Amid the hunt for Russian assets, reformers say financial transparency in the U.S. is long overdue.

Lawmakers in one of the most liberal tax havens in the United States are pressing to end a key tenet of financial secrecy by requiring the owners of highly confidential trusts to identify themselves.

The proposal in Alaska is part of a growing push to stop the flow of undisclosed money into the United States, which has for years drawn international wealth through state laws that provide anonymity for the owners of trusts, limited liability companies and other financial arrangements.

New York and Wyoming are also weighing reforms and, at the federal level, the bipartisan Enablers Act would for the first time require trust companies, registered agents and others to scrutinize clients and report suspicious transactions.

State and federal lawmakers say the changes are long overdue. They cite new efforts to trace and seize the assets of Russian oligarchs as well as findings from the Pandora Papers, a global media investigation published in October by the International Consortium of Investigative Journalists, The Washington Post and more than 150 other media outlets. The stories exposed how oligarchs, political elites and others hide wealth in the United States and around the world.

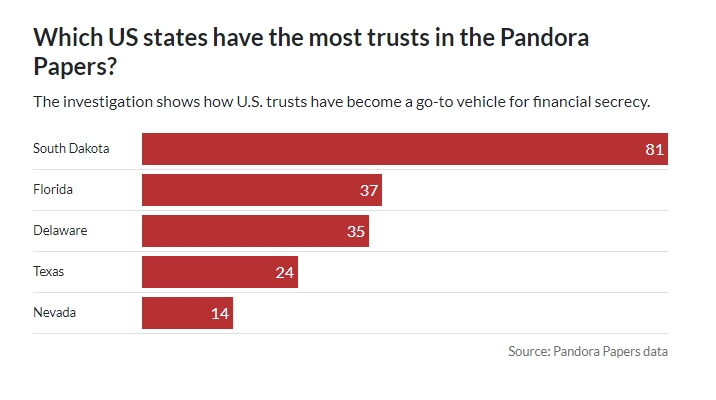

The investigation identified 206 U.S.-based trusts holding combined assets worth more than $1 billion. Nearly 30, many of which were in South Dakota, held assets linked to people or companies accused of fraud, bribery or human rights abuses.

“I think this is a good moment when everyone is focused on Ukraine and on strengthening sanctions enforcement to move the bill forward, strike while the iron and steel are hot,” said Rep. Tom Malinowski (D-N.J.), a key sponsor of the proposed Enablers Act. “Sanctions don’t work if you can’t find their money … Our extremely lax laws enable them to hide it almost without a trace.”

The proposal in Alaska, introduced earlier this month by the co-chairs of the state’s House Labor and Commerce Committee, would for the first time give regulators insight into individuals and families who shelter money and other assets in Alaskan trusts.

“When Vladimir Putin invaded Ukraine, I reflected on all the ways a state could have an impact on wealth that oligarchs … might be able to hide,” said committee co-chair Zack Fields (D). “We need transparency to make sure the bad actors are not abusing the system.”

Sanctions don’t work if you can’t find their money … Our extremely lax laws enable them to hide it almost without a trace.

— Rep. Tom Malinowski (D-N.J.)

Alaska Gov. Mike Dunleavy, a Republican who has directed state agencies to divest from Russia, has not taken a position on the proposal. Former Alaska Gov. Tony Knowles, a Democrat who approved the state’s first major trust law in 1996, said in an email that the proposed legislation is “very timely and important protection for Alaska’s security as well as our national security.”

“If passed,” he said, “Alaska would be a leader in trust assets reform.”

The nonprofit, Alaska Trust & Estate Professionals, has publicly opposed the measure. In a submission to lawmakers, the group said the bill “will have a complete chilling effect on the creation of trusts in Alaska.”

Fields said debate in Alaska’s legislature has so far been minimal. “A bill like this given the situation in Russia certainly has more of a chance … we’ve seen in the legislature a lot of interest,” he said.

Citing the Pandora Papers and other reports, lawmakers in New York last month introduced legislation requiring limited liability companies to publicly disclose their owners. The proposal goes one step further than a new federal law requiring LLCs to provide ownership information to a government database. That information will not be made public.

“I do have a say in how we govern the world’s financial center in New York, and I see it as my responsibility to ensure our city isn’t a haven for tax evasion, money laundering, or political corruption,” said New York Assembly member Emily Gallagher (D), who sponsored the bill.

Gallagher said she initially took up the issue to pursue anonymous landlords who listed only post office boxes as addresses. Then, in February, Russia invaded Ukraine.

“So much money is hidden in New York State and New York City — in particular, real estate — that it just really seemed like it was the right moment and the right move,” she said.

In Wyoming, the legislature’s joint revenue committee announced a review of the state’s trust laws later this month. Trust companies in the state last year managed more than $31 billion, including assets tied to a Russian oligarch as well as the family of a former aide to a Latin American dictator.

In other states, including South Dakota — one of the most popular tax havens in the U.S. — reforms aren’t yet on the table.

In South Dakota, with more than $360 billion held in trusts, a small group of protestors last month rallied in Sioux Falls just before the end of the legislative session to urge lawmakers to identify trust beneficiaries and freeze assets connected to Russia.

South Dakota Governor, Kristi Noem,(R), has previously said “our trust industry does have integrity and it has been proven to be an outstanding lawful system in the country.”

The legislature adjourned without taking any action.

“I had some hopes that maybe they could be shamed into doing something right after the war started, and we were flooded with images of Ukrainians being attacked,” said Andy Sivertson, a retired social worker who organized the rally. “But I have my doubts about the South Dakota legislature being able to do anything about this in the future.”

Reynold Nesiba, one of the few Democratic members of the South Dakota Senate, said the surest way to eliminate secrecy in the South Dakota trust industry is through federal legislation. Without it, Nesiba said, trust holders and company owners could simply move to other states.

“We have this lowest common denominator competition that goes on between Delaware, South Dakota, Nevada, Alaska, in terms of who has the most favorable trust laws,” said Nesiba, an economics professor at Augustana University in Sioux Falls. “Rather than participate further in that race to the bottom, it would really help to have some federal guardrails, particularly on disclosure.”

In February, a coalition of financial transparency advocates called on Congress to pass the Enablers Act. The bill’s sponsors in recent weeks have urged the House Committee on Financial Services to take up the measure, fueled in part by the global hunt for the assets of oligarchs. A bipartisan bill called the KLEPTO Act, which would impose stricter disclosure rules for U.S. purchases of assets like real estate, yachts, and private jets, was also recently introduced, citing ICIJ investigations.

This month, the U.K. sanctioned the cousin of Russian aluminum magnate Oleg Deripaska as part of a broader effort targeting the relatives, associates and employees of oligarchs.

A Pandora Papers story earlier this month described how Deripaska’s cousin, Pavel Ezubov, set up an LLC in Delaware to buy a $15 million mansion near Embassy Row in Northwest Washington. In October, the FBI searched the home as part of an unspecified federal investigation. Ezubov did not respond to a previous request for comment.

Deripaska, a key Putin ally sanctioned by the United States in 2018, has denied owning the home.

This story was updated to include information about the KLEPTO Act.

Original source of article: www.icij.org