Glencore managed to get a $440m discount in the Congo.

Paradise Papers

Mining companies now controlled by commodities giant Glencore won $440 million in discounts on payments in 2008 to a Democratic Republic of Congo-controlled copper mining company – a massive financial loss for the desperately poor nation, according to a new report based on the Paradise Papers.

The $440 million loss to the DRC, where more than a third of adults are illiterate, was almost as large as its total expenditures on education at the time.

Elisabeth Caesens, director of the Brussels-based nonprofit Resource Matters, found that Katanga Mining Ltd. arranged to pay substantially less than market rate to obtain mining concessions from Gecamines, the state-controlled mining company, as part of contract renegotiations for mining projects. Katanga includes the companies that benefited from the discounts and is now controlled by Glencore.

“The Paradise Papers allowed us to look behind the scene and follow the negotiations of some of the most important contracts,” said Caesens, who used public documents and disclosures by ICIJ and its partners from the Paradise Papers, a massive leak of documents from an offshore law firm and others.

The Paradise Papers showed that during industry-wide renegotiations Gecamines initially said it would charge Katanga $585 million to participate in the mining venture.

Katanga, in which Glencore then had an small interest, found the $585 million payment unacceptable, internal company minutes reveal. Katanga approached Dan Gertler, an Israeli businessman with a minority interest in Katanga, for help. The pay-to-play amount was reduced to $140 million, according to company minutes.

Glencore declined to comment on the report. In a previous statement, Glencore said the agreement to pay $140 million was reached before Gertler’s involvement. Lawyers for Gertler have previously told ICIJ that Katanga didn’t receive preferential treatment as a result of Gertler’s involvement and that all negotiations were legitimate and arms-length.

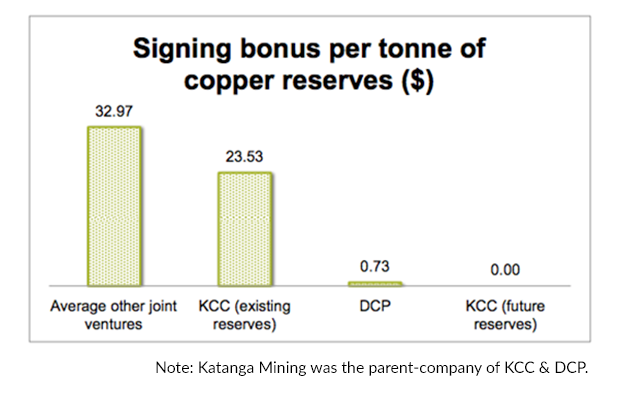

The 21-page report zooms in on a series of discounts secured on the mining ventures that total $440 million. In the most striking case, one of the two companies that were part of Katanga Mining paid $5 million to obtain rights that would have typically cost $240 million, based on the industry average paid by other companies at the time, the report says.

In another case discussed by Caesens, the mining venture secured 4 million tons of copper without paying additional money to the state-owned mining company. In yet another discount, the DRC mining company granted the venture a favorable deal by using a less common measurement of copper reserves that could have saved the venture $60 million, according to the report.

“Congo is one of the poorest countries in the world,” Caesens said. “Social services are minimal to non-existent. At the time, $235 million represented more than the country’s yearly budget for primary and secondary education.”

While more than a dozen other mining companies working in the same copper-cobalt rich region paid an average of just under $33 per ton of copper, Caesens found, the mining project now managed by Glencore paid 73 cents per ton.

The dollar amounts of signing bonuses.

“That is proportionally 48 times lower than what virtually all other investors agreed to,” Caesens wrote.

The Paradise Papers indicate that Gertler may have played a role in obtaining the larger discount. In March 2009, Gertler attended a meeting with DRC mining company representatives to discuss a range of issues, according to minutes from a Katanga meeting.

“All outstanding points were discussed there and Dan Gertler led the discussion before leaving the meeting,” minutes stated.

Less than one week later, at a Switzerland hotel, Katanga executives, including a senior Glencore manager, confirmed that it would pay $140 million, rather than the $580-plus originally sought for the mining concessions, according to board minutes from the Paradise Papers. The costs would be divided between two of Katanga’s projects in payments of $135 million and $5 million, according to the minutes.

The Resource Matters report comes amid growing pressure on Glencore and its operations in the DRC.

Last month, Glencore and Katanga announced that three directors had stepped down after an official investigation by the Ontario Securities Commission in Canada, where Katanga is based, prompted an internal audit that found “material weaknesses” in the company’s financial reporting controls.

Canadian authorities are also reviewing Katanga’s compliance with disclosures under bribery and anti-corruption laws, the company said.

In an interview, Switzerland’s justice minister said the Paradise Papers revelations would further pressure the country to reform is commodities sector and evoked new legislation to force companies to “play by the rules.”

Paradise Papers Research Raises Questions Over Glencore’s $440m Congo Discount