economic gain over adherence to international restrictions.

Georgia and Armenia further contribute to this sanctions evasion landscape, acting as conduits that obscure the origins of imports. Businesses in Georgia, such as Georgian Oil and Gas Corporation, and Armenian firms like Armenian Energy Company, facilitate the rerouting of goods, ensuring that restricted items continue to flow into Russia, thus solidifying their role in sustaining Russian military operations and economic resilience.

Furthermore, influential figures such as Mikhail Fridman, a prominent Russian oligarch with ties to Central Asia, and Alexander Lebedev, a businessman with interests in several Central Asian industries, exemplify the interconnectedness of businesses and political influences that foster sanctions evasion efforts.

While these Central Asian countries navigate their relationships with Russia, the report emphasizes the dual nature of their engagement. On one hand, they seek stability and economic growth through these partnerships; on the other, they risk alienating themselves from international markets that could impose repercussions for their complicity in Russia’s sanctions evasion tactics.

The intricate network of alliances formed between Russia and Central Asia serves as a pressing reminder of the challenges faced by the international community. As the report illustrates, this cooperation not only prolongs the conflict in Ukraine but also complicates diplomatic efforts to isolate Russia economically.

Moving forward, it is essential for global policymakers to closely monitor these developments and devise comprehensive strategies to address the interconnectedness of Central Asia with Russia. Understanding the motivations of Central Asian nations and the nature of their partnerships will be crucial in formulating effective measures to counteract Russia’s evasion of sanctions and uphold international norms.

In this developing scenario, the role of Central Asia stands out as a pivotal element in the ongoing struggle against sanctions evasion, highlighting the necessity for a coordinated international approach to keep these nations from becoming enablers of transgressions against global order.

Read the full report: