How the United States’ legal community became global oligarchs’ most useful enablers.

The Biden administration has elevated the fight against global kleptocracy to a foreign-policy priority. National Security Advisor Jake Sullivan has openly calledfor the West to tighten the rules and regulations that allow corruption and authoritarian capitalism to thrive while acknowledging much of this transparency must begin at home. With the recent passage of the landmark Corporate Transparency Act—which calls for increased disclosure of the actual owners of shell companies—the United States appears serious not only about tackling foreign kleptocrats abroad but also about cracking down on professionals in the United States who have abetted the laundering of money and reputations on behalf of corrupt foreign officials.

Despite such efforts, a key enabler of kleptocrats has thus far escaped much scrutiny: U.S.-based lawyers. For years, U.S. lawyers have enjoyed protections and exemptions from anti-money laundering and foreign-lobbying rules that allows them to become key figures in the networks that kleptocrats use to launder both their finances and their reputations in the West. Although other U.S. industries like hedge funds and real estate have enjoyed years-long exemptions from basic anti-money laundering regulations, U.S. lawyers don’t even need exemptions—primarily because they’ve never been targeted by legislation aimed at clamping down inflows of tainted money.

To understand how U.S. lawyers, unlike many of their counterparts overseas, have transformed into key figures in modern kleptocracy, you first have to understand the decentralized oversight under which the legal industry operates in the United States. Whereas European Union-based lawyers are subject to basic anti-money laundering requirements issued by Brussels, U.S. lawyers are licensed by the bar associations of individual states and are ultimately professionally accountable to these state supreme courts. In turn, these states decide whether to enforce international transparency recommendations. Unfortunately, legislators and state executives have avoided implementing the kinds of recommendations put forth by leading anti-money laundering groups like the Financial Action Task Force (FATF), which specifically calls for transparency measures like due diligence and filing suspicious activity reports whenever lawyers conduct transactions for clients. In 2016 the FATF itself notedthat U.S. lawyers “are not subject to comprehensive [anti-money laundering] requirements, and are not systematically applying basic or enhanced due diligence processes.” One 2020 analysis found “strong resistance to the FATF lawyer regulations” in the United States, a clear distinction to Europe, where the governments are “implementing [them] aggressively.”

Trending Articles

Biden’s Strategy in the Sahel Looks a Lot Like Trump’s

U.S. diplomacy is back in West Africa—but the United States is also back to its old counterterrorism playbook.

Much of that unwillingness to implement stricter anti-money laundering controls on U.S. lawyers stems from pushback within the organized legal community, led by groups like the American Bar Association (ABA). The ABA—a national professional organization that issues model rules and ethics guidelines and lobbies on behalf of the legal industry—has publicly spoken about money laundering concerns and has consistently issued guidance regarding how U.S. lawyers should deal with anti-money laundering situations. However, unlike jurisdictions elsewhere, this guidance remains voluntary, as U.S. lawyers remain free to follow such recommendations, or not, as they see fit.

Much of the ABA’s rationale for lobbying against further anti-money laundering checks rests on the principle of client confidentiality and preserving attorney-client privilege, leading the group to directly oppose possible measures like mandating more effective diligence checks on the background of their clients (not just their transactions) or mandating withdrawal from legal representation should lawyers discover that an illegal act has been committed. These guidances don’t seem to have had much effect. As one analysis from Georgetown University Law Center read, “There exists no compelling evidence that attorneys in the United States have an adequate understanding of the money laundering vulnerabilities in the legal industry or the need to mitigate them.” Short of engaging in criminal actions themselves, as covered by the crime-fraud exception, lawyers have broad leeway under this regulatory regime to offer a variety of attractive services to kleptocrats.

One recent case in particular highlights the role U.S. lawyers play in aiding the laundering of foreign kleptocrats’ finances. Equatorial Guinea Vice President Teodorin Obiang remains perhaps the clearest case of a crooked foreign official using U.S. financial secrecy tools to launder massive amounts of money, immiserating an entire country under his father’s four-decade-long dictatorship.

One U.S. lawyer, Michael Berger, in particular freely helped Obiang set up shell companies to skirt U.S. banks’ anti-money laundering checks and set up Obiang’s purchase of one of the biggest mansions in the United States, alongside Obiang’s splurges on an entire armada of high-end automobiles and celebrity memorabilia. As Senate investigators later discovered, the lawyer helped Obiang create an American shell company to open a number of U.S. bank accounts, using the lawyer’s attorney-client account as an effective pass-through for the dirty money—and leaving the U.S. banks none-the-wiser about the source of the millions of dollars suddenly coming in. As one of the banks later revealed, “The investigation found the use of multiple corporate vehicles by [Obiang’s U.S. lawyer] … to disguise the identity of [Obiang] as well as layer and integrate funds derived via international wire transactions from a high risk jurisdiction [Equatorial Guinea], which had the appearance of money laundering activity.” In one instance, the lawyer even “lied that it was to help one of his clients pay a female employee without the client’s wife knowing about it.” And even after Obiang forfeited tens of millions of dollars’ worth of assets to the U.S. government, this lawyer faced no sanction for his role in his client’s transnational money laundering scheme, as he continues to practice law in California.

Even dramatic investigations by anti-corruption watchdogs that seemingly revealed U.S. lawyers readily willing to move what they knew to be tainted money has not moved the needle for these professional associations. A few years ago, a video sting from the anti-corruption watchdog Global Witness revealed the willingness of U.S. lawyers to work with clients identified as high risk. Posing as an advisor to an African minister looking to move millions of dollars in suspect funds, Global Witness was clear in its intentions. “We said we needed to get the money into the U.S. without detection,” Global Witness wrote. Shockingly, all but one of the U.S. lawyers immediately dove into the details of how best to launder the funds in the United States and how to obscure their links to the African minister in question. One of the lawyers, James Silkenat, formerly of the firm Sullivan and Worcester, even directly offered to “look into” which banks offered the laxest anti-money laundering oversight. The kicker? Silkenatwas then the head of the American Bar Association.

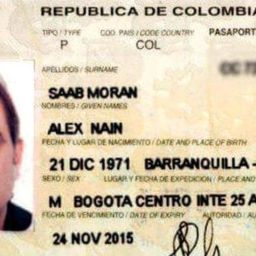

Nor is concealing dirty money the only tool kleptocrats use U.S. lawyers for. As recent years have illustrated, U.S. lawyers are also critical for kleptocrats who seek to whitewash their reputations and present themselves to the world as successful and upstanding global citizens. Whereas U.S. lobbyists working for foreign governments are required to register their work with the Justice Department’s Foreign Agents Registration Act (FARA), U.S. lawyers are exempt from such registration and disclosure. While the exemption only supposedly applies to work that lawyers do in courtrooms or conducting press conferences, we’ve seen it increasingly cited by lawyers clearly working beyond the confines of the courtroom. For instance, Ukrainian oligarch Dmytro Firtash relied on a series of U.S. lawyers to inject disinformation into the American body politic, all in the hopes of lifting a U.S. extradition request to be tried in a corruption case to return to his previous shady practices. Firtash’s case roped in lawyers like Rudy Giuliani, as well as a pair of prominent conspiracy theorists, none of whom ever registered their foreign client work with FARA and even managed to obtain a sit-down meeting with then-Attorney General William Barr. The meeting itself, according to experts, appeared to clearly fall outside the scope of the FARA exemption’s legal proceedings.

Read More

Biden Could End Kleptocracy’s Grip on the United States

A new administration can make the changes needed to break a rotten global system.

And the problem appears to be getting worse as law firms expand the scope of their work, which the case of former Ukrainian President and kleptocrat Viktor Yanukovych illustrates. In 2019, a series of DOJ filings revealed the lengths to which Gregory Craig, a senior partner at a white-shoe U.S. law firm, would go to bolster the international image of a foreign corrupt autocrat—and how many services these firms now provide. The white-shoe firm in question (Skadden, Arps, Slate, Meagher & Flom—often shortened to Skadden) initially inked an agreement with the Yanukovych government—widely considered more sympathetic to the Kremlin than its predecessor—in early 2012, when the firm nominally agreed to author a report analyzing the criminal trial and conviction of Yanukovych’s main political rival, Yulia Tymoshenko, which she claimed was politically motivated. But the Skadden report, predictably, “seemed to side heavily” with Yanukovych’s government, according to the New York Times. Skadden’s work resurfaced once more as part of Special Counsel Robert Mueller’s broader investigations into foreign interference efforts in the 2016 U.S. presidential election. Craig, the senior Skadden partner, was indicted but in 2019 was found not guilty of making false statements to the Justice Department’s FARA unit about his Ukraine-related work. Skadden—which had failed to register much of its work the DOJ and whose efforts for their Ukrainian clients the new DOJ filings detail—eventually settled for $4.6 million and agreed to register retroactively as an agent of Ukraine.

What, then, can be done to encourage more responsible representation by U.S. lawyers implicated in these transnational money- and reputation-laundering schemes? We spy two needed remedies. First, there needs to be far more understanding and scrutiny of the roles U.S. lawyers play in transactions on behalf of clients. A good place to start would be the implementation of the FATF recommendations mentioned above, which require both reasonable and meaningful due diligence obligations and suspicious activity filings for lawyers regarding things like bank accounts, financial transactions, or even the purchase of real estate on behalf of their clients. This can, and should, be part of a far broader effort from Washington to expand anti-money laundering requirements in the Bank Secrecy Act (recently extended to encompass virtual currency transactions and antiquities dealers as well as allow for the subpoena of foreign banks’ financial records that hold correspondent accounts with U.S. institutions) and to end, or at least limit, the two-decade-old anti-money laundering exemptions in the Patriot Act. In addition, we should consider introducing—if not through legislation, then updated ethical guidance—demands that attorneys disclose their sources of direct and indirect compensation, in particular when clients engage with any public authorities or the media. In doing so, U.S. lawyers would hopefully begin to think twice before helping kleptocratic clients open secret bank accounts, purchase high-end real estate, or aid their clients in dodging the United States’ patchwork anti-money laundering regime.

Fortunately, there’s reason for optimism on that front. Earlier this year, Washington finally moved to force shell companies to disclose their beneficial owners, and calls continue to swell for similar counter-kleptocracy regulations to be applied to everything from real estate to hedge funds to, yes, lawyers. Clearly, applying that momentum to U.S. attorneys is long past due.

On the reputation-laundering side, one solution is clear: In addition to beefing up FARA enforcement, the DOJ should consider ending its exemption for lawyers. FARA registration isn’t exactly strenuous, requiring little more than filing basic paperwork with the department. The DOJ should issue clear guidelines, such an exemption permits—and should illustrate a clear willingness to enforce such limitations.

The administration’s desire to shore up the United States’ counter-kleptocracy efforts offers a clear window of opportunity for ending U.S. lawyers’ key roles in enabling these kleptocratic networks and shielding unscrupulous clients from accountability. But until these policies are enacted, the legal community will continue to insist on ineffective, voluntary self-regulation—and continue expanding the services it provides to all those who continue to look to the United States for their dirty money needs.

This article was produced by the Global Integrity Anti-Corruption Evidence Programme, which is funded by the U.K. Government through its U.K. Aid program for the benefit of developing countries. The views expressed are not necessarily those of the U.K. government.

Correction, March 24, 2021: James Silkenat is a former partner of the Sullivan and Worcester firm. The original version of this article misstated his professional affiliation.

Alexander Cooley is the Director of Columbia University’s Harriman Institute and the Claire Tow Professor of Political Science at Barnard College. Twitter: @CooleyOnEurasia

Casey Michel is an investigative reporter based in New York.

Foreign Policy by Alexander Cooley, Casey Michel