Sarawak Report, in a joint investigation with the Organised Crime and Corruption Reporting Project (OCCRP), has examined how at the height of the 1MDB scandal the Malaysian fraudster Jho Low utilised a network of services accessed through a company which describes itself as the “The Global Leader in Residence and Citizenship Planning” to continue to move himself and his money around the world.

Henley & Partners Holdings Limited (H&P) is based in the Channel Islands and operates a web of mainly off-shore compani∂aes, boasting an estimated annual revenue of $73 million dollars assisting so-called ultra high net worth individuals seeking multiple citizenships. The group has repeatedly denied it ever signed up Jho Low as a client or received ‘direct payment’ from him.

“Henley & Partners rejected Mr Jho Low as a client in 2015. This was due to the contents of an external due diligence report that made it clear that he was a second-generation PEP, having been very close to the Malaysia government of

the day, which was correctly assessed as too high risk. He therefore did not pass our on boarding procedures.

[Statement from H&P 20th Jan 2021]

However, extensive evidence reviewed by this investigation and ultimately admitted to by the company shows H&P nonetheless referred the wealthy Malaysian fugitive to an established network of close business partners in return for at least 75% of the massive fees paid by Jho Low to obtain one such citizenship.

The arm’s length operation, which appeared to distance the company from this toxic client, netted H&P at least €700,000 from Jho Low’s acquisition of Cyrpiot citizenship through a property purchase organised through Henley’s business contacts on the island. We can also demonstrate that H&P, despite denials, were involved every step of the way.

In the process Jho Low obtained not only a €5 million property and a passport for himself, but likewise purchased homes and applied for passports on behalf of several members of his inner circle who are also on the run over 1MDB. These included his brother Low Taek Szen, Loo Ai Swan (Jasmine Loo), Tan Kim Loong (Eric Tan) and girlfriend Jesselynn Chuang Teik Ying, who applied for her papers as late as May 2019, more than a year after the prosecution of Najib over 1MDB began in Malaysia.

The matter is currently at the centre of a major official enquiry in Cyprus, which has suspended its citizenship programme under legal pressure from the EU following multiple reports of corruption and bribery. Last week the Archbishop of Cyprus was questioned by the enquiry after admitting that he had dinner with Jho Low at which the fugitive pledged what turned out to be a €300,000 donation towards a theological school.

Following the meeting, the Archbishop sent letters of recommendation to the Interior Minister urging he should be granted citizenship. Archbishop Chrysostomos now says he would be willing to return the money.

In January a Henley & Partners spokesman finally conceded that their company also benefitted from the fugitive’s citizenship transactions as a result of referring him to 3rd parties, but only after we provided evidence of at least three separate invoices paid to the company in September 2015 citing services to Jho Low and totalling €700,000:

“Jho Low was never our client. We never received payment from him. We did receive commission payments from independent 3rd parties following our referral of business to them.”

[H&P Communications Director, Paddy Blewer’s final amended statement to SR/OCCRP, 22nd Jan 2021]

Explaining the company’s disassociation from Jho Low, whilst at the same time receiving the lion’s share of the fees paid by the fugitive to gain citizenship, the spokesman, Communications Director Paddy Blewer, had described “investment migration” as a “niche and complex business”:

“It is therefore entirely understandable that those from outside the industry can make honest mistakes in their analysis of how transactions are managed, who is advising and who is compensated and by whom etc.”

However, Blewer maintained it was important to understand that the company to which H&P had referred Jho Low in Cyprus, a service provider named Fides Corp, was entirely independent of themselves, “an external and independent consultant” and just one of “multiple advisors” used by H&P:

“The best way to describe the relationship with FidesCorp Limited is one of several ad hoc collaborations on shared clients. This is an independent service provider who does for the most part its own accounting, corporate service provider, handling their own applications for their own clients, and similar business. We otherwise have nothing to do with FidesCorp Limited”

“To be very clear, Jho Low was never a client of Henley & Partners. Henley & Partners was not mandated by Jho Low.

We can however understand a level of confusion from outside observers as to the nature of the relationship. It can be explained as follows:

- Jho Low was rejected by Henley & Partners as an investment migration advisory client

- Jho Low was referred without prejudice to an external and independent consultant

- Jho Low (it should be assumed) was advised by the independent consultant as regards Cyprus Citizenship by Investment Application………. At no point did any person or entity within the H&P Group structure, including Henley Estates, ever

contract or receive income directly from Jho Low. They contracted and received income from long standing corporate real estate partners.

Nonetheless, documents and emails obtained by the investigation provide a very different picture. They show that H&P senior officers did directly engage with Jho Low to assist in his property purchases and citizenship application claiming by far the largest share of the payable fees in the process.

And far from being an ‘external independent consultant’ H&P’s representative in Cyprus, Yiannos Trisokkas, described Fides Corp to Jho Low himself as their“exclusive local service provider” on the island.

Moreover, whilst invoices were channelled through Fides Corp, payments were made direct to H&P’s Malta bank account from a personal escrow account arranged for Jho Low in Cyprus by Yiannos Trisokkas in his capacity as “Director of Henley & Partners Cyprus Limited”.

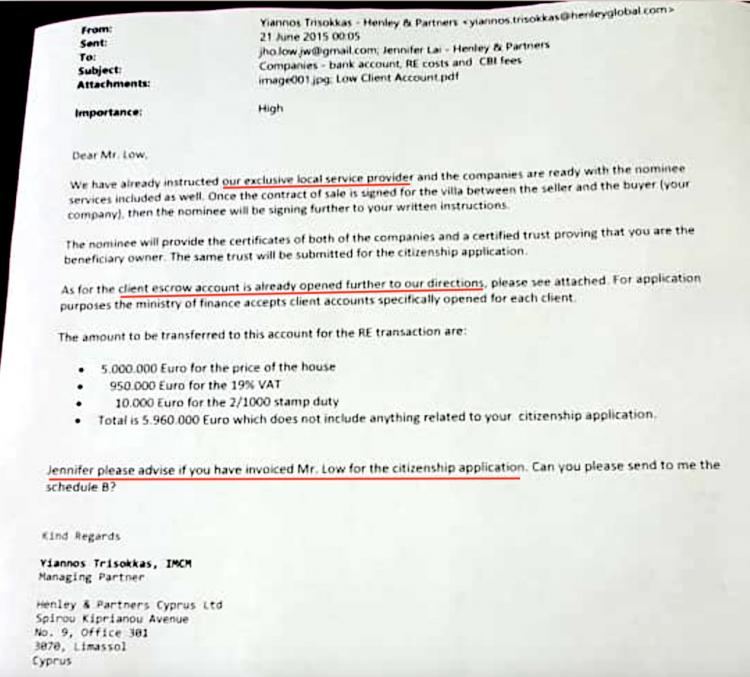

In one direct email sent by Trisokkas to Jho Low 21st June 2015, Trisokkas advised the supposedly rejected client:

“Dear Mr Low, We have already instructed our exclusive local service provider and the companies are ready with the nominee services included as well. Once the contract of sale is signed for the villa between the seller and the buyer (your company) then the nominee will be signing further to your written instructions….. the same trust will be submitted for the citizenship application”

Trisokkas advised in the same email that he had organised for Jho Low to personally open the local escrow account specifically to finance the application costs:

“a client escrow account is opened further to our directions, please see attached. For application purposes the ministry of finance accepts client accounts specifically opened for each client”

The total fees for the house purchase were listed as €5,960,000, however Trisokkas warned in that this “does not include anything related to your citizenship application”.

Trisokkas then addressed another H&P senior figure copied into the email, Jennifer Lai, Managing Partner and Head of Business for H&P North Asia, adding the comment:

“Jennifer, please advise if you have invoiced Mr Low for the citizenship application.”

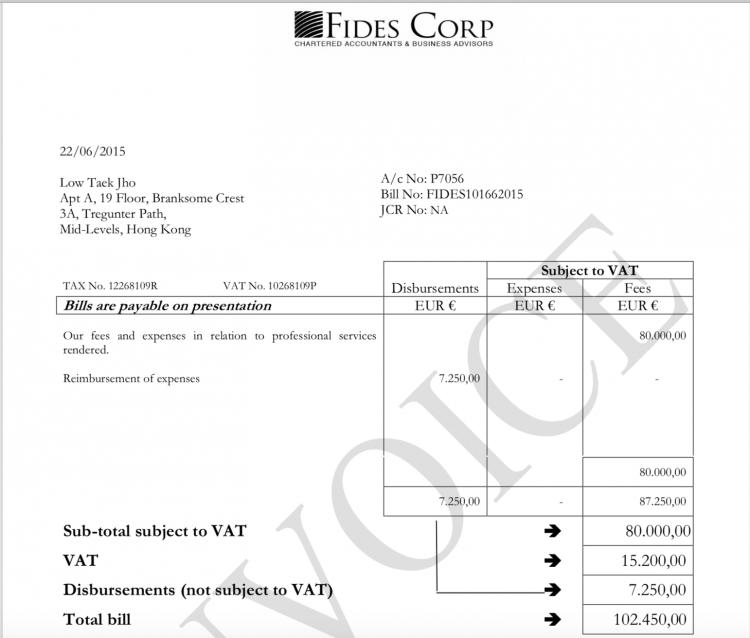

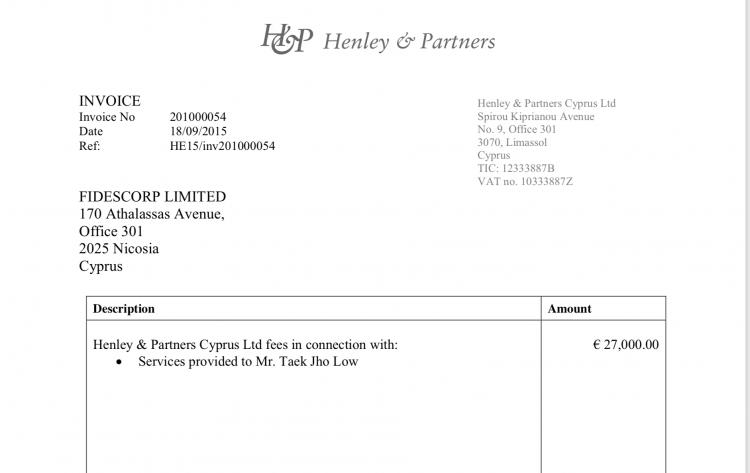

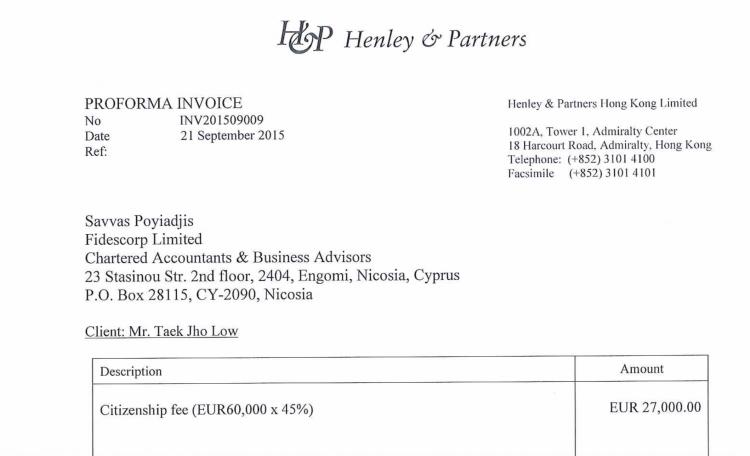

H&P duly invoiced Fides Corp immediately after the property purchase was completed in September for a total of €54,000 out of the €80,000 that Fides Corp charged Jho Low for his “citizenship fees”.

Whopping Real Estate Commission

Days later a further €650,000 was also paid to H&P’s Malta bank account direct from the same Jho Low ‘client escrow account’ that Trisokkas had arranged through Fides Corps as a whopping 13% commission on the €5 million property purchase made by Jho as part of the same citizenship transaction.

The grand total received by H&P in return for this one Cypriot citizenship for Jho Low was therefore at least €700,000. It is understood that in the event the other passport applications for his entourage failed to be processed.

It is therefore clear that despite H&P’s repeated claims that they received no payment directly from Jho Low and that they were rewarded only for referrals to independent third parties who autonomously handled the case, the Malaysian fugitive was in touch with H&P senior staff throughout his citizenship application to Cyprus through the island’s controversial passport for property scheme and paid directly.

What’s more, following the successful application and the payment of those fees Trisokkas and his colleagues were to continue to assist Jho Low according to later documents we have also obtained.

Client Agreement

Just four months before obtaining his Cypriot citizenship Jho Low signed a direct ‘Client Agreement’ with H&P dated 7th May 2015. As part of the Client Agreement H&P had required Jho Low to sign a due diligence pledge that he would the ultimate source of all funds payable to H&P.

H&P claim that the above agreement was cancelled following a negative KYC (Know Your Customer) report in June 2015, however they have so far provided no evidence of the cancellation.

A ‘One-Off’ Transaction

When asked to explain the €650,000 property commission received by their Malta head office from an allegedly rejected client, H&P claimed that it owed to an inherited real estate arrangement that Jho Low had made with another previously ‘independent’ consultant, Andrew Taylor, who later joined the company

H&P explained Taylor’s own company, Taylored Estates, had a licence from an H&P Malta subsidiary called Henley Estates (only operational under that title since May 2014) to utilise the company name for property transactions. H&P has so far failed to provide evidence of this transient licensing agreement.

Taylor became a partner and Group Vice Chairman of H&P in March 2015, explains Paddy Blewer, thereby absorbing his previously ‘autonomous’ business along with the prior arrangement with Jho Low into the company. This entitled H&P to receive the commission, the company argues.

On the other hand, Blewer admits such practices should no longer continue.

Since the original exposes in 2019 about the company’s connections with Jho Low (in 2019) there has been a thorough review of corporate governance and a reform of company procedures. “Henley and Partners in 2021 is not the Henley of Partners of 2010, or of 2015-17″ he said:

“this transaction was identified as a one off that should not be repeated and is contrary to our adjusted corporate governance post integration of Henley Estates…. Henley & Partners has both enhanced its governance standards and altered its contracts with external parties to ensure that if it rejects an individual for any reason, it can no longer benefit even indirectly from that individual’s possible subsequent transactions in any way.

[H&P Statement January 13th]

When Sarawak Report/OCCRP then alerted H&P to the growing body of evidence showing that, far from being a “one off” transaction, senior H&P staff – namely Trisokkas and H&P’s Head of Business Development, Jennifer Lai – had continued as late as November 2016 to engage and assist Jho Low in his property transactions (Jho Low later swapped his property to a larger more exclusive plot) H&P further updated its response.

H&P explained in its updated statement that although the firm maintains it “did nothing wrong” some “individual members of staff” might have failed to “exercise sufficient levels of judgement“.

Spokesman Paddy Blewer further revealed that all the staff we identified as having continued to perform services for Jho Low are now no longer with the company, including Andrew Taylor and the former CEO at that time:

“We remain entirely certain that this firm did nothing wrong. It may be that some individual staff members involved at that time did not act as one team or failed to adhere to the new procedures, or did not exercise a sufficient level of judgment as to their interaction with real estate partners.

To reiterate this important point, anyone involved in this transaction at a senior level is no longer with the firm today. Yiannos Trisakkos, Jennifer Lai, Andrew Taylor and the previous CEO have all subsequently left the company.”

[Statement by H&P 20th January]

Despite this move to effectively blame and disassociate the company from these senior former staff members, Sarawak Report has noted that both Jennifer Lai and Yiannos Trisokkas continued to be advertised as existing employees on the company website until the day after H&P issued us that statement – at which point their names were both removed. Meanwhile, Trisokkas continued to remain as the registered director of the H&P Cypriot subsidiary, Henley & Partners Cyprus (as of January 20th last checked).

Likewise, until we notified Henley of the documents in our possession, Andrew Taylor continued to represent his primary employment on his Linked In page as working for H&P … since 2009 “till present”.

His Linked In page was subsequently altered to announce he had left H&P in 2018 and had started a new company in 2019. These changes to the details on his CV also appeared on 13th January 2021, the same day H&P issued the above statement to Sarawak Report and changed their own website.

In amending his Linked In CV Andrew Taylor not only added a new company he has headed since 2018 but altered the stated dates of his past employment with H&P.

However, both versions claim that Andrew Taylor in fact became H&P Group Vice Chairman in June 2014, which is a full year before March 2015 when H&P say he merged his prior business with Jho low into the company and also pre-dates the May 2015 Client Agreement which Jho Low directly signed with H&P itself.

Blurred Relationships

Andrew Taylor’s relationship with H&P in fact predates Henley Estates and appears far reaching. Close ties with the Chairman of H&P, Christian Kalin, in the immigration business are evidenced by their publication of a jointly authored book the “International Real Estate Handbook” in September 2013 under the imprint of H&P and Henley Estates

H&P’s Paddy Blewer explained that the company’s business and expertise is immigration and citizenship law only and it therefore plays no direct role in real estate transactions linked to citizenship – hence the partnership with Taylor and his

company ‘Taylored Way’ and the merger in 2015.

“Henley & Partners, as a pure play investment migration advisory firm, had neither the experience or appetite to engage in the management or operation of a real estate company, or provide credible advice on real estate investments. It was therefore necessary to source and develop a more structured formalised global agreement with an external organisation …. As a result, Taylored Way changed its name to Henley Estates, and Andrew Taylor (the managing director) led the expansion

from 2013 onwards” [Paddy Blewer].

Yet despite the stated lack of expertise, it is notable the original edition of the International Real Estate Handbook book was published in 2005 by Christian Kalin as the sole author. The publisher describes Kalin as “an international real estate, tax and estate-planning specialist and a partner at Henley & Partners, Zurich”, making for a complex web indeed of professed autonomy and expertise.

Equally confusingly, Taylor states in his own CV that he actually worked as a managing partner of Henley Estates as early as 2009 (amended to 2012 in the updated Linked In). In the absence of documentation from H&P it is unclear if this position was for the actual group or under another licence to use the name of Henley Estates.

Do Not Use Our Changing Statements Against Us

H&P has emphasised that the company now contributes to various charitable initiatives linked to “UNHCR, UNICEF, Andan Foundation and many others” assisting poor migrants. Yet, despite the references to later reforms and staff removals, the company still rejects any wrongdoing or inconsistency on its part regarding its handling of Jho Low or its earlier statements. Neither has Henley said it will return any money to 1MDB:

“It would be disingenuous for you to cast aspersions [against H&P] that simply do not exist…. This is particularly so were you to suggest that previous statements issued by us were untrue. To carry such false allegations would risk causing serious harm to our business.”

[Statement H&P 30th December]

However, there has been a problem with changing statements from H&P, who have plainly altered their explanations in response to escalating leaks about their business (direct or indirect) with Low Taek Jho.

For example, the €650,000 fee that was paid to H&P in September 2015 as a commission for Jho Low’s property purchase was, according to documents and information, originally paid through a Cyprus company named Donnica Management 23rd September 2015.

However, the payment was then returned from the H&P’s Malta bank account and was later re-sent on 30th September 2015, this time directly from the escrow Fides Corp client account for Jho Low instead (see above).

However, in the early exposes about the fraudster’s Cypriot links it was only a copy of the cancelled payment by Donnica Management that was picked up by the international press, including the Financial Times who approached H&P for an

explanation.

Expressing frustration over reports that had connected H&P to Jho Low H&P had first complained in a statement:

“Henley & Partners is aware of numerous misleading articles that have mentioned Henley & Partners in connection to Jho Low, the Malaysian fugitive….. the firm declined to accept Mr. Low as a client. It is therefore false to state that “Henley & Partners helped Jho Low acquire Cypriot citizenship.” [Statement November 2019]

Specifically H&P then told the Financial Times that “the money did not originate from any entity linked to Mr Low or his associates.”

“Henley & Partners told the FT that the payment was a fee from a Cypriot developer under a pre-existing agreement for Henley Estates to provide “marketing support services”, and the money did not originate from any entity linked to Mr Low or his associates.

Juerg Steffen, H&P chief executive, said the payment should nonetheless not have been taken, since his company had previously rejected Mr Low as a client following due diligence checks.

Mr Steffen said the case had helped trigger an overhaul of governance standards in the Henley companies. “Hindsight is a wonderful thing,” he said.

[Financial Times 24th November 2019]

However, as the latest documents that have now come to light reveal, that the payment did not ultimately arrive from the ‘Cypriot developer’ Donnica Management but from the Fides Corp’s client account for Jho Low. This was plainly an entity connected to Jho Low.

Records further show that Donnica Management is itself inextricably and directly tied to H&P. The company was set up 15th May 2015 just one week after Jho Low signed his Client Agreement with H&P and it appears to have existed primarily to facilitate the commission for his €5 million property transaction.

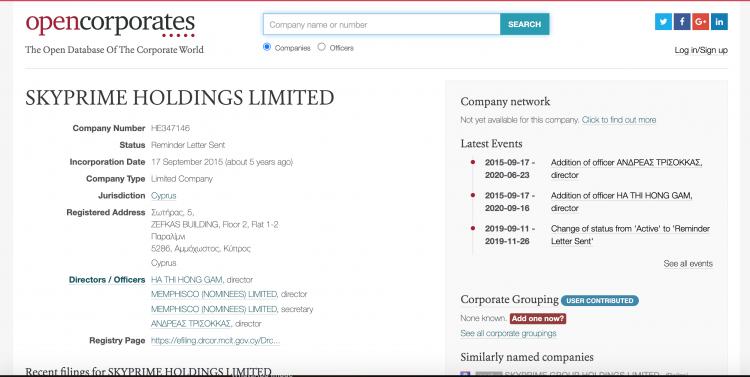

The shell company shares an address and Director (Andreas Trisokkas) with a subsidiary of an established developer on the island, Sky Prime Group, who sold the property to Jho Low according to research by OCCRP. It is the address of their mutual lawyer which houses numerous such Cypriot companies.

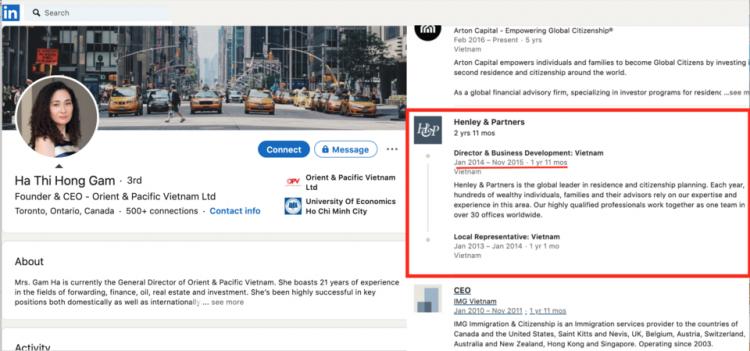

The other director of Donnica Management from the date of its incorporation was Ha Thi Hong Gam, a staff member of Henley & Partners based in Vietnam:

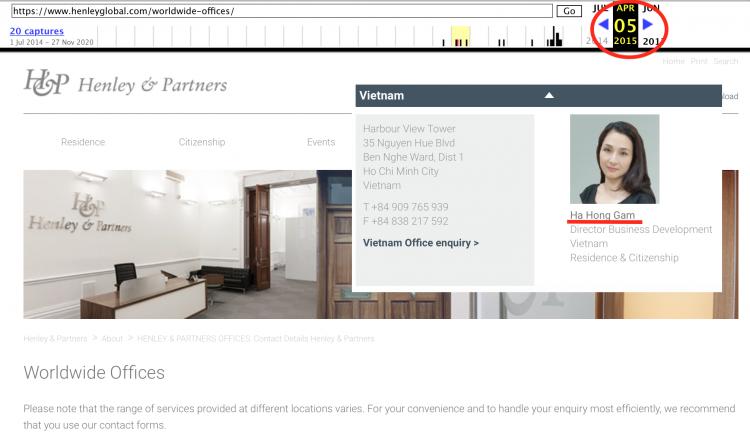

Ha Thi Hong Gam makes clear she was the Vietnamese Director representative of Henley & Partners at that time according on her Linked In site:

And also according to H&P’s own website at the time which described her as a Director of Business Development:

The conclusion must be that far from this being an independent third party transaction H&P was involved in the Jho Low property for citizenship purchase from the start, whilst claiming they rejected him as a client.

Indeed, the same Ha Thi Hong Gam is registered as the Director of a number of other Cyprus companies including Sky Prime Holdings, again in tandem with Andreas Trisokkas.

Thus the picture emerges of an interwoven relationship between H&P and the local developers and service providers involved in the property for passport deal arranged for Jho Low – and it would appear for other clients also.

Notably, the local facilitators such as Fides Corp itself only received a fraction of the fees payed by Jho Low – 20% of the €80,000 charged for citizenship work – with the rest going to H&P. This evidence would suggest H&P was the dominant and driving entity behind the application from start to finish.

Jho Low Wanted His Own Bank – And Multiple Passports

According to our research, the same network of agencies even engaged in the fraudster’s ongoing multiple attempts to buy controlling stakes in private off-shore banks as late as 2016, by which time his infamy was worldwide and the world banking system had closed its doors against him.

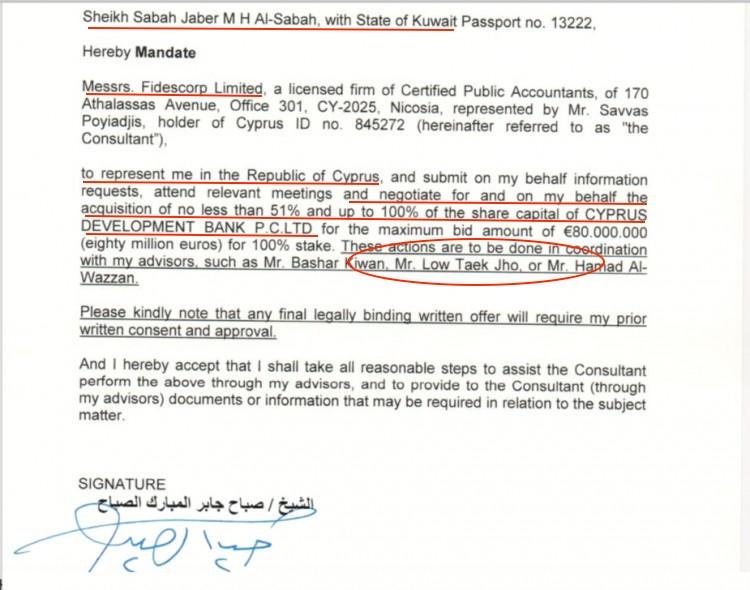

Sarawak Report has already reported how in order to facilitate the transfer of his stolen cash piles Jho Low teamed up that year with a Kuwaiti royal sheikh, the son of the then Kuwaiti prime minister Sheikh Sabah Jaber Al-Mubarak Al-Hamad Al-Sabah (Sheikh Sabah), who acted as a front paying bills and making multi-million dollar transfers.

Fides Corp agreed to manage negotiations on behalf of Sheikh Sabah for the purchase of a stake in the Cyprus Development Bank. It was Jho Low who made the introduction, Jho Low who stated himself to be acting as the Sheikh’s advisor and indeed it was Jho Low’s stolen Malaysian money behind the project.

According to documents obtained by Sarawak Report, on 23rd June 2016 Jho emailed a mandate he had drafted for the Sheikh to sign authorising Fides Corp to negotiate the purchase of up to 100% stake in the bank for €80 million.

The mandate, which the Sheikh duly signed and sent cites Jho Low quite clearly as the Sheikh’s “advisor” in the matter, despite the fact the 1MDB scandal had been raging for over a year. Two others also cited as advisors in the mandate drafted by Low say they were not involved in the attempted deal.

H&P has told Sarawak Report it also knows nothing of those arrangements and according to research by OCCRP the negotiations eventually stalled:

“Even if this individual was a client (which he was not), this sort of subject would not have been part of our discussions, because Henley & Partners is purely focused on professional investment migration advisory services. This is all we do”

[Statement 30th December 2020].

As late as November 2019, by which time he was the world’s most wanted fraudster, Jho Low was still able to reportedly travel to Abu

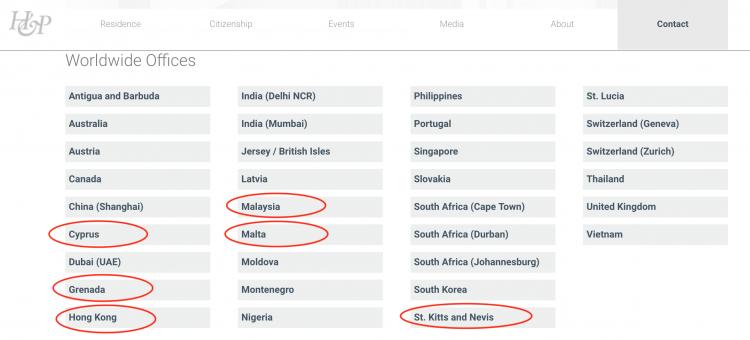

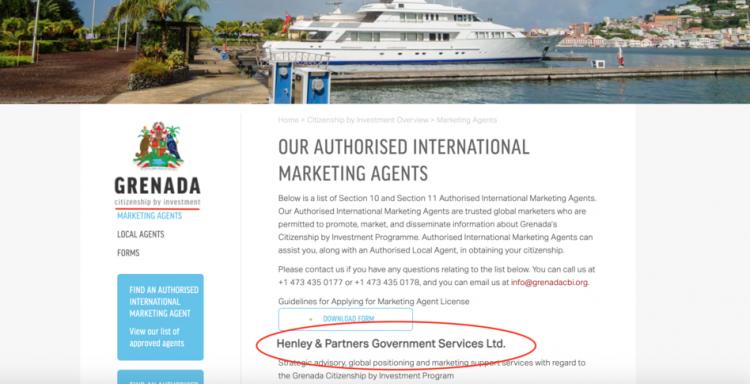

Dhabi on a passport obtained through another citizenship scheme relaunched in 2016 by H&P thanks to a mandate from the island government of Grenada.

No one apparently thought to alert INTERPOL to the existence of that document. H&P denies it was involved in the obtaining of the passport.

The DOJ has also disclosed that Jho Low held a separate passport from the island of St Kitts & Nevis, which is also one of the

string of mainly offshore locations where H&P boasts offices and local agents claiming to be the leading purveyors under cash for passports schemes. However, H&P in a statement has denied it supplied that passport either.

“We cannot comment on whether or not Mr Low acquired citizenship and passports from Grenada and St. Kitts and Nevis because he was not a client of Henley & Partners … We can confirm that never handled any application for this individual in any investment migration program anywhere in the world, nor did we do anything else anywhere for this person, because we rejected this individual as a client following our due diligence process. [H&P statement 30th December 2020]

Treasure Island Escape Routes For Global Fugitives?

Henley & Partners, fronted by Swiss lawyer Christian Kalin as Group Chairman, markets its ‘citizenship through investment’ schemes as a route to ‘Global Citizenship’ for so-called ‘High Net Worth Individuals’ using a network of mainly off-shore commonwealth domains boasting visa free travel arrangements to the world’s top destinations such as Europe, the UK and America.

However, there are concerns that in the same way the off-shore finance sector enables individuals to hide cash and assets, the off-shore citizenship business enables them to travel unfettered on multiple passports. Jho Low has exemplified the use to wealthy crooks and fugitives on the run.

Over the past two decades the trade has exploded into a multi-billion dollar business for which H&P, as the market leader, makes no apologies:

“We are particularly proud of the fact that we have helped and are helping many countries that are struggling to attract sufficient investment and create jobs. Many of these countries are post-colonial economies that have significant

difficulties in the face of financial crises, natural disasters, and now this unprecedented global pandemic with catastrophic impact in many economic sectors, and not least in tourism. We are equally proud of the fact that we help hundreds of

families every year to improve their personal security and mobility, as well as their overall life opportunities, which are randomly assigned by way of where you happen to be born. We will always robustly defend our track record and the positive

value we create.”

[H&P Statement 30th December]

Cyprus has now suspended its citizenship scheme and launched a major official investigation into the scandal, including links between the industry and members of the government

connected to the scheme.

The Director of Fides Corp is himself the son-in-law of the now resigned Speaker of the Parliament, Demetris Syllouris, also caught on record by Al Jazeera claiming he could fix the passport they required.

H&P has also been accused of close ties with the now fallen Maltese Prime Minister Joseph Muscat, who had been challenged by journalist Daphne Caruana Galizia for granting the company an exclusive concession for another passports for sale scheme providing entry into the EU. Henley was reportedly threatening legal action against Caruana Galizia before the journalist was murdered by a car bomb.

Malta’s scheme has also now been suspended and is under investigation by the EU.

‘Faustian Pact’ To Elect ‘Conducive’ Governments?

Further criticism of the company’s alleged manipulative ties to off-shore political bosses was published in the February 2019 report of the UK Parliament’s Culture, Media & Sport Committee enquiry into the scandal hit political consultancy Cambridge Analytica/SCL.

The committee referred to a “Faustian Pact” between the two companies whereby H&P steered donations from wealthy passport buyers to ruling political parties to help keep the governments issuing passports through the company in power, including paying SCL to run their election campaigns.

One example highlighted in news reports involved an election in St Kitts & Nevis. According to the Guardian newspaper H&P Chairman Christian Kalin first denied supporting elections, then acknowledged he made some ‘introductions’:

“Kälin denies it. “This is rubbish. This whole notion that we raised or organised the financing is misguided,” he said.

Kälin insisted there was no coordinated effort by him, or Henley, to raise money for SCL. But he admitted many of his wealthy clients could have donated to the campaign.

He recalled meetings where he introduced people to Douglas and SCL, which, he said, he saw as part of his mandate as the then honorary consul for St Kitts in Switzerland.

“At that time I had direct interaction with clients. They trusted me. The prime minister trusted me. So I introduced many people to the prime minister. For sure many of them would have gone on to make a donation.”

Some of those donations, he says, would have been paid directly to SCL, but not all donors were Henley clients.” [Guardian 16th Oct 2018

‘The passport king who markets citizenship for cash’]

However, H&P has dismissed the comments by the UK Parliamentary Committee as being under-informed and based on inaccurate claims:

“The referenced comments made by that committee in its report were in fact outside its terms of reference. This perhaps puts in context why the statements we have described above are so inaccurate. Indeed, had the report not been subject to

parliamentary privilege we would have successfully challenged it as it contains a large number of factually incorrect statements.” [H&P statement 30th January].

What the global community can no longer ignore after examples like Jho Low is that off-shore financial secrecy combined with multi-billion dollar off-shore citizenship programmes have become the key instrument for global criminals to evade justice,

hide illicit funds and avoid paying taxes.

Recent estimates calculate trillions of dollars are lost to world governments owing to this

corruption – and the 1MDB scandal has helped place it in the spotlight. Following Brexit, the EU last week voted to add the Channel Islands and British Virgin Islands to its off-shore blacklist with other major players like the Cayman Islands likely to face similar scrutiny.

The new United States President Joe Biden has also pledged to tighten crackdowns on kleptocracy and off-shore money laundering under which the FBI assisted in the pursuit of Jho Low:

““I will lead efforts internationally to bring transparency to the global financial system, go after illicit tax havens, seize stolen assets, and make it more difficult for leaders who steal from their people to hide behind anonymous front companies,” [Foreign Affairs March 2020]

Indeed, as governments begin to chase the stolen money, off-shore operators like Henley & Partners may find their business model becomes more challenging and that the next probes will be from regulators rather than journalists.