A massive leak of documents reveals the hidden owners behind Meridian Capital, a major Kazakhstani investment and holding company with interests in oil and gas, real estate, mining, banks, aviation, transportation, and more.

For over a decade, Kazakhstan’s most valuable resources – its oil and gas – have been in the hands of one man. Known for little else other than his managerial skill, the unassuming Sauat Mynbayev has negotiated deals on behalf of his government with oil industry executives from across the world. Officials from oil titans like Chevron and ExxonMobile, Lukoil, the Korea National Oil Corporation, and many others have shaken his hand and signed deals worth billions.

But Mynbayev isn’t what he seems. He’s not just a government technocrat – he’s a magnate himself. And it’s not just oil and gas.

Over a decade ago, in the secretive tropical tax haven of Bermuda, Mynbayev and a group of powerful bankers created a company that would become a multi-billion-dollar empire, investing in everything from real estate to natural resources to banking to aviation, transportation, and dairy.

But Meridian’s inner workings, the full extent of its holdings, and the methods used to acquire them have remained obscured behind a dizzying array of offshore companies that stretch across some of the world’s most secretive jurisdictions.

Until now.

Its secrets are revealed in a leak of 6.8 million confidential records from Appleby, a Bermuda law firm, that were obtained by the German newspaper Süddeutsche Zeitung and shared with the International Consortium of Investigative Journalists (ICIJ) and its global network of media partners, including the Organized Crime and Corruption Reporting Project (OCCRP).

Not even Appleby – the firm that handled Meridian’s paperwork in Bermuda – was aware of the full extent of their client’s empire. Dozens of leaked emails reveal confusion on the side of the law firm and repeated requests for more information about the group’s structure.

In one email, a Meridian staffer politely declines Appleby’s request for information: “For confidentiality reasons we do not believe it is necessary at present to disclose the whole group,” he wrote. “Your understanding is appreciated.”

It took months of poring through thousands of records for OCCRP reporters to unpeel the multiple layers of offshore companies that make up Meridian – and to come to understand how its stunning success was possible.

In the company’s earlier years, it was Kazakhstan’s booming oil industry that fueled Meridian’s growth. This is no surprise, considering that, for much of his career, Mynbayev was either oil minister or chief executive of the state oil company.

But it wasn’t only Mynbayev who used his power, contacts, and official position to help Meridian grow.

According to Appleby data, his fellow co-founders included top executives and shareholders of Kazkommertsbank, the country’s largest private bank. It was this bank that provided the easy credit that made Meridian an empire that now stretches from the United States to Europe, Africa, Asia, and even Australia.

The details of how Meridian’s shareholders exploited the bank under their control are revealed in a separate leak of Kazakhstani banking data obtained by OCCRP.

That leak reveals that the group used a large portion of the bank’s deposits to fund project after project. This enabled them to grow quickly, and at little risk to themselves. According to an email from a central bank official, whenever a project failed, the bank owners and executives – who were also Meridian’s owners – would dump the losses onto the bank’s balance sheets.

This free spending on its own executives’ ventures came back to haunt Kazkommertsbank, which ended up needing multiple government bailouts. Under a state-run stabilization program, infusions of government deposits reached a high of $1.4 billion in 2010. Less than a year after bank was transferred to new ownership, it needed another $7.5 billion bailout. The true cost of the bank’s behavior in bailouts and bad deals will likely never be known, but Kazakhstan’s citizens could be on the hook for billions of dollars.

It is not known how much money Mynbayev and his fellow shareholders have made in total. A 2006 disclosure put Meridian’s value at over $3 billion, but the company is so secretive that the full extent of its investments may also never be known.

This was possible, in part, thanks to Kazakhstan’s notorious corruption and weak rule of law. But it was the Meridian founders’ exploitation of the international financial system that enabled them to hide their riches from the eyes of their own people.

An Island Paradise

It’s a safe bet that few Kazakhstanis have ever been to Bermuda. This tropical paradise is about as far a cry from the land-locked Central Asian country as you can get.

But the strings that connect our modern financial system are long, and can lead to unexpected places. For over a decade, this island nation – known as one of the world’s least transparent tax havens – has been hiding Meridian’s big secret.

In November 2002, a clerk at Appleby’s Bermuda office entered ten names into an internal database. A Kazakhstani technocrat and nine bankers joined thousands of other businessmen, oligarchs, politicians, celebrities, and royals who wanted to benefit from the anonymity (and tax benefits) that offshore company ownership provides.

Their company – Meridian Capital – had been incorporated by Appleby staff several months earlier.

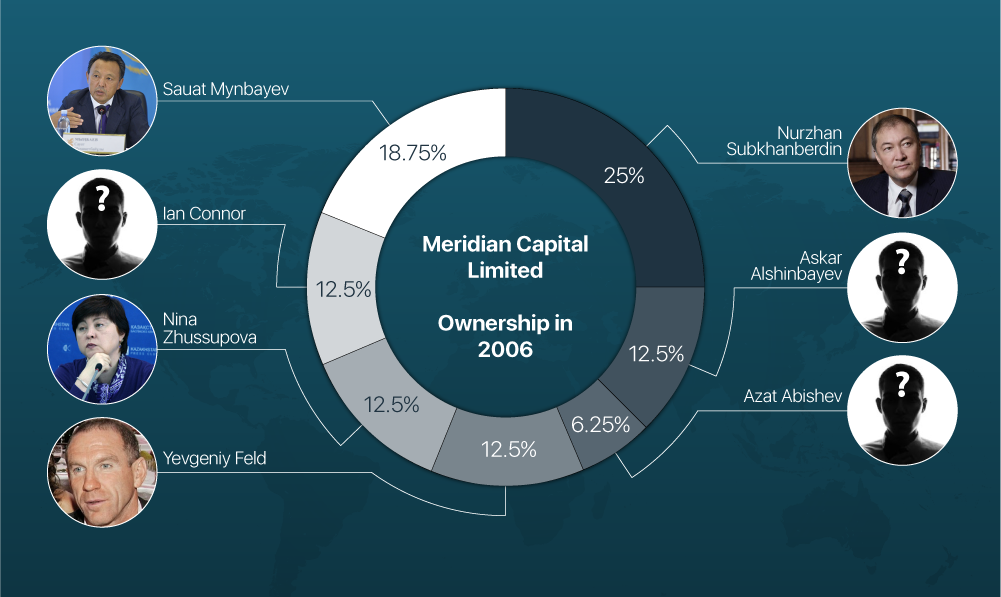

The leaked Appleby data is incomplete, so it’s not clear what percentage of the company each of Meridian’s ten co-founders initially owned. But a 2006 document gives a full picture of the company’s ownership at that time.

The document shows that Mynbayev was the second-largest shareholder, with 18.75 percent. His other co-owners in 2006 – by this point there were six – were Askar Alshinbayev, Yevgeniy Feld, Nurzhan Subkhanberdin, Nina Zhussupova, Azat Abishev, and Ian Connor.

This was a veritable “bankers’ club” – all seven shareholders had occupied top positions in Kazkommertsbank, the fourth-largest in the former Soviet republics.

By then, three years after its creation, the company had already become massively successful and was paying millions in dividends to its shareholders. Ian Connor, Meridian’s only non-Kazakhstani co-owner, had done so well for himself that he was preparing to move to Monaco to lower his tax payments.

This is according to notes (obtained from an earlier leak) from a May 2005 meeting he held with his bank, HSBC, in the French Riviera.

In that meeting, Connor estimated the company’s total assets at $1.2 billion, and said he had received a $9 million dividend payment from the group the previous month.

He described Meridian as a venture capital firm “investing in distressed companies in commodities mining and resources.” Its investments, he said, included major Kazakhstani gold mining and oil companies, though its most recent acquisition had been a mine in South Africa.

For such a big success, one would expect the name “Meridian” to pop up everywhere. You would at least expect the company to have a web site, but it doesn’t.

An online search of Meridian Capital leads to multiple sites that use the same generic name, but none of them are related to the Bermuda company. Considering it is worth billions, the company is nearly absent from the web. It keeps its name out of the press and rarely talks to reporters, even when it is involved in massive projects.

But why would some of Kazakhstan’s wealthiest and best-connected people go to such lengths to hide their success?

For Mynbayev, the most basic reason may have been a straightforward conflict of interest. By the time Meridian was founded, he had already occupied several of the country’s most senior positions, including Finance Minister, Agriculture Minister, and Deputy Head of the Presidential Administration.

And after Meridian was founded in 2002, his career only continued to rise. By the late 2000s, he had become the country’s key oil official, holding the positions of Minister of Energy and Oil Minister, and then becoming head of KazMunayGaz, the state oil and gas company, where he remains today. In these positions, running a business empire fueled by oil would have been unacceptable and possibly illegal. In response to reporters’ questions about whether Mynbayev has ever disclosed his ownership of Meridian, the company replied that he has never been a shareholder or founder.

But even aside from the legal requirements, Mynbayev – known to be the “president’s man” – had a reputation to uphold.

“Unlike other representatives of the elite, he is … in a shadow, in terms of the absence of any negative reputation,” explains Dosym Satpaev, a Kazakhstani political analyst.

This was a particularly useful asset for a man charged with representing Kazakhstan’s government in major oil deals with foreign corporations.

“Leaders in this sector must be able to work with the international investment community, to find a common language with foreign companies and businesses,” Satpaev says. “Mynbayev is someone who president tries to put into positions where [he needs] to have a presentable, good look.”

Nor would running Meridian openly be a good idea for Mynbayev’s banker partners.

Between 2005 and 2011, Kazakhstani legislation banned owners of offshore companies from holding shares in the country’s banks. This particularly concerns Subkhanberdin and Zhussupova, Meridian shareholders who were both also Kazkommertsbank shareholders.

So Meridians’ co-owners needed secrecy. And Bermuda offered the perfect place to find it. The island doesn’t require companies to disclose their owners. This information is stored only in the records of their registration agents – in this case, Appleby – who have no obligation to reveal them to the public.

But even beyond going offshore, Meridian’s owners took the secrecy to a whole new level. In fact, the Meridian registered in Bermuda is just the top of an enormous pyramid that consists of hundreds of companies across dozens of jurisdictions, including some of the most secretive places in the world.

Secrecy At All Costs

Most legitimate companies use one or just a few law firms to register their offshore companies, even when they have large, elaborate structures. But Meridian had its own in-house service company, based in the UK, which itself used half a dozen offshore service providers or law firms to register small parts of the empire. None of them, including Appleby, had enough pieces of the puzzle to understand the full extent of its holdings.

The leaked emails show evidence of confusion among Appleby administrators about some aspects of Meridian’s structure. And when they asked Meridian for clarification to comply with Bermudan regulations, they were sometimes surprised at their client’s reluctance to come clean.

“The requested list of information and documents seems excessive,” read one email from a Meridian staffer.

In another case, Meridian agreed to provide Appleby with some information to satisfy Bermuda’s “Know Your Customer” (KYC) rule, which requires a certain level of disclosure about the identity of one’s business partners. But before providing the information, Meridian demanded that Appleby staff first sign a non-disclosure agreement.

Appleby seemed surprised by the request. “I don’t believe we have ever been required to sign a non-disclosure agreement in respect of KYC, nor do I believe it advisable,” wrote an Appleby employee in an internal email. “Has Appleby or one of its service provider entities ever agreed to or signed something like the document in question?”

In at least one case, Meridian preferred to move one of its related companies to another agent rather than going through what an employee called a “time-consuming and expensive KYC again with Appleby.”

The information Appleby had requested in this case was nothing unusual: a report of the company’s activities over the past 12 months, the status of its bank account, and the names of its ultimate beneficial owners. Evidently, this information was not something Meridian wanted its Bermuda law firm to have.

Catch Me If You Can

The profits from Meridian’s global holdings may end up in Bermuda, but that’s not where its operations are run from.

The next level in the pyramid consists of two investment funds – Meridian Capital CIS Fund and Meridian Capital International Fund – which are registered in the Cayman Islands, another secretive offshore jurisdiction.

From there, it gets complicated.

In some cases, the Cayman funds form the top of a chain of holding companies that – for those who have the patience to follow the trail – eventually lead to the actual businesses. For example, Meridian Petroleum, its domestic oil and gas consultancy in Kazakhstan, is owned by a Dutch company that is owned by a Cyprus company which, in turn, is owned by one of the Cayman funds.

In other cases, the name “Meridian” doesn’t show up anywhere in the publicly available chain of ownership of a given business. Instead, its role as “beneficial owner” can only be discovered in obscure reports, sometimes years after it takes control. For example, TengizTransGaz, a major Kazakhstani transportation service provider, has no mention of “Meridian” in any of its four layers of ownership.

In the most complicated cases, Meridian’s businesses are run by nominee owners or by completely parallel structures which lead to separate, seemingly unrelated, offshore holdings. The mechanisms through which the profits from these companies end up in Meridian’s hands are unknown. In such cases, only a leak of private correspondence, like the Appleby leak, allows the connection to Meridian to be established.

In one leaked email, for example, a Meridian employee asks Appleby to prepare the paperwork to transfer shares in Unimilk, a major Russian dairy company, from a parallel structure called Afleet Investments to one of the Cayman funds. “Since Unimilk is now capable of providing required financial information to comply with our strict reporting requirements, it was decided to bring this investment into the Meridian Capital group,” the employees email reads.

An Empire of Oil and Luxury

Meridian’s modus operandi is more about acquiring existing businesses than building them from scratch. Over the years, the company has operated and often sold for profit everything from oil and gas companies to glitzy malls to second-tier airports to vast transportation companies. The company’s shareholders have built a business empire, the full extent of which has been unexplored until today. OCCRP reporters spent months piecing through Meridian’s web of offshores to find the main areas from which it makes its billions.

A key area of business is oil and gas. Over the years, Meridian has made dozens of investments in this sector. In some cases, it acquired already-established companies, often for very little money, and sold them for huge profits. In others, it partnered with Kazakhstan’s state oil and gas giants in joint ventures or got government licenses to set up new projects itself, to which it often invited international investors. Today, it controls over a dozen of oil and mining fields around the world – from Alaska to Africa to Australia.

Meridian also controls a major Kazakhstani rail transportation company which leases wagons and provides maintenance services to some of the country’s largest oil and gas companies, including Tengizchevroil, which operates the country’s largest oil field. It also has dozens of investments in mining and the extractive industries.

The group also made hundreds of millions in real estate, largely in Russia and Kazakhstan. When it sold the St. Petersburg Galeria Mall to Morgan Stanley for $1.1 billion, this was, at the time, the largest Russian real estate deal ever. Last year’s Panama Papers leak shows that it also acquired half of another Kazakhstani real estate empire, Capital Partners, which built and sold projects like Moscow’s Metropolis mall – one of the largest in the country – and Ritz Carlton hotels in Moscow and Almaty.

Meridian also acquired at least two business jets and bought a stake in a Russian regional airport company which owns 14 airports – and is gunning for more in Europe.

Finally, it once owned half of Unimilk, a major Russian dairy company which would later be acquired by Danone, the French food giant. Meridian is currently investing in one of Latvia’s largest dairy producers.

Who Owns It Now?

On the rare occasions when Meridian has disclosed anything about its owners, the names that appear have almost always been Askar Alshinbayev and Evgeniy Feld, two of the company’s original founders.

Their names also frequently appear on boards, or as directors, of the group’s various projects.

So what about Kazakhstan’s top oil official?

In response to reporters’ questions about Mynbayev’s role in Meridian, KazMunayGaz, the state oil and gas company that he heads, responded with a single sentence: “S.M. Mynbayev is not a founder or shareholder of Meridian Capital Limited.” No other shareholders responded.

However, there is one publicly available document which does associate his name with Meridian. A Russian bank then owned by the group filed a 2011 disclosure to comply with newly toughened disclosure requirements.

The document contained a list of people who ultimately controlled the bank at the time: Alshinbayev, Connor, Feld – and Reid Finance, a company incorporated in Bermuda that, according to the document, was acting as a trustee for Mynbayev.

Meridian’s most recent disclosure, filed just a couple of days ago in the United Kingdom, does not include Mynbayev among its shareholders and lists only Alshinbayev, Subkhanberdin, and Feld as beneficiaries.

The company’s ownership is different every time it’s disclosed. The omission of Mynbayev’s name from the latest disclosure could mean that he has recently sold his shares. But because his name was not always revealed in earlier filings, it could simply mean that the company does not give full disclosures of its ownership.

Two more pieces of evidence in the Appleby files suggest that Mynbayev has never given up his initial shares.

In one case, a corporate administrator noted in her timecard for May 21, 2014 that she had spent three hours reviewing email correspondence with Meridian’s lawyer in search of certified documents in relation to a “transfer of shares for S. Mynbayev.” It is unclear whether he was buying or selling shares, or how much, but this does indicate that he was present in the company at the time.

The Appleby leaks also show that, as recently as April 2016, Mynbayev’s name was in a database of active PEPs, a designation that stands for “politically exposed people.” According to a manual for Appleby’s PEP database, only PEPs who are active shareholders will show up, indicating he still owned a stake in Meridian Capital, the only known company associated with his name at Appleby.

Askar Alshinbayev and Evgeniy Feld, two of the company’s original founders and its most frequently appearing public faces, are on Forbes’ 2014 list of the top 10 richest people in Kazakhstan.

Considering Meridian’s success, this should be no surprise.

But given Mynbayev’s major stake at the time, shouldn’t he also make the list? If he ever chooses to disclose his ownership, perhaps he can look forward to appearing in the next edition.

OCCRP will publish additional details of the organization’s operations in the coming weeks.

Contributors to this story: Olga Gein, Federico Pignalberi, Karina Shedrofsky, Vladimir Petin, Stella Roque, Lejla Camdzic, Chris Benevento, Aubrey Belford, Tessine Murji and OCCRP Kazakhstan.

By Miranda Patrucic, Vlad Lavrov, and Ilya Lozovsky