As US president Donald Trump whirled around Poland on July 6, a story in the Financial Times (paywall) turned up an interesting new development relating to his real-estate empire. Felix Sater, a Trump associate and a convicted criminal, is cooperating with an international probe into Kazakh money laundering, some of which allegedly went through a Trump property.

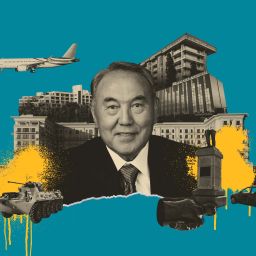

According to the FT, former Kazakh cabinet minister Viktor Khrapunov spent $3.1 million buying three apartments in Trump Soho through shell companies using funds that the Kazakh government alleges he stole from the state. The FT reports that Sater, a Russian-born US citizen convicted in 1998 of a fraud in partnership with the New York and Russian mafia, acted as a fixer to help Khrapunov’s family buy the properties. Khrapunov claims he is innocent and is being persecuted by the regime of Nursultan Nazarbayev, Kazakhstan’s strongman president.

Could this damage Trump?

While the Kazakh investigation is unlikely to shed any light on possible ties between Trump’s election campaign and Russian interference in last year’s US election, says Alexander Cooley, author of Dictators Across Borders: Power and Money in Central Asia, if it prompts special prosecutor Robert Mueller to probe Trump’s real-estate transactions, it could become uncomfortable. The Trump Organization has courted Russian buyers and, like many high end sellers of US real estate in large American cities, it sells properties to mysterious shell companies.

Cooley speculates that Mueller may want to question how buyers of Trump properties obtained their money. “Where do cash infusions for Trump properties come from? What are the types of funds they’re attracting? What are the motives for investing?” asks Cooley, who is director of Columbia University’s Harriman Institute.

The problem here

The Kazakh probe once again exposes the murky way the US real-estate world works. Moguls like Trump have long been able to legally sell properties to secretive shell companies and ask no questions about the true owners—who could be legitimate buyers but also kleptocrats, drug lords, or terrorist financiers.

When the Patriot Act was passed during the Bush administration to clamp down on terrorist financing, the Treasury exempted the real-estate sector from a rule that forced banks to find out who owned anonymous firms before doing business with them.

That rule was supposed to be temporary. But 16 years later, the government has done little to change regulations—despite the fact that almost half (paywall) the expensive residential properties in the US are owned through shell companies, according to a 2015 New York Times investigation. New York City began requiring shell companies (paywall) buying property to disclose their members in May 2015, but many said the new rules didn’t go far enough.

Just last week, the US won the right to seize a Manhattan skyscraper being used by Iran to avoid sanctions after a nine-year legal case. For Eryn Schornick, a policy advisor at anti-corruption NGO Global Witness, the Treasury’s failure to end the Patriot Act exemption adds up to “the real-estate lobby having won the battle to keep regulation out of its industry.”

The government has tightened rules through a measure called Geographic Targeting Orders, applying to the counties surrounding six major cities, including Trump’s stomping grounds of New York, Miami, and Palm Beach. Under the orders, when a shell company buys an expensive residential property with cash, the company it gets title insurance from then has to find out who owns the shell firm and pass that information to the Treasury. Then? Well, nothing happens unless there’s an investigation into the buyer.

The Treasury says 30% of buyers involved in deals since this system was put in place last year have been deemed suspicious in previous reports. So? By the time their names are revealed, such buyers have already parked their money, says Shruti Shah, vice president of the Coalition for Integrity, a transparency NGO. “The transaction is already done,” she says. Instead, she argues that real-estate brokers should have to do their due diligence before the purchase is made. “The sad part is this can be done without legislation; it can be done through rule-making by the Treasury,” she says.

Given Trump’s lifetime in the real-estate industry and the vested interests of the property magnates he trusts to advise him, the chances of change seem slim. Nonetheless, advocates like Schornick remain hopeful. “If civil-society organizations go to the mat on this, I think there’s going to be a very strong argument for some movement because the evidence is so overwhelming,” she said. However, “we’ll have to understand that there’s a very strong real-estate lobby that now has direct allies in office. I don’t think it’s fair to say they’ll just jump in bed together, but it’s human nature to some degree.”

WRITTEN BY Max De Haldevang

A new corruption probe linked to Trump is a scathing indictment of the US real-estate industry